Tactyc is a performance forecasting and scenario planning platform for venture capitalists. Our software enables funds to construct, manage and forecast their venture portfolios - and is used by more than 160 funds globally.

Tactyc makes investment teams more data-driven, efficient and analytical in their fund operations. The primary use cases are:

- Portfolio Construction: creating fund models and testing various strustrategies

- Investment Planning: modelling various deal outcomes and reserve planning

- Portfolio Management: track and manage company KPIs

- Reporting: LP ready reports on fund and investment performance

How can you see it in action?

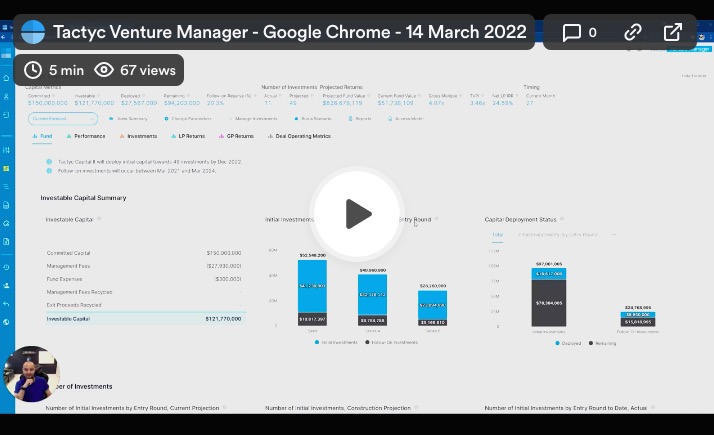

Visit to learn more and click on "Get Started" to create an account. Here is a completed dashboard that shows the platform in action, and you can also schedule a 1-on-1 demo with Tactyc's founder directly here.

Comparing Foresight to Tactyc

Foresight provides a range of free and paid tools primarily built in spreadsheets (Microsoft Excel, Google Sheets) to help you create portfolio construction models, fund budgeting and capital deployment planning, and performance projections and analyses for venture capital funds and angel investing portfolios.

Just as I've worked to update the financial model templates over time to make them better for users, I've always worked towards my larger goal in helping people understand how to build financial models to make meaningful business decisions, using any model they are using, across spreadsheets and web apps.

Tactyc lets fund managers build and share portfolio construction models with potential limited partners, update their models with actual investments, evaluate actual vs. projected variance, and scenario plan individual investment.

Should you use a spreadsheet or a web app?

I don’t believe it’s an either/or choice between spreadsheets and web apps. There are situations and stages in a fund’s growth where spreadsheets are sufficient, or are better for specific analyses, and there are situations where web tools can provide a better user experience for building models and evaluating perfornace. Finance is just beginning to see an explosion of tools and platforms long-available for product development, design, collaboration, and HR, and I’m excited to see and participate in the innovation in the space.

More practical how-to's and example models to model venture funds at How to Model a Venture Capital Fund →