First, a disclaimer: I am not a lawyer or a financial advisor and am not offering financial or legal advice.

Let's clear up what a fund waterfall is, typical ways they are structured, and how to model them.

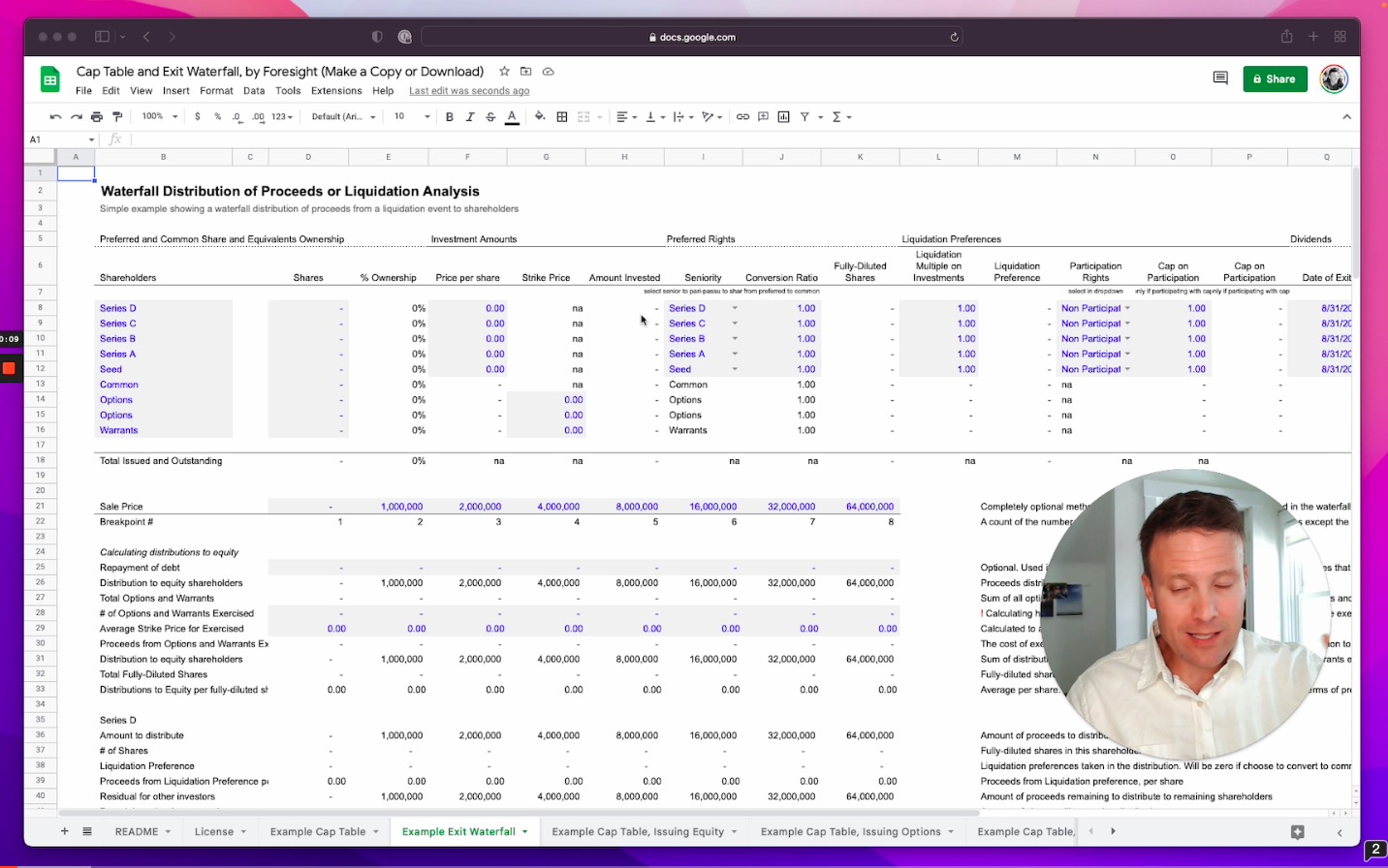

Company exit waterfalls v. fund waterfalls

The goal of a company exit waterfall or liquidation analysis is to determine how the proceeds from an exit event (a "liquidity event") are allocated and distributed to all shareholders in a company. The exit waterfall is typically created as a forward-looking scenario analysis to understand liquidity preferences and their impact on distributions over a range of potential exit valuations, to understand how a round would impact returns, as well as an analysis done at the time of an exit to handle the calculation of distributions.

