Driver-Based Forecasting

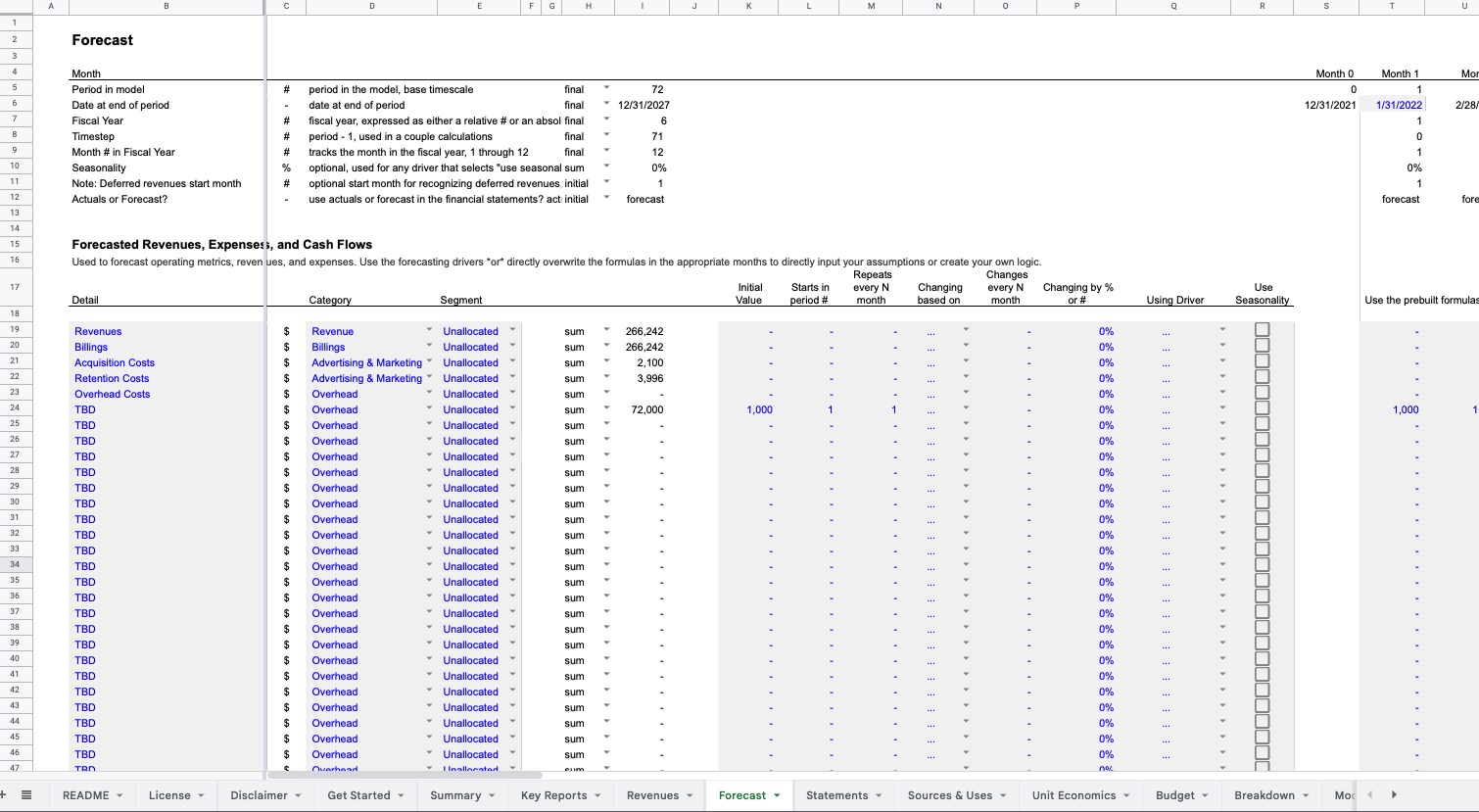

A key component of the model is the driver-based system for revenue and expense forecasting. Below details how that works:

Five year financial model template with prebuilt consolidated three statements - income statement, balance sheet, and statement of cash flows - and key charts, summaries, and metrics. No prebuilt revenue model, easy to build in your own custom revenue forecasts.

