First, a disclaimer: I am not a lawyer or a financial advisor and am not offering financial or legal advice.

What is an exit waterfall?

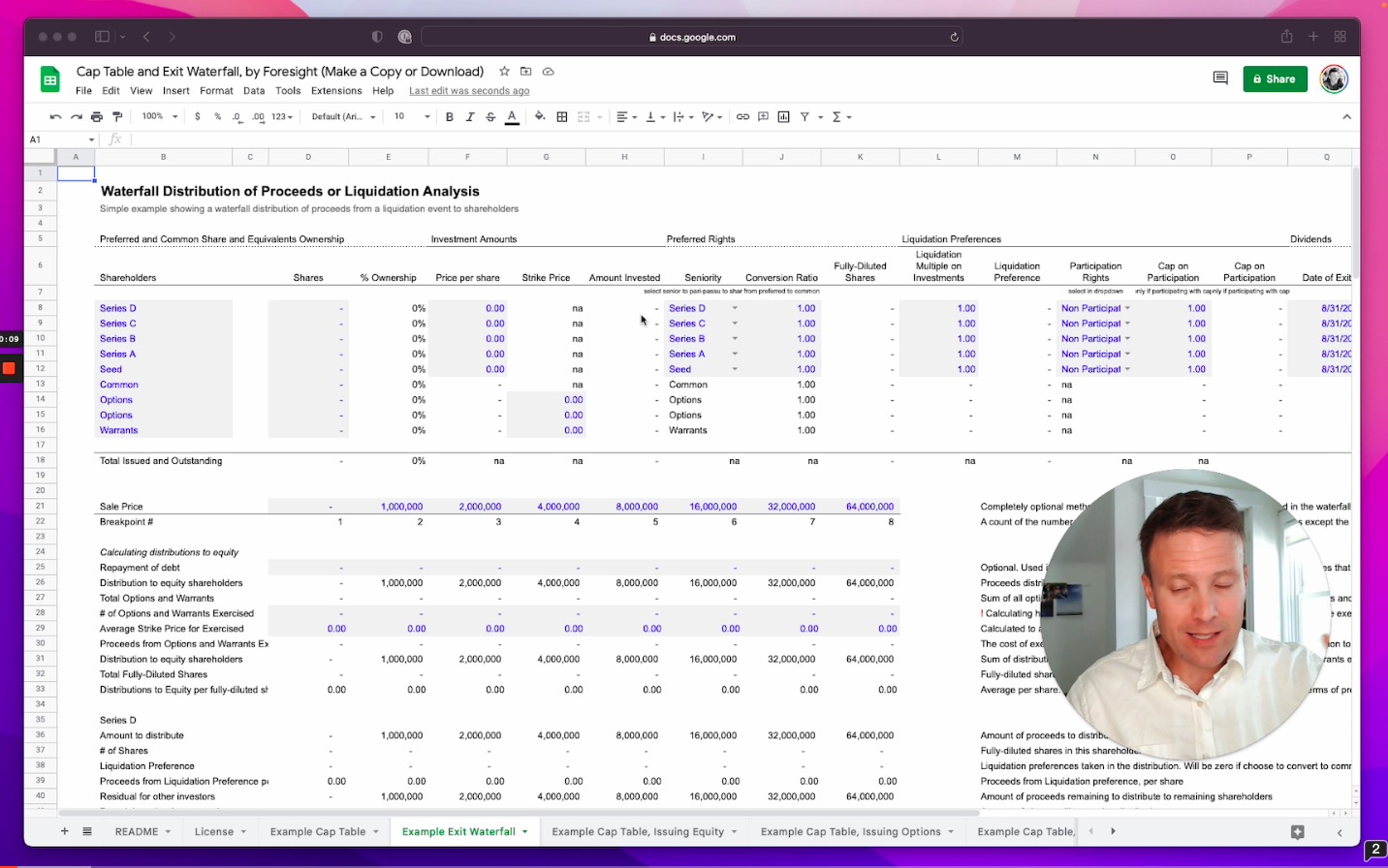

Also called a liquidation analysis, the goal of an exit waterfall is to determine how the proceeds from an exit event (a “liquidity event”) are allocated to all shareholders in a company. Typically created as forward-looking scenario analyses comparing multiple exit valuations, it's good to do when doing a fundraising round, so can understand the impact of a round (and dilution) on exit proceeds and returns.

Three basic steps (the third is the fun part)

Three basic steps:

- First step is setting up a pre-distribution cap table, showing different classes of shareholders with the respective rights you need for your calculations

- Second step is determining how much to distribute to shareholders (do you need to pay off any debt or unconverted convertibles)

- Third step is figuring out who gets what

Preferred and Common

Preferred shareholders, typically investors, usually have two important features to their investments:

- They have liquidity preferences on the value of their invested capital, meaning they get the right to get their money back before shareholders junior to them.