The goal of a fund waterfall is to determine how the proceeds from liquidity events from the investments by a pooled investment vehice are distributed to the limited partners and general partners of the investing entity (typically a fund). The fund waterfall is a core component of modeling a venture capital fund in determining the amount and timing of distributions, and thus are important for calculating net performance metrics (more on metrics at Metrics for Venture Capital Funds).

Understanding fund waterfalls

The structure of a fund waterfall will dictate how proceeds are distributed to the participants in the fund, highlighted by how proceeds are distributed to limited partners (generally passive investors in the fund) and general partners (managers of the fund). The terms can vary by the type of fund, and can have up to four tiers:

- Return of capital: return of called capital of investors, consisting of capital used for investments as well as expenses and fees

- Preferred return: a "preferred" internal rate of return that allocates distributions to limited partners up to the agreed preferred return. Preferred returns can be cumulative or non-cumulative, and can represent a rate of return or a cumulative return; preferred returns are not common in US venture capital, more common in Europe in Asia.

- GP catchup: allows the general partners to "catchup" on the carried interest they would have earned on the preferred return. Common if there is a preferred return. Preferred returns can be structured as a "hard hurdle" if there is no GP catchup, or a "soft hurdle" if there is a catchup, and thus the catchup can vary from 0% to 100%. In addition, the catchup can be structured to pay 100% of distributions first to the general partners as the catchup, or a rate less than 100% to have limited partners share in the distributions during the catchup.

- Carried interest: allocation of distributions to general partners paid as incentive compensation for fund performance. The carry is the "20" of the "2 and 20" common venture fund compensation structure; carried interest can be a simple, single rate for all distributions greater than return of capital (and preferred return and GP catchup, if applicable), or a tiered carry where the rate increases if net returns (either a multiple or a rate of return) are greater than an agreed performance benchmark (e.g. 20% carry up to 2x net, and 30% carry thereafter). If there is a tiered carry, there can optionally be a catchup the carry that would have been earned up to the lower threshold at the higher rate.

As you can tell from the overview of terms above, there can be a range of options and complexities to structuring fund waterfalls. Always work with experienced fund formation counsel familiar with the expectations for your investment strategy and limited partner base.

European and American fund waterfalls

Fund waterfalls are commonly structured as a "European" or total fund waterfall or an American "deal by deal" waterfall. The difference is summarized here:

In a European equity waterfall, sponsors do not receive carried interest until all of the limited partners’ capital contributions – including unrealized investments – have been recovered.

In an American waterfall, sponsors receive carried interest from individual investments in the fund before limited partners are made whole. In other words, sponsors earn carried interest from individual deals rather than the fund as a whole.

From a practical perspective, the choice of waterfall does not affect total cash flows to LPs and GPs, but does impact the timing of cash flows. GPs generally prefer earning carry earlier and thus prefer American waterfall structures, whereas LPs prefer receiving all capital returned before paying carry.

Which waterfall is more common? It varies by type of investment fund and region, but American waterfalls are more common for late stage private equity, European waterfalls more common for early-stage venture capital.

American waterfalls will also have a clawback or lookback provision, that allows for carried interest that has already been paid to be pulled back ("clawed back") if total returns go under the requirements of the previous tiers (return of capital, preferred return, etc.).

For a concrete example of how an American waterfall can be detailed in an LPA, check out Decile Group's Cornerstone LPA, the waterfall is detailed in Article 3, and the clawback in 6.4.2.

How the Foresight models handle waterfalls

In the Foresight venture capital fund models, the default assumption of the fund waterfall is a European "total fund" waterfall whereby the fund must return total called capital to-date before taking carried interest out of the fund's distributions to limited partners.

However, the default waterfall behavior can be changed through a dropdown on the Forecast sheet to selected either the American "deal by deal" waterfall or the SPV "no clawback" options. The American "deal by deal" waterfall allocates fund expenses to deals and pays carry based on proceeds from individual deals to date, and will claw back carried interest in later periods if necessary.

The SPV no clawback option is used to model an aggregation of SPVs where each deal is independent, meaning that the GP only needs to return capital on an individual investment - not the overall fund - to earn carried interest.

More details on modeling SPVs and SPV "waterfalls" at Creating and Managing Investment SPVs.