Model and free email support

Model and Get Started 1 hour custom services

The Starter Model is built to be the simplest, "Minimum Viable Model" for an entrepreneur to use to raise capital. The focus is still on expenses, cash, and runway, but also includes consolidated financial statements - income statement, balance sheet, and statement of cash flows - along with more detailed approach to the operating costs, equity and debt financing, inventory (if applicable), and accounting treatment of the expense forecast. The model is easy to use to build in your own revenue and growth forecast, but that structure does not come prebuilt.

The Starter Model provides no prebuilt structure for forecasting revenues but is completely open, so you may build in any logic to forecast your revenues and expenses - growth rates, customers, users, employees, etc. - in any way you want.

For a seed-stage entrepeneur, the focus is on costs, and I'd argue that a detailed revenue forecast is not necessary, thus the structural choice I made with the model to focus on costs and not revenues.

If you need a prebuilt revenue model, check out the Standard Financial Model, which shares the same common financial core as the Standard but adds a prebuilt structure to forecast revenues using a range of assumptions around paid and organic growth, sales efforts, conversion rates, churn, repeat purchase rates, prices, cost of goods sold, and much more.

The model offers an extensive structure for forecasting costs, allowing you to input specific costs, one-off and repeating costs using growth rates, and driver-based forecasts, calculating expenses from financial and operational metrics. Each expense line can be selected, through dropdowns, into preset (but editable) SG&A and Cost of Sales categories for reporting purposes.

Create hiring plans by inputting specific roles and hires, or let hires be determined by other metrics (e.g. employees in a certain function, users, customers, many more options).

Input all your expenses, and select the accounting treatment, and the model will handle how the expense is handled in the financial statements, as well as any resulting effects like depreciation, repayment schedules, and more.

The model creates consolidated financial statements - income statement (profit and loss, or P&L), balance sheet, and statement of cash flows - on a monthly basis, summarized into annual reports. Applicable worldwide, independent of GAAP or IFRS accounting methods. Equity, debt, and grant funding can be input, and creates sources and uses reports and burn and runway charts automatically.

Model handles corporate taxes and value-added taxes (VAT) automatically, with options for different accrual and payment schedules. Depreciation, accounts receivable, deferred revenues, and other balance sheet calculations have prebuilt logic, change if necessary.

Track Actual Financials by pulling in Quickbooks, Xero or other (manual data pull or requires third-party integrations) to create rolling forecasts and budget v. actual variances over different time periods.

Assign expenses and revenues to separate business lines and automatically create a P&L that details expenses and margin profile per segment.

A key component of the model is the driver-based system for revenue and expense forecasting. Below details how that works:

Questions, happy to assist, contact anytime. Documentation for many model features is detailed at Docs, I provide personal support through free email support and short screenshares and calls, detailed here →

I also provide custom model services for 50-100 companies per year, or check out the Talent Collective for other resources for building financial models, and contact me if you have any questions or specific needs.

5 star reviews

4 star reviews

3 star reviews

2 star reviews

1 star reviews

Taylor worked with us to create a custom model perfect for our unique business that helped us start off on the right foot and quickly plan for growth. I couldn't recommend it more!

5 star reviews

4 star reviews

3 star reviews

2 star reviews

1 star reviews

Very impressive. Incredibly comprehensive. Taylor is quick to respond to any queries. Standard Financial Model

Rebuilding our financial model starting with a Foresight template — and layering in Taylor’s consulting — saved me a considerable amount of time and resulted in a far more sophisticated model. Working with Taylor allowed me more time to focus on my business and my fundraising. I would recommend a Foresight template to any business owner. Standard Financial Model

Taylor's expertise in his field is evident, and he couples it with an exceedingly amicable manner. Taylor's work speaks for itself (the models are stunning!), and his insightful questions, lively discussion and ongoing support make working with him a pleasure. Standard Financial Model

Worth every penny! Purchased the Saas Model two years ago, and Taylor *still* swiftly responds to every email any time a question or need arises. He is extremely fair + generous with rates for providing additional support throughout the customization process. Standard Financial Model

