Documentation

Each sheet in the model is detailed below, with links to documentation as relevant.

README

Contact into, overview on model. Safe to delete or hide. Details on the colors and formatting in the model at Model Formatting.License

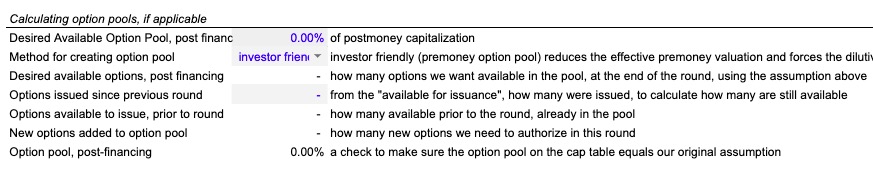

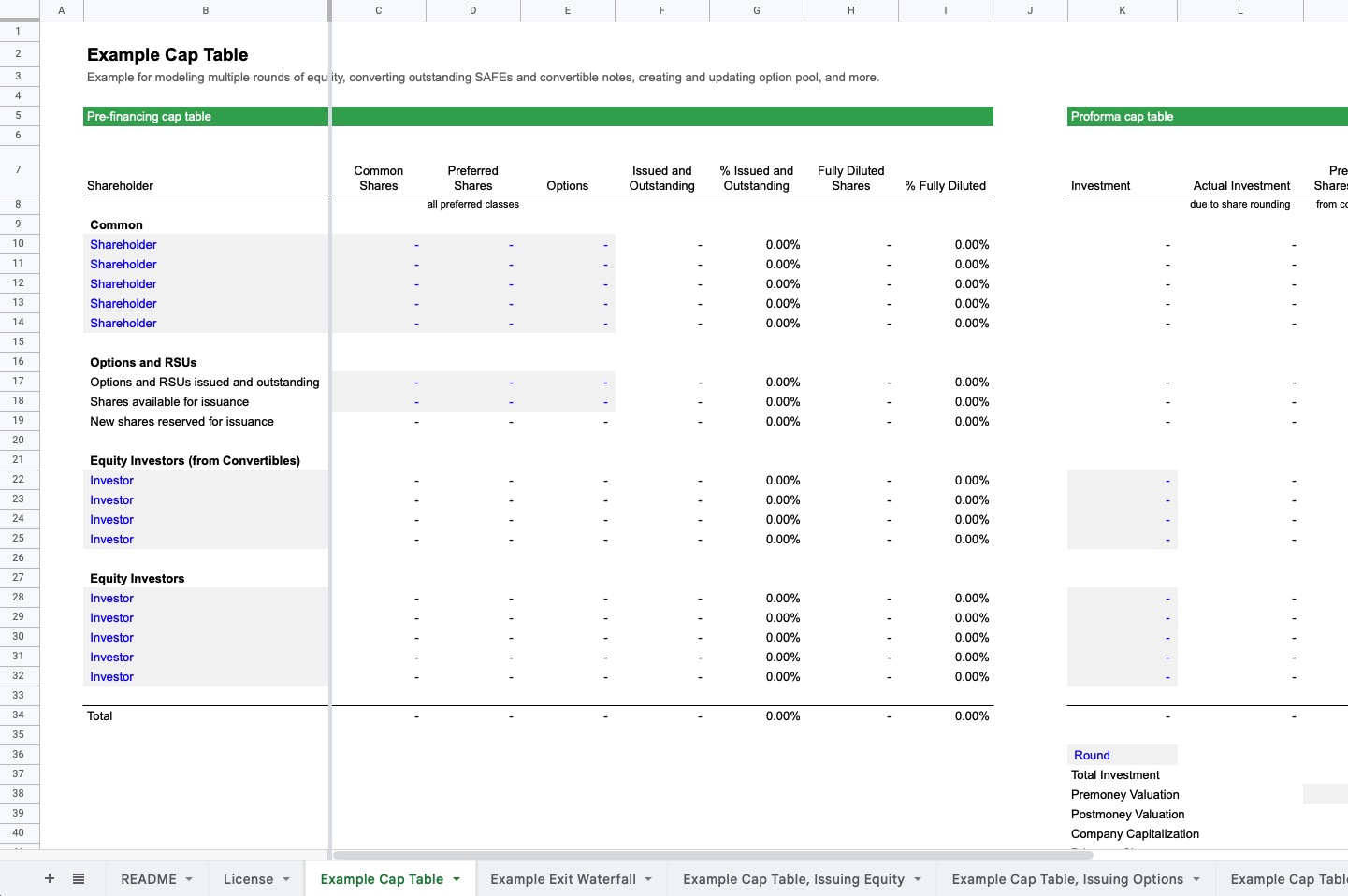

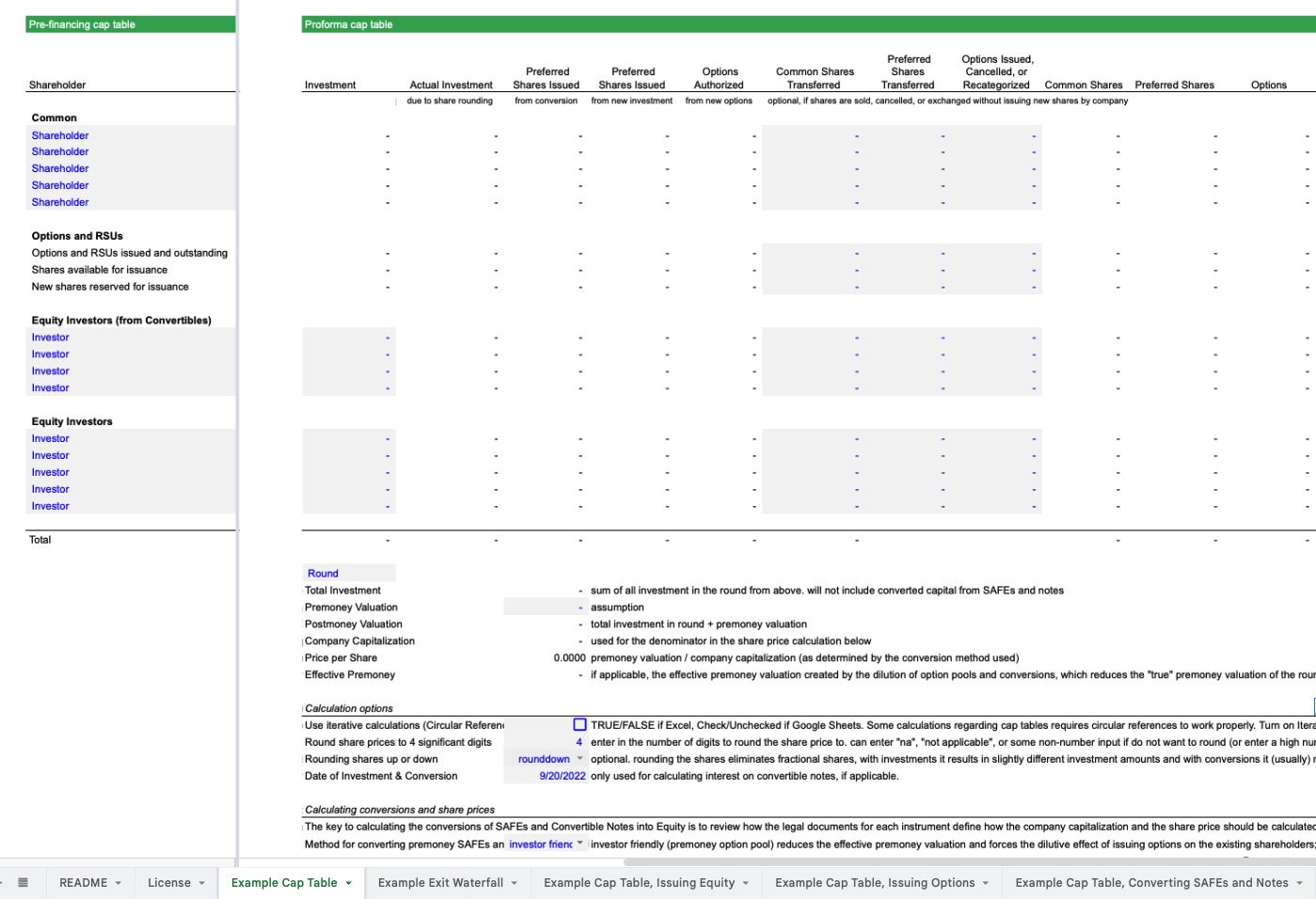

Terms of use of the model. Safe to delete or hide.Example Cap Table

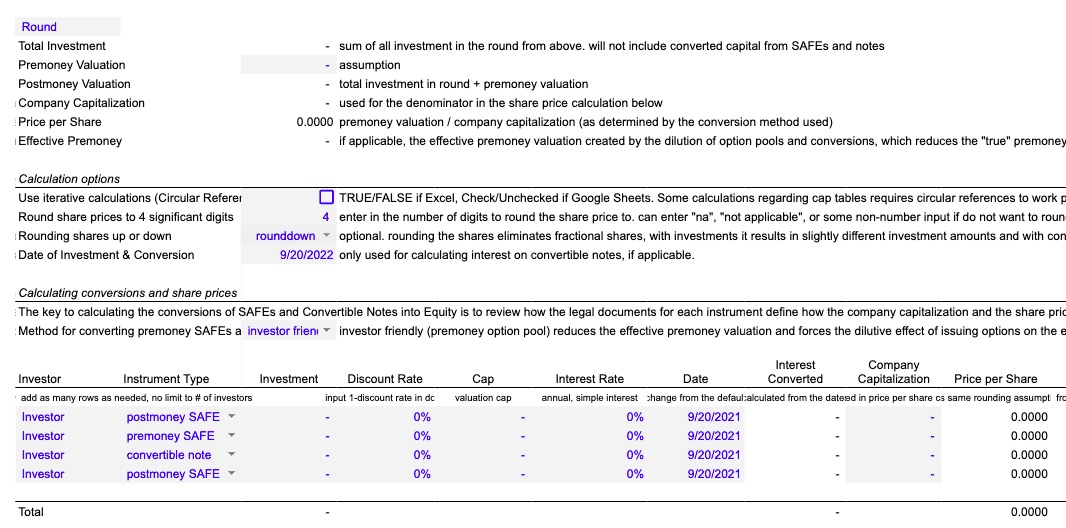

Core cap table example, used to model 1+ rounds of issuing equity to investors (new and proratas to existing investors), as well as converting premoney and postmoney SAFEs, convertible notes, issuing option pools, and more. Easy to use for proforma cap table analysis and scenario modeling for evaluating the impact of raising funding on ownership, dilution, and more.- Video: How to add in additional rounds

- Video: Modeling an equity round

- Video: Modeling convertibles

- Video: Modeling options

Example Cap Table, with Anti Dilution

Core cap table example, adding prebuilt anti-dilution protection for preferred equity investors if the option is selected and if it is applicable based on new share prices. This handles ownership dilution and value dilution, and for situations where the investor is issued new shares as well as the conversion ratio is changed. In addition to the implementation options, the amount of anti-dilution protection can be calculated using full ratchet and weighted average (broad-based and narrow-based) anti-dilution protection, and this is calculated separately for each investor with anti-dilution protection.- Video: Modeling anti-dilution

Example Cap Table, Issuing Equity

Example cap table, only modeling the issuance of an equity round- Video: Modeling an equity round

Example Cap Table, Issuing Options

Example cap table, modeling the issuance of an equity round and an option pool- Video: Modeling options

Example Cap Table, Converting SAFEs and Notes

Example cap table, modeling the issuance of an equity round and converting SAFEs and Convertible Notes- Video: Modeling convertibles

