Originally posted at VC Lab, How to Build a VC Fund Model

Even quantitatively-minded first-time GPs can find modeling a challenge because venture capital models are often quite different from the models you may be familiar with. There are also some similarities and basic differences that we can leverage to get a running start.

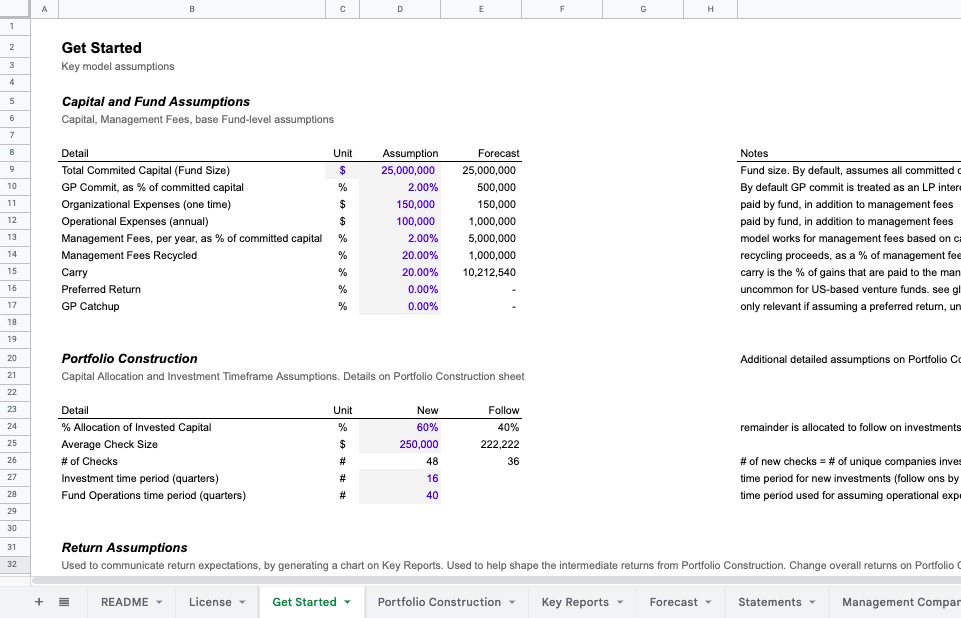

Build an Overall Forecast

Start with a simple budget including total capital, expenses, investments, proceeds and distributions. At the same time, factor in assumptions for management fees and carry that most closely relate to your situation. Once you have this framework in place, you can apply an assumption of gross return multiple on your invested capital to estimate returns.

Building this model may seem simplistic, but it’s essential for closing your first round of capital. Not only does it give you a basic understanding of your business and the size of investments you can make from your fund, but a well-designed forecast shows prospective LPs that you know what you’re doing.

Forecast Cash Flows Over Time

It’s imperative that you understand the long commitment you’re making into this fund, and how/when you’ll make investment decisions. A cash flow forecast provides the foundation for that analysis.

Once you have an overall budget, you should estimate how you’ll deploy capital. Here are the basic steps:

- Create a budget for your expected management fees and fund expenses over time.

- Build a forecast of new investments over your new investment timeframe. Optionally, create a forecast of follow-ons based on your initial investments, follow-on reserve strategy and expected timing between rounds.

- Add your forecast of expenses to your forecast of investments to create a capital call schedule.

- Then, to fully understand and calculate performance metrics, build a forecast of proceeds from those investments and the resulting distributions from the fund to investors.

- This process will take your overall budget into an annual or quarterly budget of cash flows.

Once you have this framework, you should estimate how you’ll deploy capital. This means when and how much you’re putting into companies at the first check, and potential follow-ons. If you then layer on a fees estimate, you’ll be able to forecast capital calls and net out the proceeds and distributions.

Create a Portfolio Model By Detailing your Investment Strategy

Portfolio construction is the process of creating your portfolio strategy, check sizes, follow on reserves, and expectations around valuations, ownership, and dilution over time. To wrap your head around the portfolio model for your firm, you need to make some key assumptions about the companies you’re going to be investing in. For example:

- How big are the initial and follow-on checks?

- How much do you expect them to grow over time?

- When is the expected exit and at what multiples?

Obviously, if this is your first fund it may be difficult to estimate these inputs, and you should only put the level of detail into the portfolio modeling that’s appropriate to your stage. For example, if you’re at the idea stage, a hypothetical may work best to test your assumptions. Therefore, you should keep your model as simple as possible. Conversely if you’re further along, you may need more detail, several different company scenarios, and example companies. Whenever possible, you can base this model on either your direct experience or comps if you have the data.

Create Scenarios And Model Power Laws That Affect Performance

There are two basic ways to scenario-plan your fund’s performance: using discrete scenarios or probabilistic models. In both cases, the goal is to understand the power laws and events that most affect your performance. That is: what X-Factors can change the trajectory of your fund the most.

In discrete scenario planning you’ll develop a base, best and worst case expectation. Choose several inputs as the starting point, and make intuitive assumptions about their application to your performance.

If you’re comfortable with them, probabilistic models provide an added level of insight when assessing scenarios. By creating simulated timelines on a probabilistic basis, you can arrive at a range of possible results, and assign a degree of confidence to each. Though this produces less specific outcomes, it may provide a more realistic view.

Sanity Checks

Before sharing your model with prospective investors, it’s critical that you sanity (and gut) check your expectations, performance and assumptions. Venture accelerators – like VC Lab’s free program – provide an excellent way to acquire and share benchmarks and insights from emerging managers and mentors.

In particular, we suggest you pay close attention to a few “gotchas” that often bedevil first time managers. First, check that your strategy makes sense. That is, do other people think it’s logical that you can get the kind of deals you seek at your check size? What about the team – can you handle the volume you’re looking for with the people you’ve allocated? Comparisons can be really helpful here.

Secondly, check to make sure you’re not forgetting crucial expenses. Doing so will leave your invested capital too high, and distort your returns. At the same time, ensure your follow on strategy makes sense. For example, will you get many pro-rata opportunities and will you have the capital necessary to make those follow-on calls?

Lastly, ensure your returns assumptions are as realistic as possible without succumbing to overly conservative thought. That is, you’re looking for a targeted return that most LPs will consider reasonable and exciting. Go too far into the black, and you’ll trigger their disbelief engine. But if you undershoot, they may not get excited at all. Again, it’s helpful to check this with others who’ve been through the same time.