First, a disclaimer: I am not a lawyer or a financial advisor and am not offering financial or legal advice.

What are prorata rights?

Prorata rights are terms written into share agreements that give investor the right to purchase additional shares in future financings, usually towards the goal of maintaining their ownership percentage of a company.

They are a tool investors use to give them the right to participate in future financing rounds to protect themselves from dilution. From an investor’s perspective, prorata rights are viewed as an important and valuable right for investors to be able to participate in follow-on rounds of their “winners”

They are a right, not an obligation, and thus they can be exercised or declined. If exercised, then they are participating in a fundraise and purchasing shares in new fundraise at the new price per share.

Investors (may) want proratas to support their investment strategies and their economics, to give themselves the ability to invest larger checks into winners as companies progress, and potentially to control a founder’s cap table and other investors.

Founders (may) want to minimize proratas to minimize investor control and leave more “room” for new investors to lead rounds, and will want to create policies for what types of investors get prorata rights.

Not all investors get prorata rights; they are typically reserved for investors that invest some minimum investment amount in a round.

Super proratas represent the right or ability to invest an amount greater than what is required to maintain ownership percentage. They are not commonly written into agreements, but handled through relationships and mutual interests between founders and investors for investors to increase their ownership stake.

Prorata rights and convertibles

The default postmoney SAFE does not come with prorata rights, but investors will often add a side letter to add prorata rights (see Y Combinator's default Pro Rata Side Letter). Prorata rights were removed when Y Combinator released the postmoney SAFEs in 2018, partially (to my understanding) out of confusion over how the rights applied. Prorata rights for premoney SAFEs and convertible notes do not typically apply to the right to participate in the equity round in which the convertibles are converting, but the right to participate in future equity fundraises. The postmoney SAFE removed that confusion by removing prorata rights from the default SAFE and clarifying it with the side letter, and also because the structure of how a postmoney SAFE converts makes the application of prorata rights clearer.

The postmoney SAFE clarifies the ownership percentage of the SAFE holder prior to the new equity round; because we can think of the process of converting SAFEs as "first convert the SAFE, then issue the new equity", it's straightforward to calculate the ownership percentage of the SAFE prior to the round, then calculate any prorata in the new equity round. If premoney SAFEs and convertible notes had prorata rights in the equity round in which they convert it would be less clear, since they convert at the same time as the issuance of the new equity rounds, and the ownership percentage is unknown until the new equity round is issued, so we have to use more circular logic (and iterative calculations in spreadsheets) to calculate what the prorata should be.

As always, this is a general note, and always read the legal documents around any investment to see how these terms are written in the specific financing aggrement. And regardless of a legal agreement, it is common for founders and investors to agree to additional investment to maintain ownership rights in any nature of additional financing, regardless of previous legal agreements.

How to calculate prorata investment amounts

Chloe Alpert in How to model ownership, dilution, and how pro rata works in venture capital covers the math to calculate a prorata investment amount:

Prorata investment amount = target ownership % * # of new shares being issued * share price of new shares being issued

This can also be reduced to:

Prorata investment amount = % ownership prior to round * total $ invested new round by all investors

One way to calculate proratas is to hold the total round size constant, and figure out how much of the round will be filled with proratas (with the remainder by new investors). In this scenario, the math is easy: assume the total round size, calculate what the prorata is for each investor with prorata rights - % ownership * total round size = prorata investment amount- talk to those investors to determine who will choose to exercise them, and then determine if the lead investor will fill the round or if the round size should flex up or down to accomodate interest in prorata rights (or, negotiate with existing investors to reduce their prorata rights, which I consider to be less common).

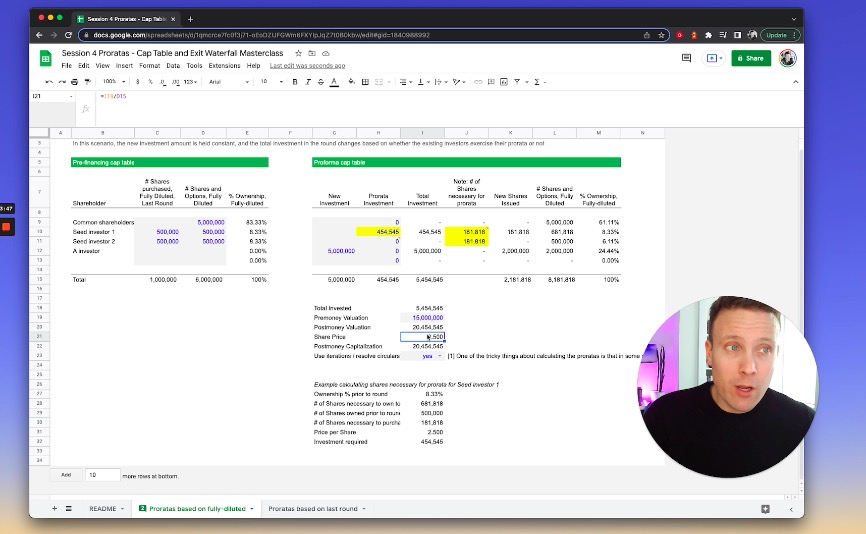

A second scenario to consider is where the round size directly floats based on proratas; the lead investor sets how much they will invest at a given valuation, then the executives of the company figure out much extra will be invested by current investors exercising their proratas. In this scenario the calculations are circular in nature - because the total shares will depend on how much the prorata investments are, so you have to calculate out what the ending share count including the prorata investments - but straightforward to implement in spreadsheets using circular calculations.

Flavors of prorata rights

Two primary ways of setting prorata rights:

Prorata of fully-diluted: prorata of the fully-diluted ownership.

number of shares owned by investor prior to the new round / number of total fully-diluted shares prior to the new round

Prorata of existing round (or last round): prorata of the existing round

number of shares purchased by investor in the prior round / number of shares sold to all investors in prior round

Prorata of fully-diluted is straightforward and standard, while the latter flavor is rare, as it provides far too much control to an existing investor over your next round, and may block new lead investors from being able to invest enough to hit their check size and ownership targets.

Prorata rights do not extend to new options issued to create or refresh an option pool; meaning, any new options being issued in the round will dilute an investor's ownership after they exercise their prorata rights. The way to calculate that is to exclude any new options from the share count used in calculating proratas.