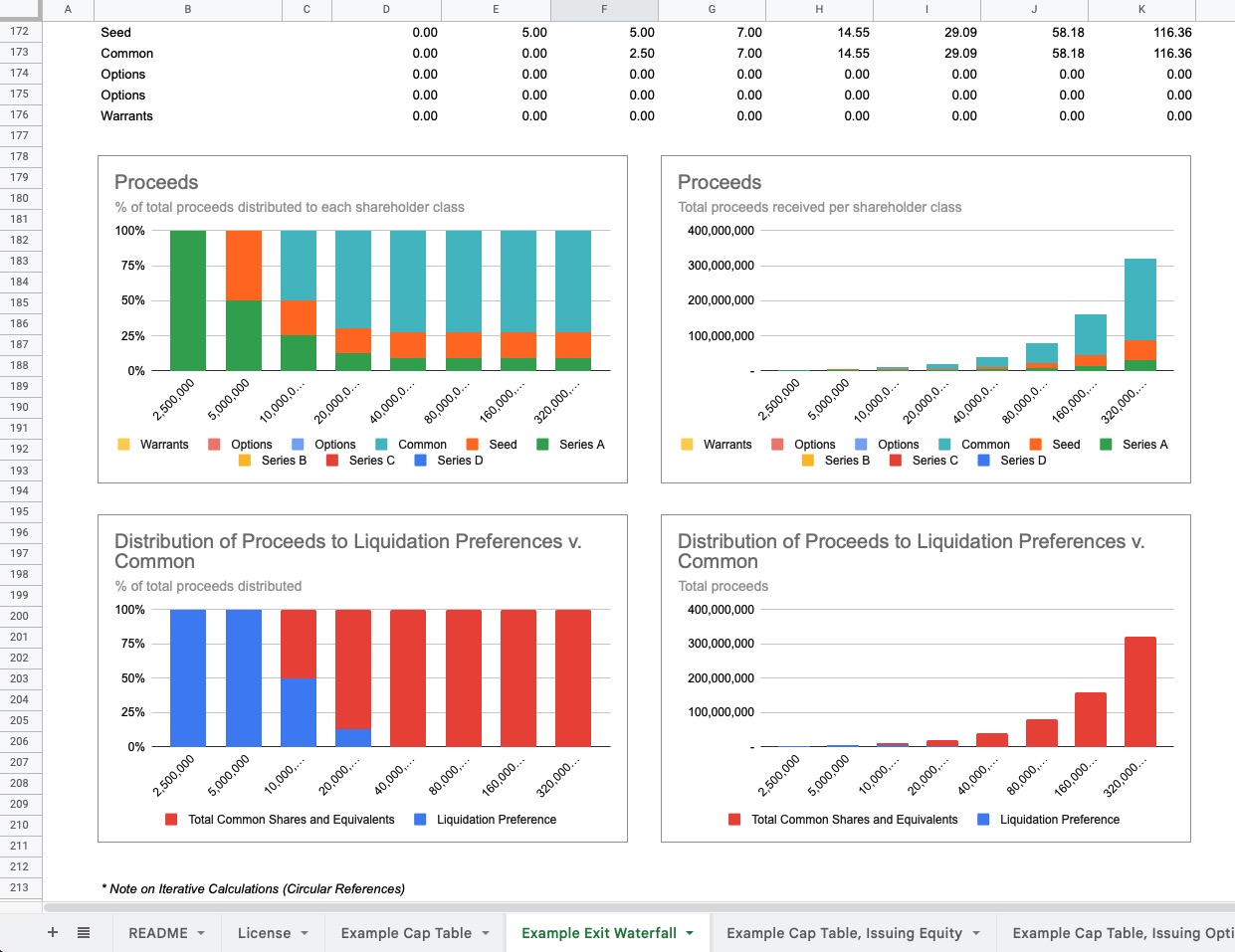

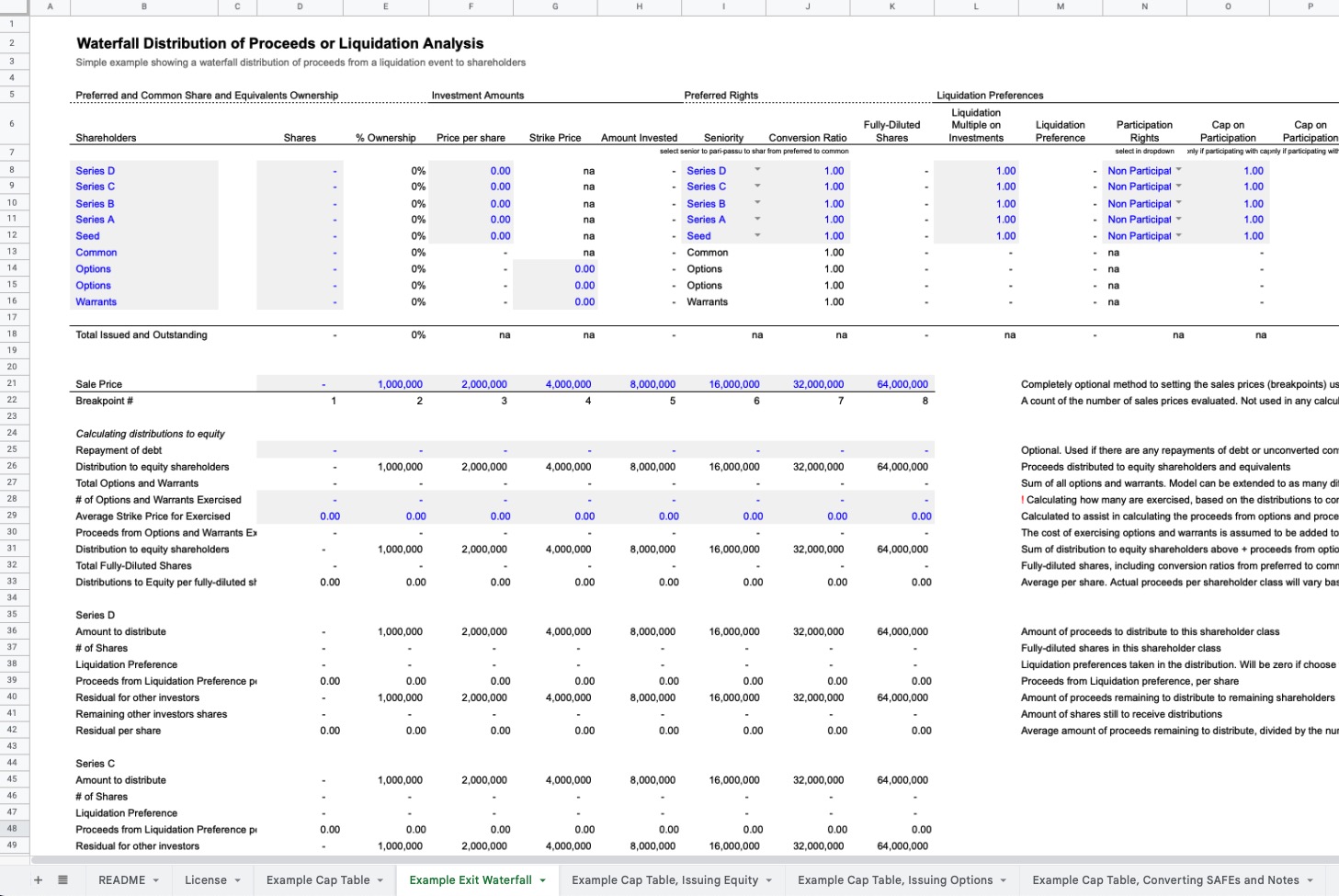

Example Exit Waterfall

Core exit waterfall example (also calleda liquidation waterfall or liquidation analysis), using a predistribution cap table and assumptions for exit prices to calculate equity distribution to each class of shareholder, using pari-passu or seniority by shareholder class, based on liquidation preferences, optional participation rights, optional dividends, option and warrant exercise based on strike prices, and more. This sheet was updated in Feb 2025 to make it much easier to use and extend for different number of share classes.- Video: Modeling exit waterfalls

Testing for unconverted convertibles to pay as debt or as equity is not supported by default in the template. Please (contact me for custom solutions for this)

Resources

Links to other models and resources for modeling venture capital funds and investments, from around the web. Safe to delete or hide.Glossary

Glossary of key terminology in the model. Safe to delete or hide.Changelog

List of what has been changed in model versions. Safe to delete or hide, although I'd advise to hide (instead of delete) so can always check to see what model version you are using to compare to future changes.

More Tools for Modeling Cap Tables

I am a fan of Angelcalc for analyzing investment rounds, which does a good job of allowing you to model different rounds, different types of investments (equity, convertible notes, premoney and postmoney SAFEs), and seeing how the cap table changes (ownership, dilution, and more) when new rounds happen.

Carta's Safe and Convertible Note Calculator is another tool that will automatically take inputs around your cap table and convertible instruments and calculate how they convert in equity rounds.

I do not build my spreadsheet to be a tracking or cap table management tool, which is why it does not handle some specific functions to track options vesting and per-investor details; Alexander Jarvis provides a spreadsheet that is intended to be a cap table tracking tool with more features to support that usecase.

Once you're running a company, I highly suggest using an online cap table management platform, as it will provide more functionality and features to help make sure that all the details are correctly entered and maintained, which is one of the difficult things to handle with spreadsheets. A few to consider: