First, a disclaimer: I am not a lawyer or a financial advisor and am not offering financial or legal advice.

What are options?

Options, also called employee stock option pool or ESOP, represent the right (not the commitment) for the owner of the options to purchase common shares. A company usually reserves or creates a pool of options, representing a percentage of the company, to grant to for future hires as compensation, typically created and amended around financing rounds.

Options are not the only way to create incentive compensation for employees. Restricted stock, phantom stock, and a number of other methods can be used to fit a company's situation.

Shares can be purchased at a price (”strike price”) related to the value of the company today, and sell (hopefully) at a higher price in future as company’s value grows

For an overview on stock options, how employees should think about stock options, and practical considerations for employees about exercising options and taxes, read Compound's Everything you need to know about startup stock options

How options impact cap tables

Creating an option pool means creating new options and increasing the total fully-diluted ownership of the company, reducing the ownership % of existing shareholders. Authorizing an option requires the reserving of a share, to be held for when an option is exercised. All authorized options are included in the calculation of fully-diluted shares. Typically tracked in a separate column from common shares, since even though financial rights are the same, voting rights and control rights are different.

Vesting schedules are important to know for tracking ownership, do not change the fully-diluted cap table.

Premoney and Postmoney Option Pools

Premoney and Postmoney option pools essentially refer to how an option pool is mechanically created, and what classes of shareholders are diluted.

- Premoney option pool, the “investor friendly”option, reduces the premoney valuation by the value of the options created, and forces the dilutive impact on existing shareholders.

- Postmoney option pool, the “founder friendly” option, shares the impact of dilution on all shareholders, including new equity investors.

Premoney pool is more standard, but both options can have equivalent impact if we adjust the premoney valuation to adjust for dilution.

More background on the topic, Basics of Pre- and Post-Money Option Pools

It is very common for companies to misunderstand the impact of creating an option pool on the premoney valuation, sometimes called the "option pool shuffle". The key is to be clear on how the option pool is being created when investors and founders agree on valuation.

What’s the right size for an option pool?

The creation or expansion of an option pool is a negotiated solution between founders, investors, and the board of directors. Since the goal of an option pool is to reserve shares to grant ownership to new hires needed to grow the company, the size of the option pool should be tied to a hiring plan for the company, to provide some foundational rationale behind the size.

Options after financing rounds are typically sized to be 10-20% of the company's postmoney capitalization, and size of the option pool oustanding and new option pools typically decrease as company raises additional rounds of funding.

How an option pool changes over time

Here's the general flow to modeling option pools:

- Option pools are created by allocating authorized shares to a pool (no change in issued shares). The shares are “reserved” for issuance for when options are exercised to buy the shares.

- You can issue options to the extent that you have available shares in the pool

- Options are granted, usually with restrictions on how the ownership of the options are “vested” over time

- Typically have some schedule where you get control or ownership of the options over time based on maintaining employment at the company

- Options are vested over time

- Options may be exercised, at which point they convert to shares

- Options may be cancelled by the company by agreement or for cause

- Common for employees to choose to not exercise options, often because of the cost of exercising options and timing after leaving a company

- Cancelled and expired options become available again for granting

- Option pools are typically expanded over time, usually through funding rounds, to create new options to grant to new employees. While the size of the option pool (the number of available options) decreases as options are granted, any options not granted are included in option pool in next fundraising.

Option pools are treated differently by Premoney and Postmoney SAFEs

All existing options are included in the company share count used in calculating share price (including vested, granted but unvested, and authorized but not yet granted options).

New option pool created during a funding round is not included in the calculation of share price for a Postmoney SAFE, but is included in the calculation of share price for a Premoney SAFE.

Why? The Postmoney SAFE is thought of “convert first, then issue new equity”, effectively treating the Postmoney SAFE as it’s own round, so any option pool created through the equity round would be considered not a part of the SAFE round.