- They can choose to “take their preference” or convert their preferred shares to common shares, and take their share of proceeds alongside common.

They will choose the option that results in the largest returns for them, given what other investors choose to do.

Understanding how to test whether an investor holding preferred shares takes their liquidation preference or converts their preferred shares to common is the most important part of creating an exit waterfall.

Structurally, creating a repeatable structure to allow you to do this through multiple rounds is important, so you can adapt to a particular structure.

Liquidity Preferences

Liquidity preferences have multiple flavors:

- Nonparticipating preferred is a basic form of liquidity preferences says that the investor gets a 1x, non-participating preference on their invested capital. E.g. if they invest $1mm, they have $1mm in preferences.

- Participating preferred, or full participating preferred, gives the investor the right to take their preference and share in the distribution to common (”double dip”).

- Participating preferred with a cap creates a maximum amount they can take from participating before they would want to convert to common. E.g. if they have a 2x cap, participating preferred, they can choose to take their preferences and share in the distribution to common up to the cap, or convert to common.

Liquidity preferences are typically 1x, meaning 1 * the amount they invested.

Conversion Ratios

Conversion ratios refer to the ratio at which a preferred shareholder can convert their preferred shares to common.

A 1x conversion ratio means that when a preferred shareholder converts their preferred shares to common, they get the same number of shares. But that ratio can vary from 1x, particularly in anti-dilution scenarios; if the investor has a conversion ratio of 3x, then they can convert 1 preferred share to 3 common shares.

Seniority, junior, and pari-passu

Typically shareholders are “senior” and “junior” to each other.

“Senior” means their claims for proceeds are higher than another shareholder, “junior” means their claim is lower than another shareholder. Seniority is typically based on when one invested, meaning the most recent round investors are more senior to the previous round, etc.

“Pari passu” means shareholders are on par with each other, meaning even though they are different classes of shareholders, they share proceeds at the same time.

Preferences all the way down

The best way to think of modeling a liquidity distribution is that the proceeds from an exit are “flowing” down through the classes of shareholders.

The distribution thus models down through each class of shareholders, from the most senior to the most junior, down to common shareholders and option holders, evaluating each of the rights and terms of their particular investments, to see what they receive, given what other investors do. Remember the goal of the terms around preferred (liquidity preferences, conversion ratio, dividends, etc.) are to shape returns outside of just the exit valuation. The average proceeds per share may hide some significant differences between what different shareholders receive.

Calculating proceeds to options

In an exit, or a “change in control”, unvested options will typically fully vest.

Unissued options are either (a) cancelled or (b) redistributed back to shareholders, based on some formula that compensates them for the dilutive effect of creating the options.

Options will be “in the money” if the proceeds per share is greater than their strike price, “out of the money” if the proceeds per share is lower than the strike price. Options where the strike price is lower than the proceeds per share will not be exercised, thus reducing the number of shares used in the calculation of proceeds per share.

The proceeds from exercising options – the amount that option holders pay to exercise the options – are typically paid to the company and are added to the amount distributed to shareholders.

This effect creates a very circular calculation and complication to evaluating all options and strike prices at exit to test if they will be exercised.

Calculating proceeds to warrants

Warrants are the right to purchase shares are predetermined prices, typically given as a bonus to investors (and often, lenders). Warrants will have a price per share, and you have to do the same test to see if they will be exercised. The strike price is often set to be negligible, however.

Warrants are typically exercised “cashless”, meaning the warrant holder won’t actually pay the strike price * the # warrants, they will just receive the difference

Structuring a waterfall analysis

The key to creating a waterfall is creating a repeatable structure to use to understand capital flowing into a set of shareholders, evaluating what they will do, then capital flowing out and down to the next set of shareholders junior to the previous set of shareholders.

The problem is that the test of preferred v. common often depends on what other investors do. The math for exit waterfalls is often naturally circular, ignore the spreadsheet error messages about circular references and turn on iterative calculations.

Proceeds per share is the crux

The key to calculating exit waterfalls is knowing how to calculate the proceeds paid per share. Everything – evaluating taking preferences or converting to common, calculating options exercises, calculating investment performance metrics for investors, proceeds to shareholders – all comes from calculating proceeds paid per share.

For the details on how to calculate exit waterfalls, check out the Cap Table and Exit Waterfall Tool

Adding more shareholder classes

If you're using the Cap Table and Exit Waterfall Tool and need to add in additional shareholder classes, it's possible to do, but it might also be better building a custom waterfall. Here's how to add in more shareholder classes: