First, a disclaimer: I am not a lawyer or a financial advisor and am not offering financial or legal advice.

What is a capitalization table (”cap table”)?

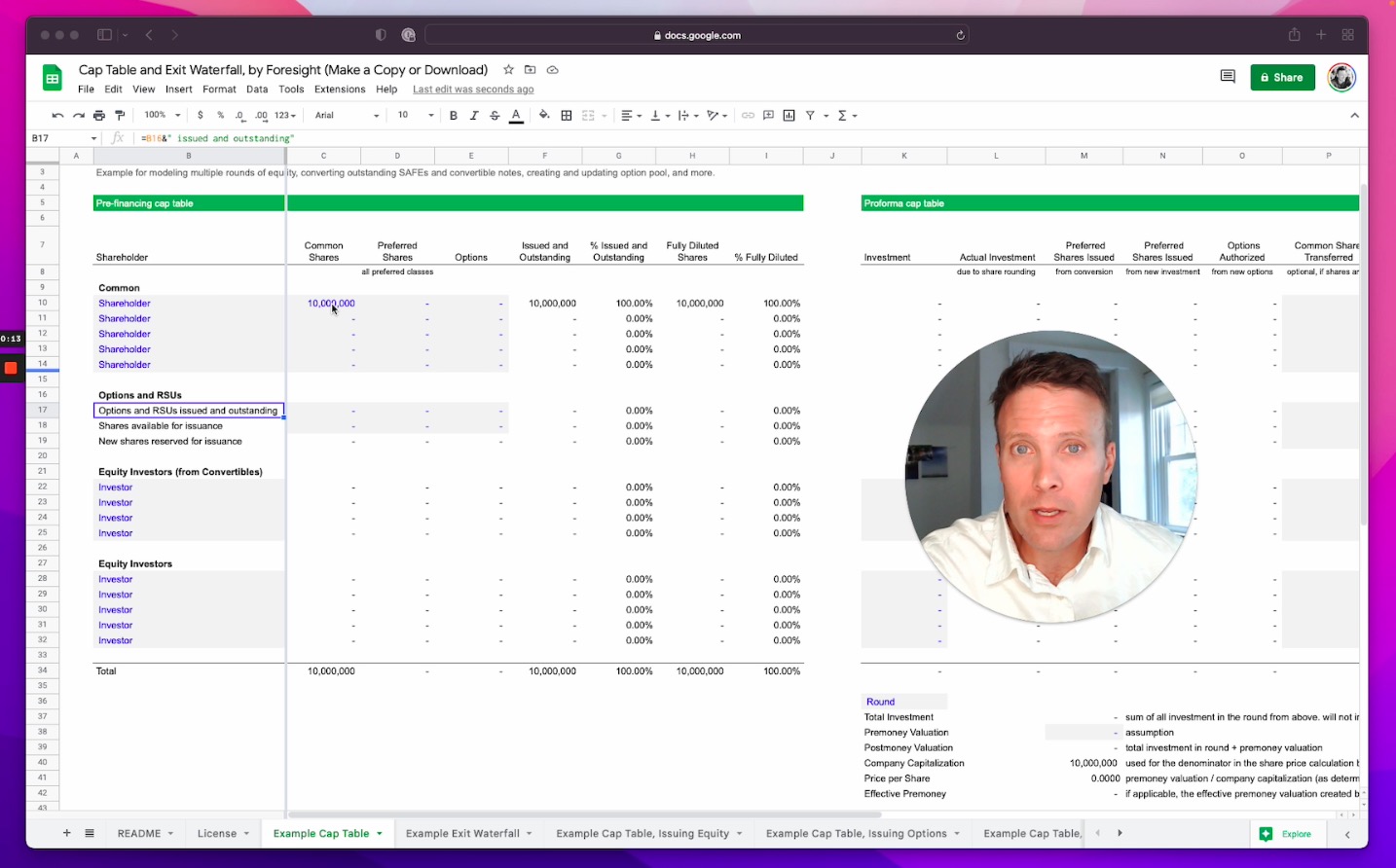

A cap table is both a record of the ownership of a company, and an analysis tool:

- List of the securities issued by a company, who owns them, how many shares they own, and what type of shares they own

- Analysis tool to understand impact of financing rounds

Pre-financing cap tables focus on the different classes of shares and ownership per investor. Pro-forma (or post-financing) cap tables focus on what the cap table looks like after a financing.

What is the difference between authorized, issued and fully-diluted shares?

There are a few different ways to think of the share count, most importantly authorized, issued, and fully-diluted.

- Authorized shares are the number of shares that a company is legally allowed to issue by the company’s operating and shareholder agreements, and this can be changed by the company’s board of directors if needed.

