A management company of a venture capital fund is the business entity that manages the venture capital firm's activites. A common question from emerging managers is how the entities are organized, and how to create a forecast for a management company.

How a venture capital fund is organized

- A venture capital fund is a business entity - typically organized as a limited partnership in the USA - that pools capital from limited partners (LPs, the investors in the fund) to invest into companies.

- The fund is the legal entity that makes the investments, and it pays fees, called management fees, to the general partners (GPs) of the fund to run the fund.

- In addition to management fees, the fund will bear additional expenses, typically broken down into organizational expenses and operational expenses.

- Organizational expenses are typically the legal formation fees associated with creating the limited partnership agreement (LPA) and all the legal agreements that LPs and GPs must execute to create a fund, and the closing costs associated with executing the agreements and funding the entity. These are often capped at a fixed dollar amount in the LPA.

- Operational expenses are the ongoing fees associated with operating the fund, most typically fund administration, tax, audit, legal and additional expenses as defined in the LPA. These are typically not capped, but GPs are generally incented to manage these to be low, as lowering the expenses increases the amount of capital available to invest.

Managers often have questions about what expenses are paid by the fund, and what are paid by the management company. VC Lab covers the details at Managing Fund Expenses for Venture Capitalists.

How a management company is organized

- This company, often organized as a single-member or multiple-member LLC in the USA, is managed by the general partners (GPs) of the fund, and it is set up to separate the operations (and revenues and expenses) of the fund from the venture capital firm. (More on how to set up a management company at Sydecar, A Guide to Management Companies.)

- The management company may operate multiple funds, leveraging the same partners and shared resources to manage multiple funds across the lifetime of the venture capital firm.

- The management company earns revenues as the manager and advisor of the fund, paid by the fund as management fees, which are set in the LPA for the fund. Typically these fees are based on the total committed capital to the fund, and charged quarterly based on an annual percentage rate (typically 1.5% to 2.5%) over the fund's lifetime, typically over ten years.

- The LPA will also typically allow the lifetime to be extended (usually for an additional year or two, to allow more time for the fund's investments to exit), and will establish whether management fees can be charged during this period (typically not, for most managers). At the end of the lifetime the fund may disperse unexited holdings to the LPs, or make other efforts to move the investments to new vehicles to close out the fund.

- The management company pays expenses to operate the company that manages the investments of the fund. The primary functions are sourcing potential investments, conducting due diligence, closing investments, and then working with entrepreneurs to increase the value of their investments.

- The primary expense of a management company is salaries to partners, associates, analysts, and the operations team that supports the management company and its efforts in sourcing and managing investments.

- Budgeting for a management company typically means establishing a hiring plan and forecast of operating expenses, typically including office rent, insurance (general business insurance and key person insurance), travel, marketing, and other expenses typical with operating businesses.

- Budgeting for rolling funds can be a bit different due to how management fees work as the fund grows, that is covered deeper at an article I wrote with AngelList, How to Make a Budget for a Rolling Fund.

- Management companies also get paid carried interest by the fund, and distribute that to the general partners and staff according to the management company's agreements. Carried interest is a share of the profit from the performance of the fund's investments; typically after returning the value of what was invested in the fund to the limited partners, the management company will then share in the distributions of the fund at a rate agreed in the LPA, commonly 20% to 25%. (The "2 and 20" that people typically refer to as the compensation structure for fund managers refers to the standard 2% per year for management fees, and 20% for carried interest.) Here's more detail on modeling the proceeds, distributions, and carried interest waterfall in the venture fund.

- To add an additional legal wrinkle, management companies may also be set up with a dual-vehicle structure to handle distributions of management fees and carry. For the purposes of budgeting for the management company the structure does not matter, but it may matter for managers of the fund from a legal and tax perspective.

AngelList also details the fundamentals at The Basics of Venture Capital Management Companies.

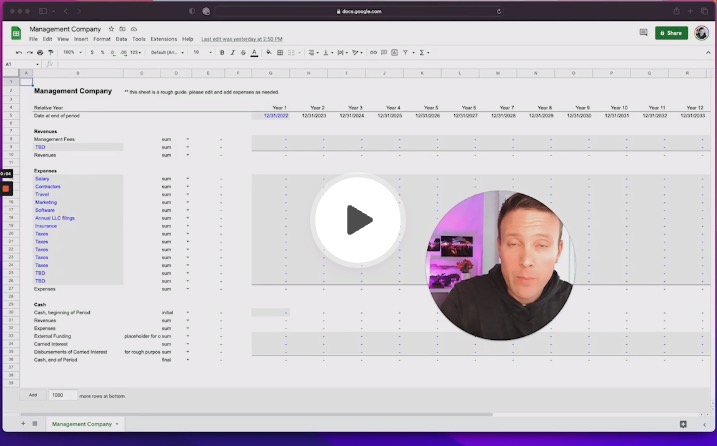

How to model a management company

Modeling a management company is typically fairly straightforward compared to modeling a venture capital fund:

- The fund's forecasted management fees are the revenues for the management company.

- The largest expense of the management company will be people, and the management company will be small for most funds, typically just a few people - partners, associates, analysts, operations staff.

- Additional expenses will include typical business operating expenses: rent, utilities, insurance, marketing, travel, computers, accounting, and more (VC Lab has a good post covering typical management company expenses).

- Any cash on hand on issues by the management company will have to be handled by the members of the management company (e.g. members may have to invest or contribute cash to pay the management company if management fees to not cover expenses).

- Carried interest is typically not budgeted to cover operating expenses, and is distributed to the people at the management company according to their individual agreements.

Sometimes funds will manage the management company and note problems with cash flow after the investment period of the fund; what happens is that after the management fees from the fund are reduced or expire, the forecasted management company will show negative cashflows. Typically managers will either:

- Assume that they will raise another fund managed by the same management company, showing management fees from the new fund, or

- Show how the management company expenses will decrease over time.

Typically this is not an important issue, as most fund managers will strive to raise another fund beyond the immediate one being forecasted, so any shortfall in revenues would be covered by the future fund.

Currently, the Venture Capital Model and Venture Capital Model, Quarterly include sheets for the management company budget, but it is also easy to add this to any venture capital fund model.

Questions, contact me anytime.