Chief Financial Officer

In 2025 I am looking to add a client to my fractional CFO services. Here's more about what I can do for you.

Managing Director / Founder

The latest insights from Foresight

In 2025 I am looking to add a client to my fractional CFO services. Here's more about what I can do for you.

Managing Director / Founder

Understanding how corporate franchise taxes work and how they impact your business.

Narratives and numbers can work together.

How to model SaaS, ecommerce, and 15+ other common revenue models.

How you can earn CPE credits while learning about venture capital

How multi-billion dollar investments in Artifical Intelligence companies are structured

Recapping a webinar with Graph Advisors on going from Fund I to Fund II.

Tracking the Tax Cuts and Jobs Act, Section 174, and why it matters for bootstrapped and early-stage companies

Learn how to build financial models the right way

Highlighting the Cornerstone Limited Partner Agreement (LPA) for emerging venture capital managers

Or, how to make sure you never create something like community-adjusted EBITDA.

$1 MM in template sales on Gumroad

An overview of the tools, processes, and expectations around Special Purpose Vehicles (SPVs)

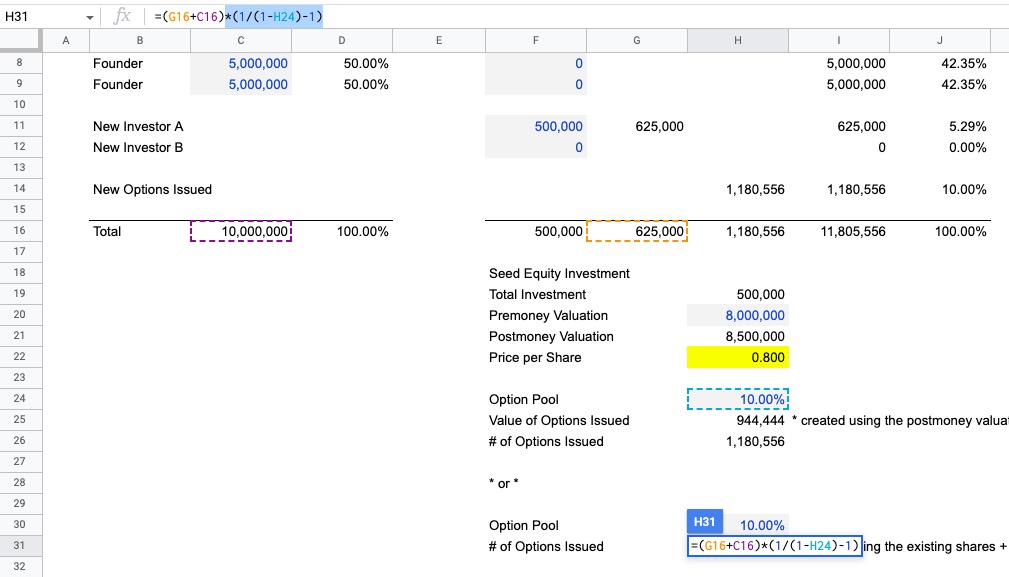

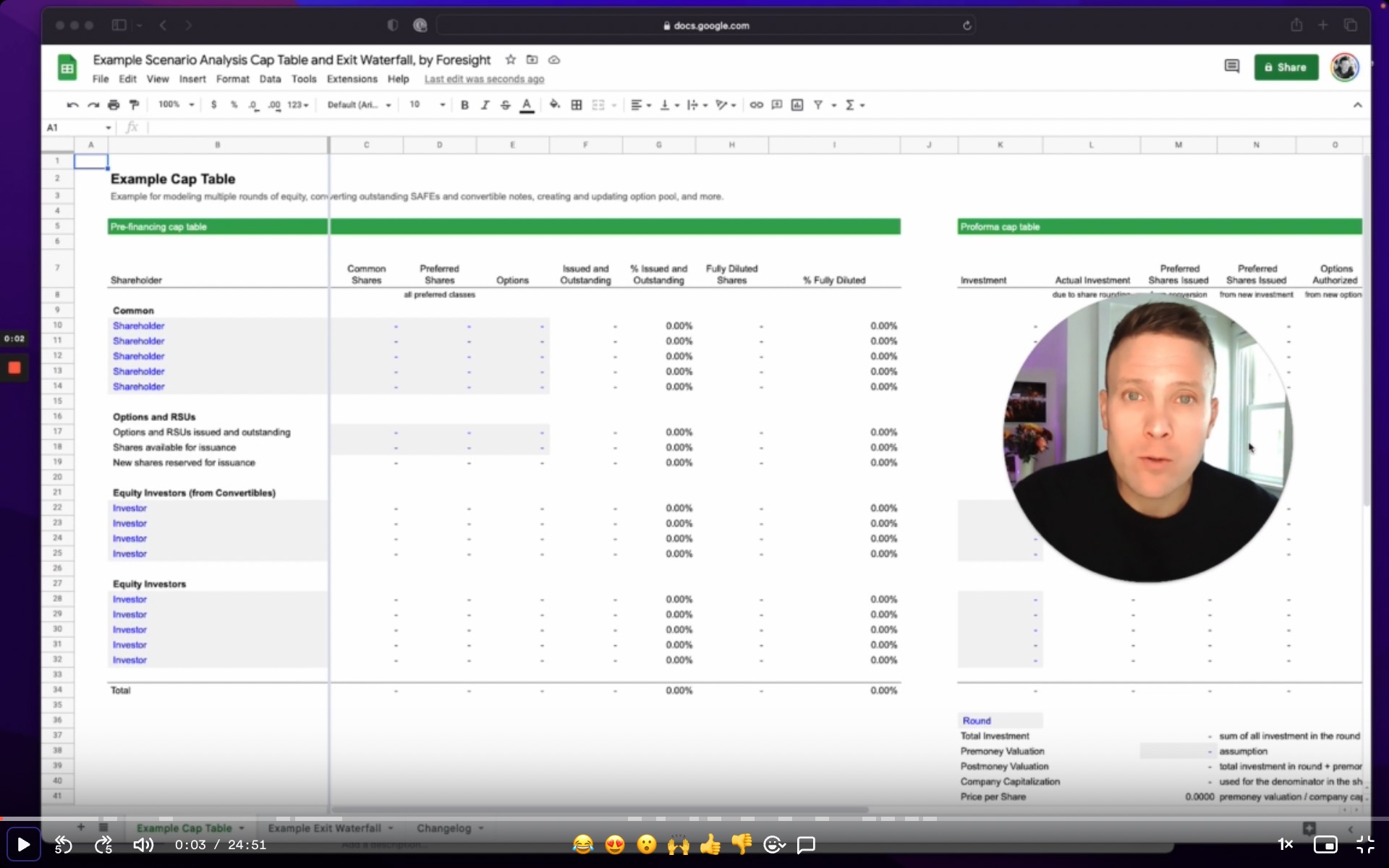

How the cap table course has evolved 2022-2024

What a circular reference is, how iterative calculations work in Excel and Google Sheets, and when (and when not) to use them.

What the various roles in finance mean at a startup, and how to think about hiring for finance as companies grow.

Technical and practical considerations to keeping a clean cap table.

Plus when and how to use it in business decision making

From spreadsheet jockey to prompt CFO, the intersection of artifical intelligence and financial forecasting will bring experimentation to spreadsheets and new opportunities to financial modelers.

How to close out 2022 and create a 2023 budget.

Courses on modeling cap tables, venture funds, and more.

Data sources and approaches to benchmarking your metrics for private, early-stage companies.

A quick teardown of the main differences between the previous v4 and the new v5 Standard Financial Model.

Using the Cap Table and Exit Waterfall and an import of a share register to create scenarios for fundraising rounds and proceeds from exits.

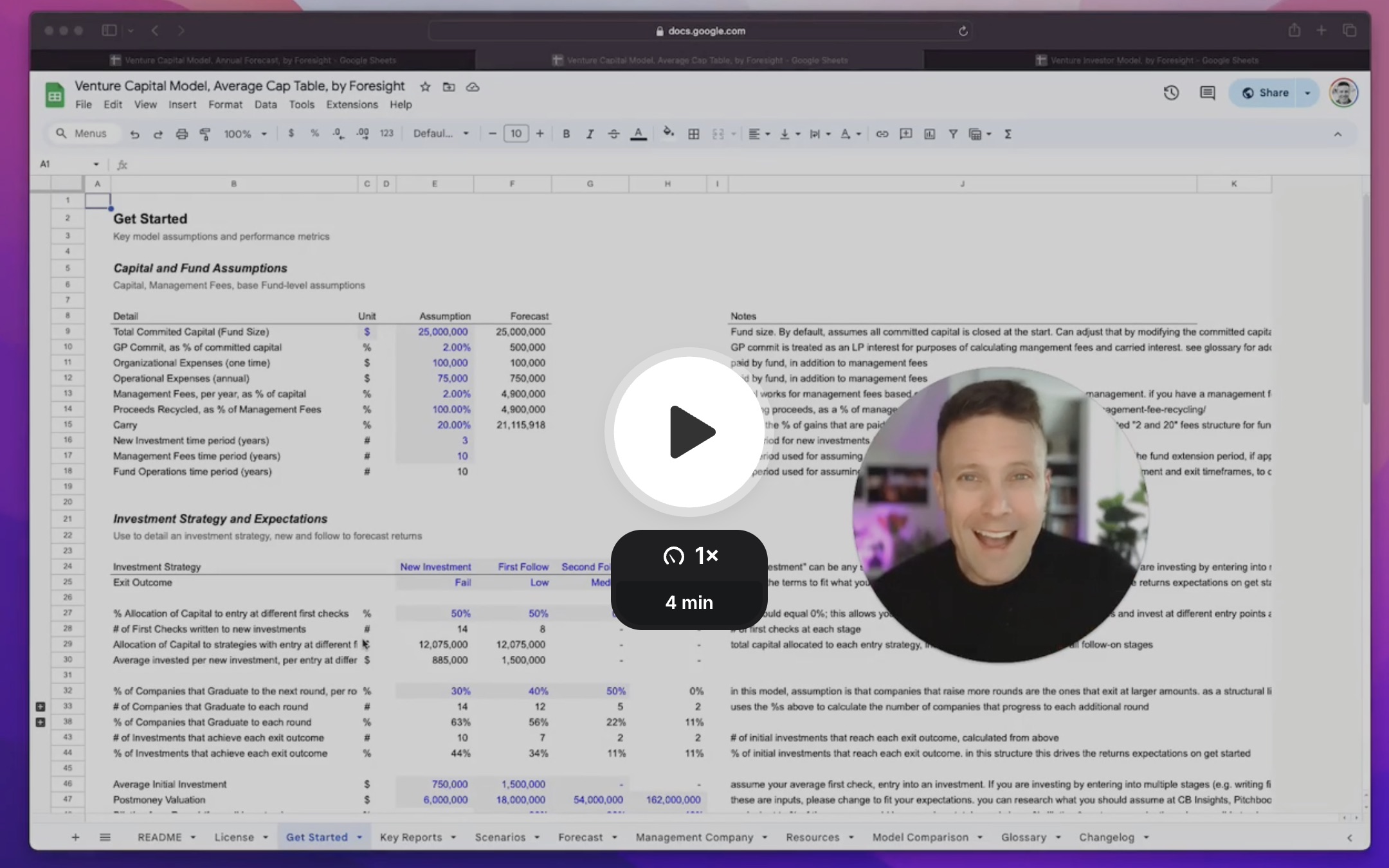

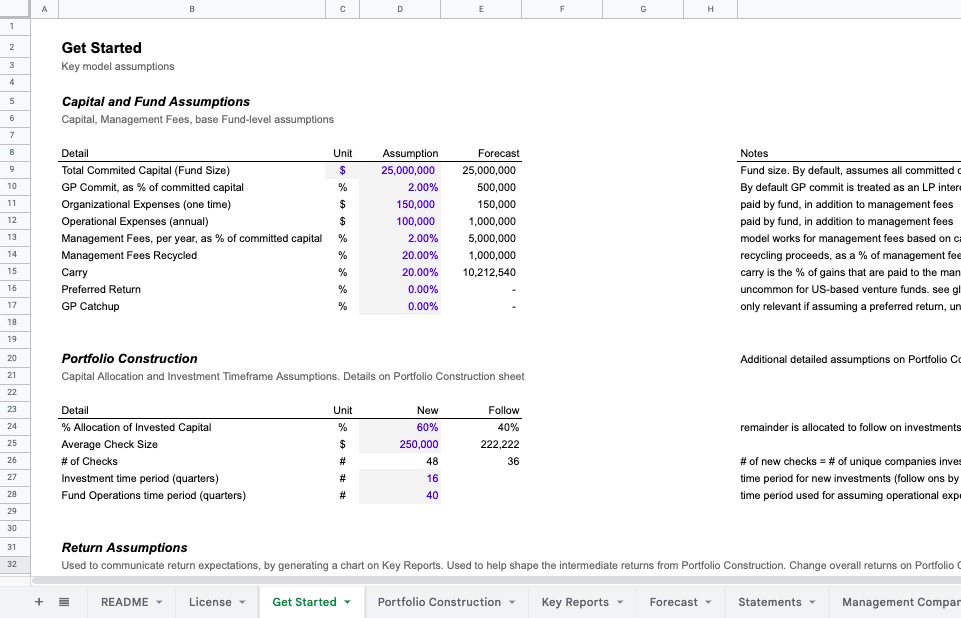

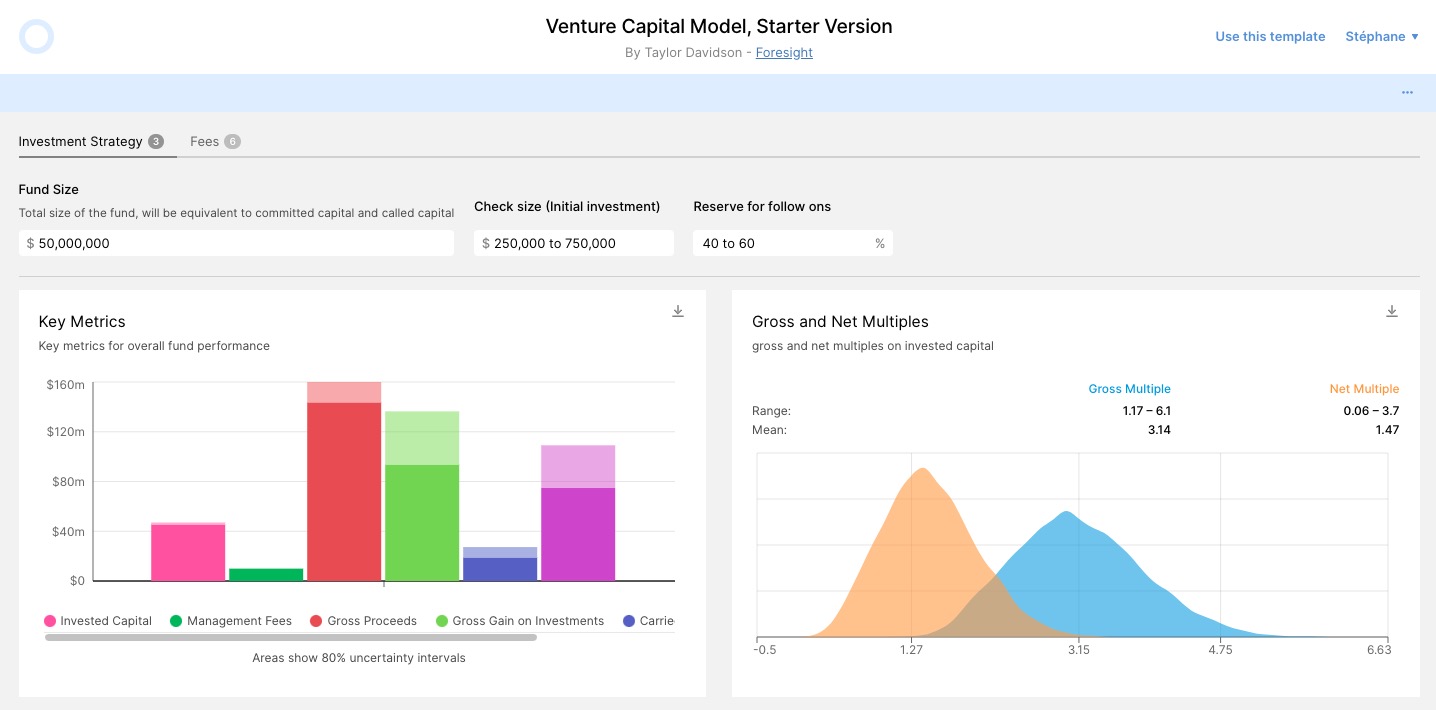

What it means to create a financial model for a venture capital fund, the various ways you can create a portfolio construction and operating cash flow model, and templates and examples that you can use for modeling your fund.

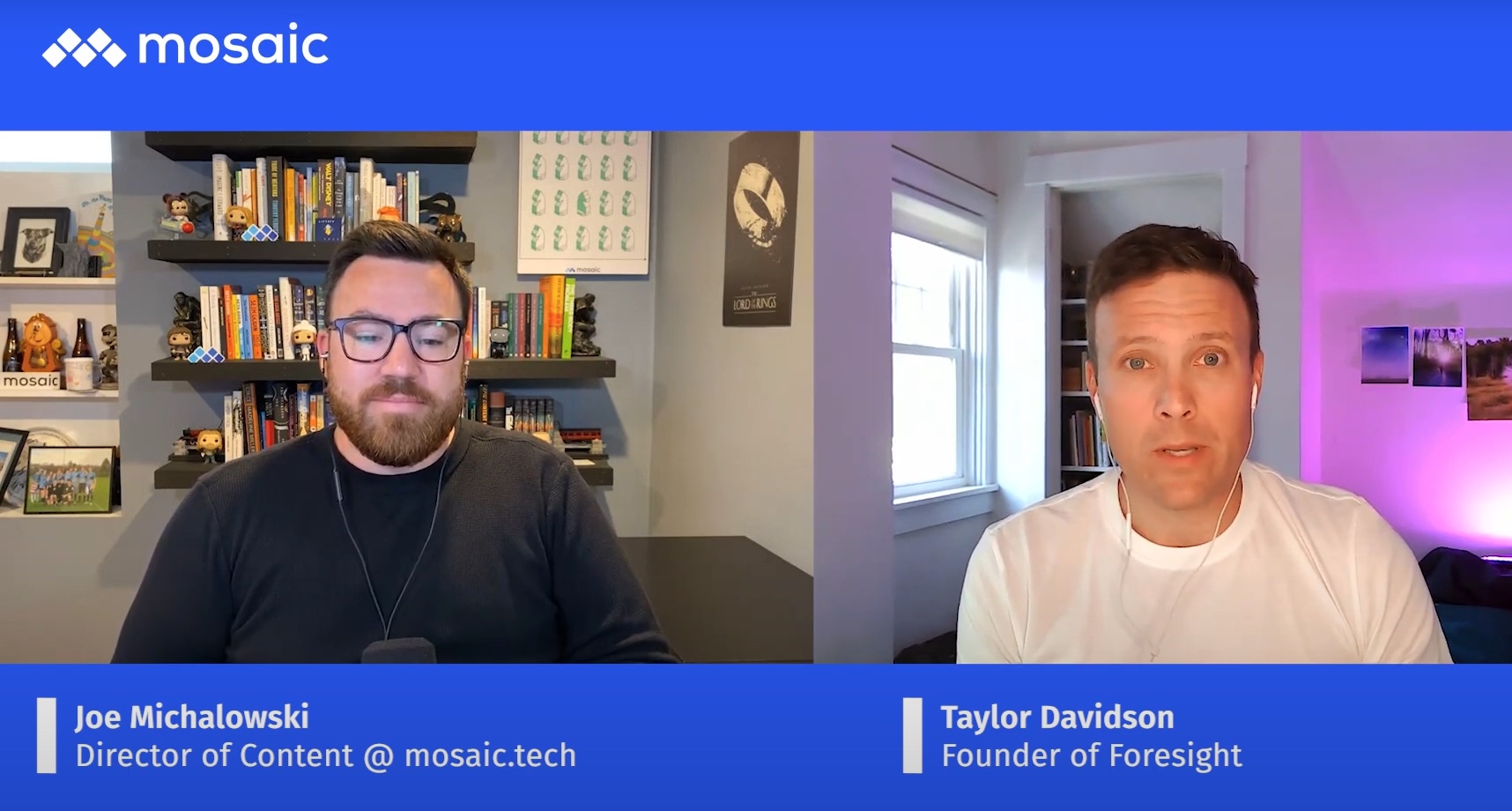

Discussing the core building blocks of an early-stage SaaS financial model with Mosaic.

The foundations to building a forecast model for a venture capital fund.

Best practices for effective budgeting for a rolling fund.

Links to posts, resources, and Microsoft Excel, Google Sheets, and Causal template models.

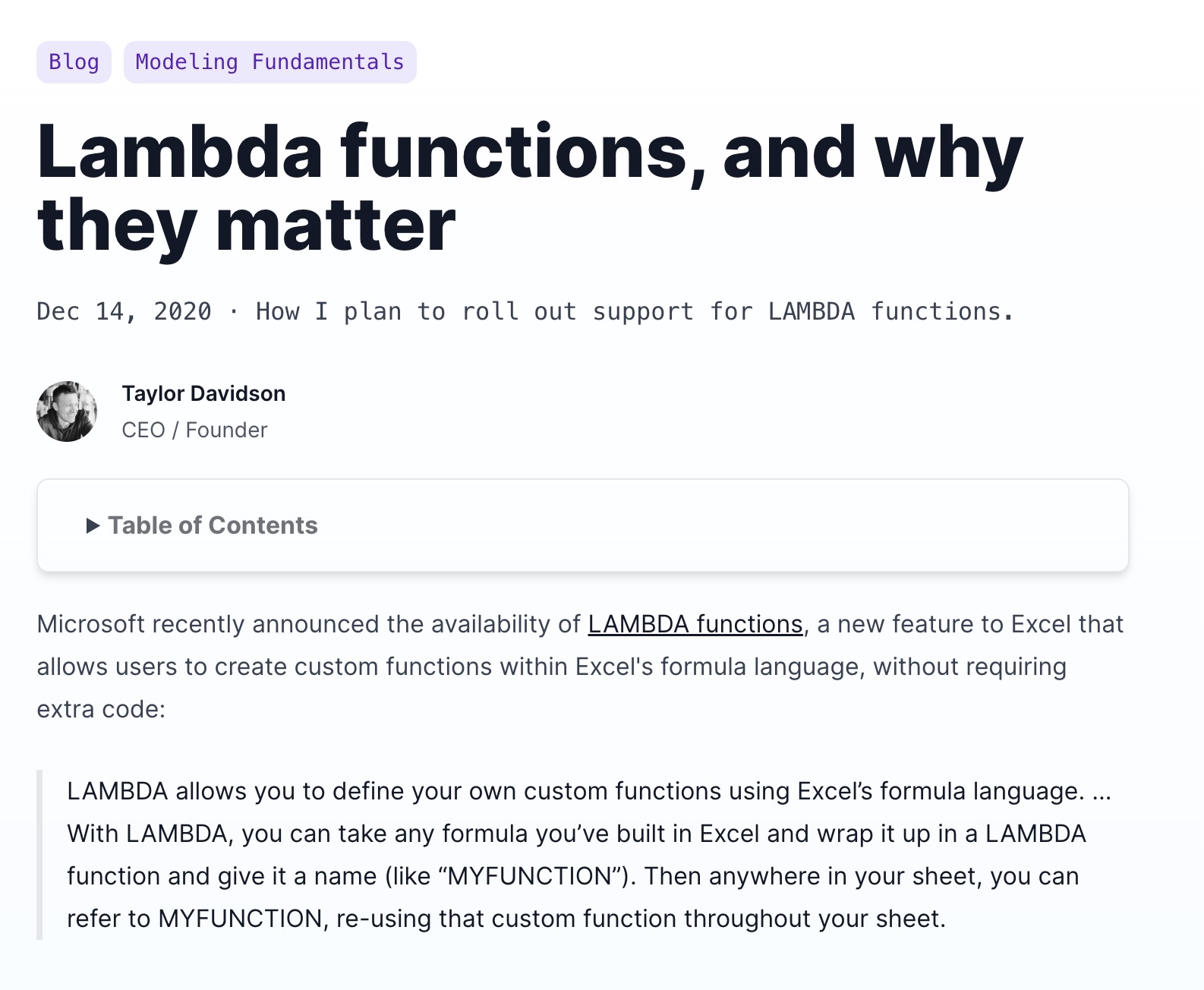

How I plan to roll out support for LAMBDA functions.

Updating models and plans for new economic realities.

Here's a few intermediate-level Excel functions that have significantly improved my financial modeling skills.

Foresight's templates focus on using operational mechanics to forecast financials. Here's why.

Foresight's Bring Your Own Model (BYOM) functionality allows you to build or bring your own growth and revenue model and easily use it to replace the default growth and revenue model in Foresight's Standard Model.

The fundamental concepts about finance and accounting you need to know to use the Foresight templates (or any financial model).

Here's a detailed look at consolidated financial statements, how to understand them, and the role they play in financial projections.

Estimating your cost budget is the first, and most important, step towards creating your financial projections.

How to model revenues using the top-down and bottoms-up approaches.

A common question for entrepreneurs is when to hire a chief financial officer. Here's my perspective.

The FAST Standard is a guideline on how to construct good financial models. Here's an explainer of what the Standard aims to achieve and why I achieved my FAST certification and support the standard.

You're thinking about applying to an accelerator, or you're picking which one to choose. Here's what to pay attention to.

Startups often present their financial projections incorrectly. Here's why, and what you need to do instead

Good advice starts with good questions.

How to create the assumptions for startup financial models

A crash course for new startup employees in understanding how equity works.