- Issued shares are the shares that are owned by investors, the sum of all the different share classes mentioned previously, and can include common and preferred shares.

- Fully-diluted shares includes issued shares (on an as-converted basis, in case any issued preferred shares have the right to convert to different numbers of common shares), and adds shares reserved to issue under options and warrants.

The important thing to remember is that governance and control will often be based on ownership of issued shares, most calculations of share prices will rely on fully-diluted shares, and that authorized shares can be changed if a company needs to issue or reserve more shares.

Issuing Equity

Called a ”Priced round”, issuing equity is selling shares at a determined price set by a valuation on the shares.

Premoney valuation / ( # of shares issued and outstanding + # of options = price per share)

Convertible Note

Convertible notes are debt that has the right to convert into equity upon a milestone (a date or a significant financing event), and it is treated as unsecured debt, with the seniority of debt and rights to repayment.

Convertible notes can include a discount rate (right to purchase shares at a discount to the equity price), a cap (a max valuation paid at the time of conversion), an interest rate (typically accrued, and converted into equity or paid at time of conversion), and a maturity date (a date it has to be converted by, which can be renegotiated in practice).

Sidenote: a 20% discount rate is usually written as “the right to purchase at 80% of the equity price” in legal documents.

SAFEs

SAFEs (or Simple Agreement to Future Equity) are essentially treated as a warrant to purchase shares, not treated as debt as convertible notes. They were originally introduced in 2013 to be simpler and easier (simpler docs) and standardized, to reduce legal costs and complexity for startups raising capital.

SAFEs can have cap or discount, do not have an interest rate, and do not have a maturity date.

The standard SAFE was updated in 2018 (all documents available at Y Combinator > Documents, with the new "postmoney SAFE" replacing the preexisting "premoney SAFE", intending to provide more clarity on ownership by defining the exact conversion method.

Effectively, this conversion method adds antidilution protection for investors, an addition that some in the community find an overreach, explained at Why Startups shouldn’t use YC’s Post-Money SAFE, with an amendment proposed at A Fix for Post-Money SAFEs: The Math and a Redline and A CORRECTED “SAFE FOR FOUNDERS” POST-MONEY SAFE.

The postmoney SAFE also removed prorata rights by default - which can be reinstituted with a side letter, which YC provides - in part to clarify how the prorata rights apply.

“Raising a round”

Raising a round means taking in investment capital using – typically – one of the structures – and giving investors securities at a determined price (or the right to purchase securities at a price to be determined later).

Rounds can be amorphous and can aggregate multiple investments at different valuations, when using convertibles, because it is not uncommon to raise money from investors over time on different terms but group them together as a single round in the narrative to the fundraising history.

SAFEs, convertible debt, and warrants are often listed separately on a cap table because the holders of those do not yet own shares, and the number of shares they convert to will depend on the next financing round.

“Converting investments”

Convertible notes and SAFEs are converted into equity when an equity round is raised, purchasing similar shares as the new equity round, but usually for a different price. The lower price they pay is their reward for investing earlier and bearing more risk.

Basic cap table math and definitions

Below are a number of terms commonly used in cap tables.

| Term | Definition |

|---|---|

| Investment Amount | New amount invested to purchase shares in a round |

| Premoney Valuation | Negotiated valuation of a company prior to a round of investment, what a company is worth before a financing round |

| Postmoney Valuation | Valuation after an investment round. Premoney Valuation + Amount Invested = Postmoney Valuation |

| Company Capitalization | Definition used for the number of shares to use in calculating price per share |

| Price per Share | The price per share that an investor is paying to purchase new shares issued to the investor. Price per share = Premoney Valuation / # of shares included in company capitalization |

| Common Shares | Common Stock |

| Preferred Shares | Preferred Stock |

| Authorized Shares | The number of shares that the company is authorized to issue, per their legal documents, and approved by their board of directors. |

| Issued and Outstanding Shares | Shares issued and currently outstanding to shareholders. This will be less than the authorized shares. |

| Fully Diluted Shares | Issued and outstanding shares plus shares reserved for authorized options, and assumes that all authorized options will be eventually granted and exercised. |

| Fractional Shares | Shares are typically not issued in fractions (e.g. 1/2 a share). Typically we round the number of shares calculated purchased or issued so that no fractional shares are issued. |

| Secondaries | Selling existing shares = transferring ownership from one investor to another, no new money to the company. |

For the details on how to calculate option pools, check out the Cap Table and Exit Waterfall Tool

Adding more rounds

If you're using the Cap Table and Exit Waterfall Tool and need to add in additional rounds to the template, it's easy to do.