Very logically laid out and very flexible. Easy to "bring your own model". Lines can be inserted to expand the number of attributes, for example different operational metrics. And the support is great. Highly recommend. Standard Financial Model

Foresight's model is very professionally constructed, thorough and flexible. It gave us the clarity we needed as an early stage startup to pitch investors with a solid understanding of our financial needs and possibilities. Thanks to Taylor's help and the model we were able to successfully raise capital for our business. Standard Financial Model

Taylor's excel models are without question the best financial models. As someone who has done freelance financial modeling, I have a great appreciation for architecture and intuitive design. Taylor's work is amazingly powerful and customizable while remaining usable for those less experienced with Excel. Standard Financial Model

Taylor worked with us to create a custom model perfect for our unique business that helped us start off on the right foot and quickly plan for growth. I couldn't recommend it more! Starter Financial Model

Taylor provides a very detailed model. This was invaluable to us. The personal service and customisation work that was provided was of the highest level. We were up against a difficult deadline and Taylor worked with us to ensure this was met. We highly recommend the SaaS model, and personalisation work provided by Taylor. Saas Financial Model

As a startup coach and repeat entrepreneur myself, I spend a lot of time in spreadsheets. The Foresight tools that I’ve used are easy to understand, modify, and, perhaps most importantly, the formulas are correct! Beyond the actual spreadsheets, Taylor is a wealth of knowledge and an incredibly quick communicator. He has gone above and beyond what I expected to deliver value. Runway And Cash Budget Tool

Taylor helped us with our financial model when we were planning to go raise capital. He was fast to respond and even walked us through all the dependencies of the model. When it came time to update the model a year later, he was very responsive to help and adjust it based off of our product updates. It was a great experience and am super thankful for the assistance. Standard Financial Model

Absolutely loved working with Taylor and Foresight as we built out the next iteration of our financial model - would continue to recommend him to any founder who is looking for a scalable financial model + excellent support with tailoring it to a company's specific needs. Standard Financial Model

I couldn't have better things to say about getting additional guidance from Taylor to ensure I maximize the utility of the standard model when embarking on modeling some new (to me) complexities. Absolutely worth the price of admission and would do it again when I have other challenges to tackle when building a tailored strategic model for clients. Get Started

Anyone can toss together a quick and careless excel spreadsheet but what is it really worth if it doesn't truly tell the story of the business? Taylor took the time to understand the ins and outs of our business and helped build a flexible model that made sense. His guidance and work helped secure us a loan from the bank (who thought it was one of the best models they've ever seen). Custom Services

Taylor was very helpful in helping me understand the nuances of a waterfall model. He is a powerful educator who cares about his clients. Cap Table Services

I discovered Taylor’s Foresight thanks to OpenVC.app's high praise of his work which I must concur with. Not only is the model itself excellent: very powerful, flexible, and does what SaaS owners need, but above and beyond that, the speed and quality of Taylor’s support when you get stuck is exceptional. I would argue he undercharges for the quality of the product and service he offers. I highly recommend Foresight and Taylor, you won’t be disappointed. Standard Financial Model For Saas

These templates are worth their weight in gold. Hired Foresight for a few hours to customize the template and we moved mountains. Best money spent! Standard Financial Model

There is a lot of information available on the web. Many tools solve part of the problem, some posts provide a small level of insight, others a slightly greater level. After 4 or 5 hours of research, I discovered Foresight. My only wish was to have discovered it earlier! This is the most effective, practical and well thought through modelling template. For such an important and foundational element of a business. to structure and optimise the agreements that are made at an early stage and forecast, with confidence, is a huge problem solved. Thank you!! Standard Financial Model

Taylor is my go-to for anything that has to do with financial models. He has the experience and perspective to help understand business challenges and develop winning business models. Standard Financial Model

Your model is outstanding, both from an organizational standpoint but also from a technical perspective (coming from a fellow excel nerd). You saved our startup considerable time vs. starting from scratch. Standard Financial Model