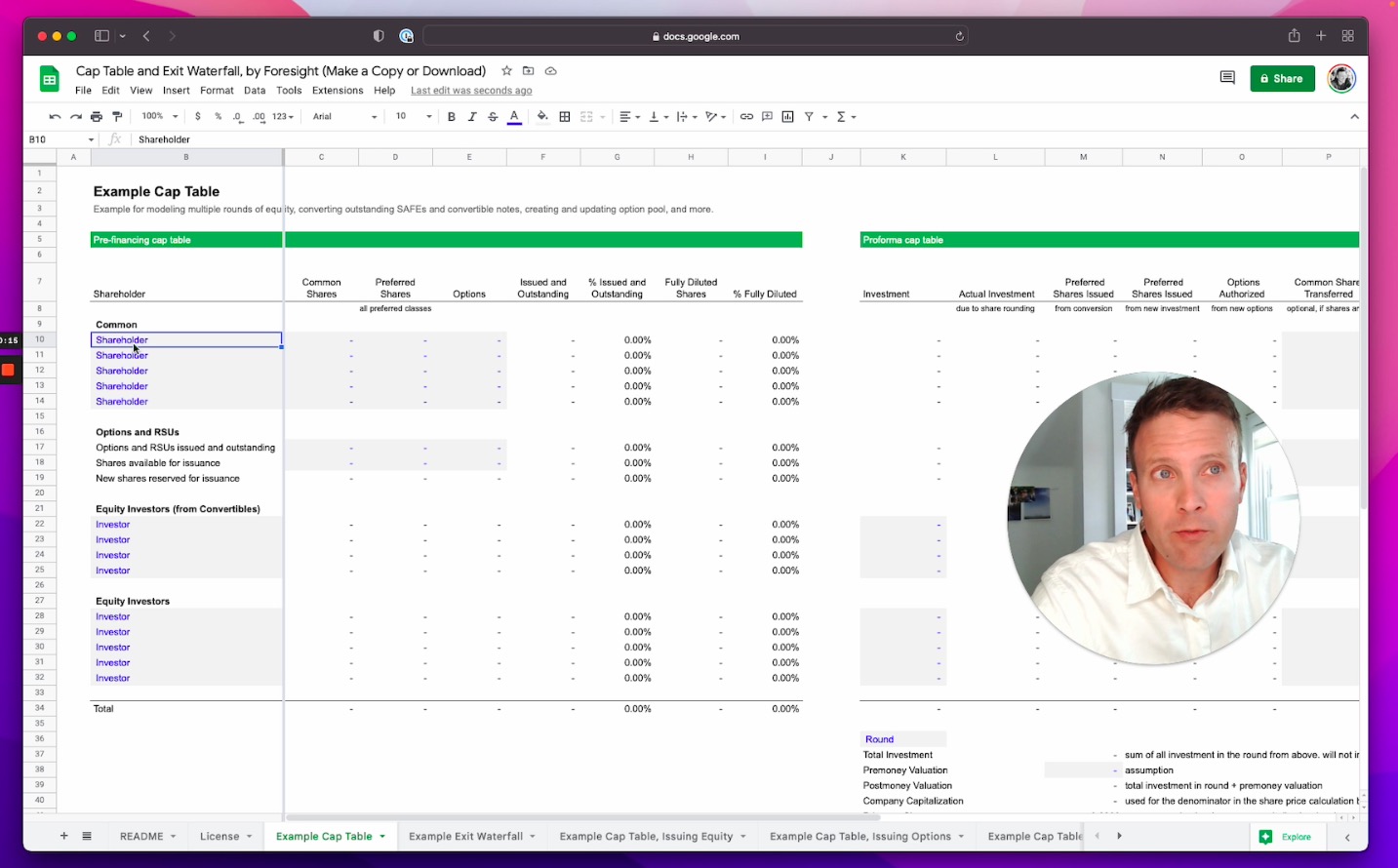

For the details on how to calculate option pools, check out the Cap Table and Exit Waterfall Tool

Glossary

Below are a number of common terms used in cap tables

| Term | Definition |

|---|---|

| Issued and Outstanding Shares | Shares issued and currently outstanding to shareholders. This will be less than the authorized shares. |

| Fully Diluted Shares | Issued and outstanding shares plus shares reserved for authorized options, and assumes that all authorized options will be eventually granted and exercised. |

| Investor Friendly | Refers to a method of issuing options or shares from convertibles where the dilution incurred from those events is borne entirely by existing shareholders prior to the round, and not the new equity investors |

| Founder Friendly | Refers to a method of issuing options ot shares from convertibles where the dilution incurred from those events is borne entirely by all shareholders, including the new equity investors |

| Premoney Option Pool | A Premoney option pool, the “investor friendly” option, reduces the premoney valuation by the value of the options created, and forces the dilutive impact on existing shareholders. |

| Postmoney Option Pool | A Postmoney option pool, the “founder friendly” option, shares the impact of dilution on all shareholders, including new equity investors. |

| Option Pool | Options, also called employee stock option pool or ESOP, represent the right (not the commitment) for the owner of the options to purchase shares. A company usually reserves or creates a pool of options, representing a % of the company, to grant to for future hires as compensation, typically created and amended around financing rounds. |

| Strike Price | Provides the right to option holders to purchase common shares at a price (”strike price”) related to the value of the company today, and sell (hopefully) at a higher price in future as company’s value grows |

| Authorized Options | Options authorized to issue |

| Granted Options | Options already granted to option holders |

| Vested Options | Options vested by option holders, based on their vesting schedule |

| Options Available for Granting | Options available to grant. Authorized options less granted options |