Taylor was extremely helpful and provided a service that far exceeded our expectations. The model was very well structured and I was able to modify it to my needs. Taylor helped me along the way to make sure I understood the model well. We had great feedback from investors, which is great because it was my first time putting together a financial model! Standard Financial Model

Taylor's SaaS model has helped me quickly and easily build a financial model. It allowed me to easily capture the assumptions about my business model and discuss them with my investors. Allowing me to close a high six-figure seed round in record time. Saas Financial Model

5 star reviews

4 star reviews

3 star reviews

2 star reviews

1 star reviews

Taylor was extremely organized and made efficient use of time while covering a complex topic. He comes prepared with a wealth of tools and templates that allow one to continue learning and practicing independently after the course. Build A Cap Table From Scratch

Very impressive. Incredibly comprehensive. Taylor is quick to respond to any queries. Standard Financial Model

Very useful, gives clear ideas on key concepts, specially for VCs that are so worried on how a new round affects exit values etc. and clear instructions on how an exit waterfall works. Fantastic models people can use to build own models in real life work. Cap Table Masterclass

Great class! Great instructor! You will leave this course feeling confident in cap table modeling and exit waterfall analysis from the very simple to the more complex scenarios. Taylor teaches you the concepts that make modeling easy. Highly recommend. Cap Table Masterclass

Rebuilding our financial model starting with a Foresight template — and layering in Taylor’s consulting — saved me a considerable amount of time and resulted in a far more sophisticated model. Working with Taylor allowed me more time to focus on my business and my fundraising. I would recommend a Foresight template to any business owner. Standard Financial Model

Taylor's expertise in his field is evident, and he couples it with an exceedingly amicable manner. Taylor's work speaks for itself (the models are stunning!), and his insightful questions, lively discussion and ongoing support make working with him a pleasure. Standard Financial Model

Worth every penny! Purchased the Saas Model two years ago, and Taylor *still* swiftly responds to every email any time a question or need arises. He is extremely fair + generous with rates for providing additional support throughout the customization process. Standard Financial Model

Very logically laid out and very flexible. Easy to "bring your own model". Lines can be inserted to expand the number of attributes, for example different operational metrics. And the support is great. Highly recommend. Standard Financial Model

Taylor was remarkably helpful in taking the templated model and customizing it so that it worked for our specific and very complicated use case. It was a smooth process that would not have been possible with someone who was equally great at spreadsheets but lacked Taylor's deep knowledge of venture capital. Venture Investor Model

Foresight's model is very professionally constructed, thorough and flexible. It gave us the clarity we needed as an early stage startup to pitch investors with a solid understanding of our financial needs and possibilities. Thanks to Taylor's help and the model we were able to successfully raise capital for our business. Standard Financial Model

The [Venture Investor] model is very in depth and chances are, if you have an issue the model can handle it. If you do need to make modifications and aren't sure exactly what you to do, Taylor is incredibly helpful and responsive over email. He helped me make a few unusual changes to the model and even looked through my changes. Venture Investor Model

Great course and format. Covers from the basics to more complex topics and Taylor did an amazing job on having a hands on approach as he didn't stick to the theory and was building models in real time. How To Model Venture Funds

Understanding the ins and outs of fund modeling is generally not a walk in park and can be convoluted. The resources from Foresight have been a huge help towards my learnings of portfolio construction, fund metrics and waterfall analysis. Venture Investor Model

Taylor's excel models are without question the best financial models. As someone who has done freelance financial modeling, I have a great appreciation for architecture and intuitive design. Taylor's work is amazingly powerful and customizable while remaining usable for those less experienced with Excel. Standard Financial Model

Great course for understanding the math and logic necessary to model cap tables and waterfalls. This coming from someone who had no prior experience. Cap Table Masterclass

Great course with extremely supportive instructor. We covered a lot of material in a very short span of time which was very impressive. I love that Taylor provides access to the material even after the course is done, allowing me the time necessary to fully absorb. Cap Table Masterclass

Both the [model] and Taylor are amazing! Definitely recommend. Venture Capital Model

Excellent course to get all the basics covered to build a cap table! Course material and contents are succinct. Above all, Taylor did a great job explaining every single step of creating a cap table! I will highly recommend this course to founders. Build A Cap Table From Scratch

Taylor was extremely helpful and put context to a lot of concepts we needed clarity on. Venture Capital Model

Taylor worked with us to create a custom model perfect for our unique business that helped us start off on the right foot and quickly plan for growth. I couldn't recommend it more! Starter Financial Model

Taylor is able to quickly distill complex fund modeling techniques for the average user. I highly recommend this course for any first-time VC manager or analyst, and as a refresher for those who have been in the industry for a while. How To Model Venture Funds

Taylor provides a very detailed model. This was invaluable to us. The personal service and customisation work that was provided was of the highest level. We were up against a difficult deadline and Taylor worked with us to ensure this was met. We highly recommend the SaaS model, and personalisation work provided by Taylor. Saas Financial Model

I thoroughly enjoyed the course! Taylor made it incredibly interesting, yet still managed to keep it simple. Even though I'm familiar with funds and excel, I found it difficult to model everything accurately from scratch. However, the free templates that Taylor provided were incredibly helpful - they pushed me to go further than what I'm used to. The workshop was also great, Taylor's "start small and scale" approach really helped me to understand and appreciate the models. How To Model Venture Funds

Taylor is a terrific instructor who patiently walks through every model that he has built and thoughtfully answers all questions; regardless of how nuanced or basic. He is also quite generous with his time and additional materials, so the value of the course is quite evident. Finally, its clear how much he loves this material and will happily go on a tangent where you can nerd out about different elements of the course. How To Model Venture Funds

This is training that you actually get to take home with you and implement - a rare thing in business education. Taylor is very good at answering project-specific follow-on questions and the course materials deserve proper attention: reading and implementing via spreadsheets. How To Model Venture Funds

As a startup coach and repeat entrepreneur myself, I spend a lot of time in spreadsheets. The Foresight tools that I’ve used are easy to understand, modify, and, perhaps most importantly, the formulas are correct! Beyond the actual spreadsheets, Taylor is a wealth of knowledge and an incredibly quick communicator. He has gone above and beyond what I expected to deliver value. Runway And Cash Budget Tool

Taylor helped us with our financial model when we were planning to go raise capital. He was fast to respond and even walked us through all the dependencies of the model. When it came time to update the model a year later, he was very responsive to help and adjust it based off of our product updates. It was a great experience and am super thankful for the assistance. Standard Financial Model

Taylor delivers an effective and interesting sequence of lessons to model pre-seed, seed and letter rounds and the impact to outcomes by different instruments. I left the course feeling that I can absolutely model out a cap table for a series of fundraising rounds effectively and I have an excellent baseline with which to evaluate the result of different instrument choices when making tactical decisions while doing due diligence on deals. Can't recommend the class more! Cap Table Masterclass

Taylor helped me clarify my conceptual understanding of how the SAFE note terms are modeled, including the distinction between ... Pre- vs Post-Money Cap SAFEs. Cap Table Tool

Absolutely loved working with Taylor and Foresight as we built out the next iteration of our financial model - would continue to recommend him to any founder who is looking for a scalable financial model + excellent support with tailoring it to a company's specific needs. Standard Financial Model

I couldn't have better things to say about getting additional guidance from Taylor to ensure I maximize the utility of the standard model when embarking on modeling some new (to me) complexities. Absolutely worth the price of admission and would do it again when I have other challenges to tackle when building a tailored strategic model for clients. Get Started

I really enjoyed taking this course. Very knowledgeable instructor, and access to tons of resources. I think it's also important to note that depending on your baseline knowledge, you may need to dedicate time outside of the course to understanding and retaining the concepts. Cap Table Masterclass

Anyone can toss together a quick and careless excel spreadsheet but what is it really worth if it doesn't truly tell the story of the business? Taylor took the time to understand the ins and outs of our business and helped build a flexible model that made sense. His guidance and work helped secure us a loan from the bank (who thought it was one of the best models they've ever seen). Custom Services

Foresight's Venture Model was extremely helpful for us as we mapped out our capital allocation strategy for both existing and forecasted funds. The model is more robust than anything we could have built in-house in such a short time period. It provides all the information we want, from a portfolio dashboard to operating forecasts and financial statements for our funds & management company alike. Taylor's published guidelines make it very easy to navigate the model, and in case that wasn't enough, his customer support has been exceptional -- he is prompt, thoughtful, and generously thoughtful with his responses to our questions. We look forward to continuing to use his products and services. Venture Investor Model

Taylor was very helpful in helping me understand the nuances of a waterfall model. He is a powerful educator who cares about his clients. Cap Table Services

Great course for Cap Table 101. Taylor covered all the important concepts and explained them very well. Learned a lot - thank you! Cap Table Masterclass

I discovered Taylor’s Foresight thanks to OpenVC.app's high praise of his work which I must concur with. Not only is the model itself excellent: very powerful, flexible, and does what SaaS owners need, but above and beyond that, the speed and quality of Taylor’s support when you get stuck is exceptional. I would argue he undercharges for the quality of the product and service he offers. I highly recommend Foresight and Taylor, you won’t be disappointed. Standard Financial Model For Saas

This course was great because you could get real-world practice with a realistic VC fund model and work through some of the issues you would face in actually building your own from scratch. Very helpful for my growth. How To Model Venture Funds

This course did a great job building up to the case study - we started with fundamentals of modeling different investment scenarios and then progressed to waterfall analysis and a case study. Taylor is incredibly knowledgeable and makes himself available to answer questions as they come up. He also has a lot of helpful videos recorded to help with course work if needed. Cap Table Masterclass

These templates are worth their weight in gold. Hired Foresight for a few hours to customize the template and we moved mountains. Best money spent! Standard Financial Model

Taylor leads a highly collaborative and instructional program which breaks down a higly complex subject into digestible and accessible components. I left the course comfortable not just with knowledge of the mechanics of a model, but the theory and "so what" context around cap table modeling and term sheet negotiations. Cap Table Masterclass

Extremely helpful tool that saved us countless hours. Venture Capital Model

I was provided the cap table and exit waterfall tool and instruction as part of the Canadian Women in VC Bootcamp. Modeling cap tables and waterfalls can be incredibly challenging, especially when there is a number of existing convertible securities. Foresight's tool was easy to follow and modify for use in a number of different exit modeling scenarios I have since done. Cap Table Tool

Taylor is very clearly a seasoned expert and passionate teacher. The course is a great way to get your hands dirty building a venture model. I would recommend for emerging managers or those looking to augment their skillsets and up-level their thinking as it pertains to capital allocation, cash flow modeling and downstream impact of early decisions in fund formation. How To Model Venture Funds

I found this course to be very helpful and informative. Looking forward to building my first [cap] table! Build A Cap Table From Scratch

Excellent coverage of modeling a VC fund both from a portfolio construction viewpoint and an operating viewpoint. Instructor interacts with participants in a workshop format and shows how excel templates work and impacts of assumptions. How To Model Venture Funds

There is a lot of information available on the web. Many tools solve part of the problem, some posts provide a small level of insight, others a slightly greater level. After 4 or 5 hours of research, I discovered Foresight. My only wish was to have discovered it earlier! This is the most effective, practical and well thought through modelling template. For such an important and foundational element of a business. to structure and optimise the agreements that are made at an early stage and forecast, with confidence, is a huge problem solved. Thank you!! Standard Financial Model

Liked the way theory and practice were presented. Taylor really walked us through a lot of scenarios, and was clear in his explanations and always open to questions. Cap Table Masterclass

Taylor is my go-to for anything that has to do with financial models. He has the experience and perspective to help understand business challenges and develop winning business models. Standard Financial Model

Fantastic tool Venture Valuation Tool

Fantastic course! Taylor not only explains the mechanics of how to model a fund well, he also provides valuable insights into the questions to answer so that the model will reflect the reality and be feasible to execute. Taylor encourages us to ask questions and patiently answered all of them, the shared model spreadsheets were also very helpful. I also picked up some spreadsheet formulae tricks. How To Model Venture Funds

Learned SO MUCH from Taylor. The live sessions, examples, and assignments just really helped break down so many complex topics. Really appreciated the thoughtfulness Taylor takes in the course design. Cap Table Masterclass

Excellent course. It is a difficult topic to present as attendees will have different experience levels - and Taylor did a great job making this work for all attendees. How To Model Venture Funds

Your model is outstanding, both from an organizational standpoint but also from a technical perspective (coming from a fellow excel nerd). You saved our startup considerable time vs. starting from scratch. Standard Financial Model

Great resource for modeling venture funds. Taylor has probably seen more scenarios than anyone else, which makes him a great instructor for the class. How To Model Venture Funds

Taylor is a true expert who knows how to simplify complex concepts and communicate them with excitement and authority. As a guest speaker in my Maven venture capital course, Taylor had the difficult assignment of teaching the fundamentals of capitalization tables and portfolio construction in 90 minutes. He was fantastic! He covered a ton of material and patiently answered students' questions as they arose. He offered a wealth of free or easily-accessed resources, and he even stayed longer than he had promised so he could engage with students. Taylor collaborated extensively with me on the design of the session, and he was very well prepared to teach the class. I would definitely work with him again. How To Model Venture Funds

This course was amazing - it really laid out the foundations of learning a Cap Table and built up from there. I liked the scenario-style of learning, it allowed me to go over everything in my own time. Taylor's teaching also built my confidence by breaking everything down into easy to understand concepts. Build A Cap Table From Scratch

Taylor was extremely helpful and provided a service that far exceeded our expectations. The model was very well structured and I was able to modify it to my needs. Taylor helped me along the way to make sure I understood the model well. We had great feedback from investors, which is great because it was my first time putting together a financial model! Standard Financial Model

Taylor's SaaS model has helped me quickly and easily build a financial model. It allowed me to easily capture the assumptions about my business model and discuss them with my investors. Allowing me to close a high six-figure seed round in record time. Saas Financial Model

Excellent tool for conceptualizing outcomes of different strategies. Venture Investor Model

There is no other way to put it; Taylor knows his stuff. From his financial model (which I have been using for years) to this course, his work always exceeds expectations. This course covers everything I expected and much more. The detail on SAFES, option pools, and exit waterfalls was the refresher I needed. Overall feel like I am now equipped for any cap table scenario. Cap Table Masterclass

Really well organized and broken down into steps that build on one another. Cap Table Masterclass

If you have used this model, please share your thoughts >

Taylor Davidson, Founder, Foresight

I created the financial models behind Foresight so early-stage entrepreneurs can spend less time on finance and more time on their products. I care about financial modeling because I believe that financial models can help us make critical business decisions even if the models themselves are not “always right”. Financial models can help even the earliest entrepreneurs if we build “minimum viable models” to focus on the decisions that matter most.

Model and free email support

Model and Get Started 1 hour custom services

You will have the option to download a Microsoft Excel .xlsx file and copy a Google Sheet file immediately after purchase or submission or your email, and anytime through the link in your email receipt, as well as by logging into my transaction provider at Gumroad and creating an account.

Foresight's spreadsheet models can be used in both Excel and Google Sheets interchangeably; simply upload the Microsoft Excel model template from Foresight into Google Sheets, or download the Google Sheets to Excel, and everything will structurally work fine.

The models are originally built in Google Sheets, and the formatting is a bit better in Google Sheets; in Excel you may want to adjust the row spacing, fonts, and chart formatting to get the aesthetics you want.

We accept credit cards, debit cards, and PayPal. The transmission of your billing information is encrypted using secure socket layer technology (SSL/TLS) and will be processed by Gumroad. Foresight does not have access to your payment details (why it's safe).

You'll get a payment receipt by email immediately after purchase. Note, you will see Gumroad, not Foresight, on your payment card or PayPal statement.

VAT, if applicable, is additional. Businesses with a valid VAT number can enter their VAT number at time of checkout and not get charged VAT, or can get a VAT refund after purchase. Details on Gumroad, I need a VAT refund.

License and Terms apply on all downloads, purchases, services bookings, and courses.

Get help buying. Call (or text, WhatsApp, et.al.) 1-646-770-0052.