Learn how to model convertible financing structures, options, and warrants

Today more than ever, it's important to know how fundraising structures impact ownership and dilution as valuations change, but the terminology and structures can often be confusing and opaque even to people experienced in finance. Even if you are working with experienced investors, lawyers, and founders, knowing the fundamentals of how venture financing structures work can save you from costly misunderstandings and errors.

I've helped over 35,000 founders, venture capitalists, and lawyers from around the world with tools and classes to understand how equity, convertible notes, SAFEs, and tokens impact their cap tables, dilution, and ownership.

This self-paced, 9 hour, email supported course provides a beginner to advanced level comprehensive education on modeling equity fundraises, convertible financing instruments (e.g. convertible notes and SAFEs), options, warrants, exit waterfalls.

You'll watch the recordings and work on the practice exercises at your own pace, with me available by email for questions anytime, and leave the course with access to a spreadsheet resource library covering numerous examples of cap table calculations, slides and videos for you to review whenever you need, and a solid understanding of the fundamentals.

If you want to take the class through a series of live sessions with me with comprehensive access to slides and spreadsheets, signup at Cap Table and Exit Waterfall Masterclass

Learn how to read, understand, and create cap tables and exit waterfalls

The learning objectives for the course are tied to the practical skills required by venture capital lawyers, investors, and startup executives to forecast, understand, and manage capitalization table and liquidity distributions.

Build a cap table from scratch.

Understand the math and structures necessary to create fundraising rounds, convert notes and SAFEs, calculate proratas, antidilution, and more.Understand how fundraising rounds impact cap tables.

Understand how to calculate dilution and ownership over time to understand the impact of different fundraising structures (equity, notes, SAFEs). Understand how to calculate share counts and share prices for new equity rounds (up and down rounds) and conversions of convertible notes, premoney and postmoney SAFEs, and other convertible structures, through different conversion methods and including the impact of new and refreshed option pools during rounds of financing.Build an exit waterfall from scratch.

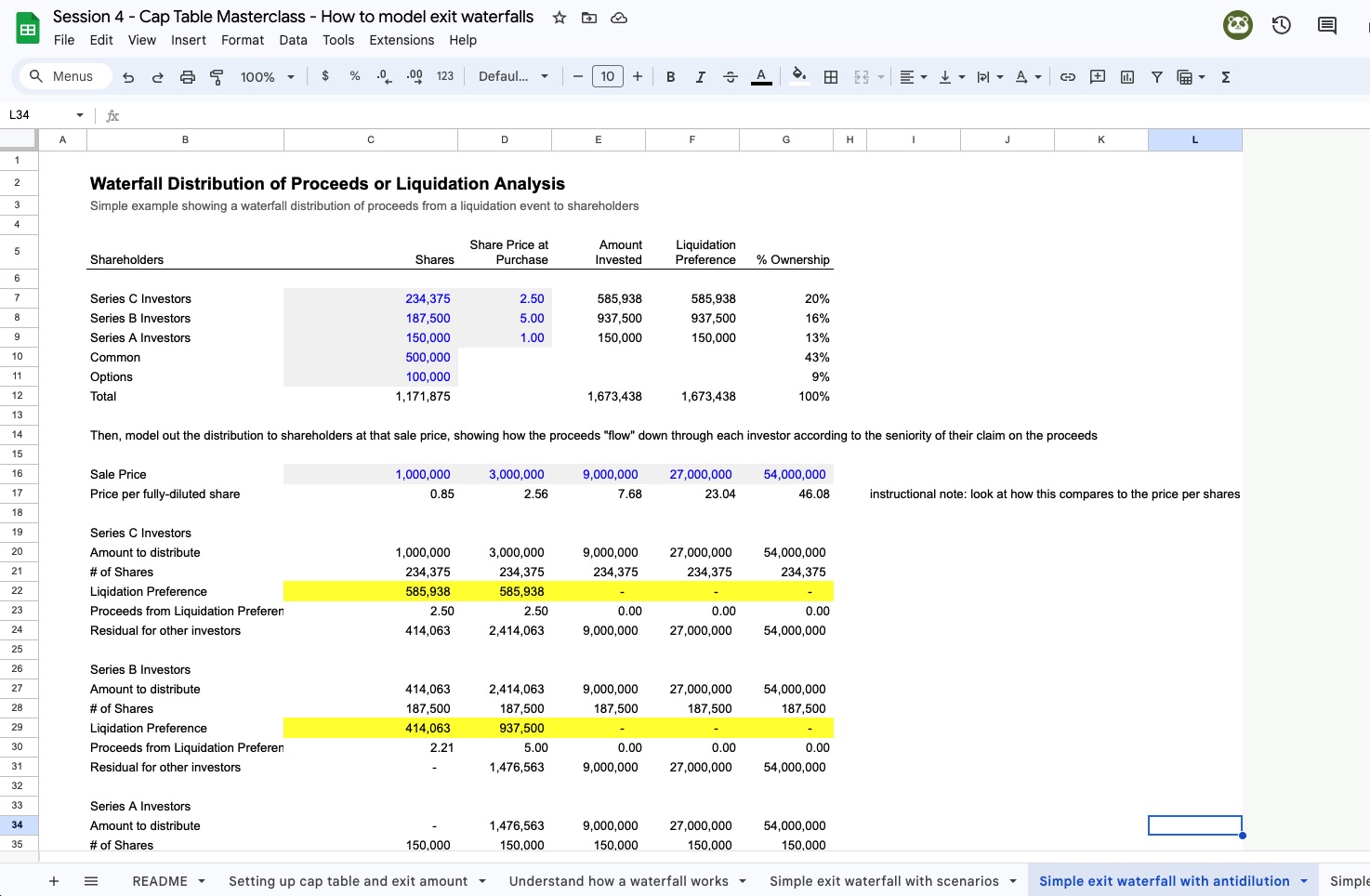

Understand the terminologies and math involved in showing how proceeds from an exit are distributed to the owners of a business, and be able to build your own. Understand how preferred shares and liquidation preferences impact liquidity distributions, including various participation rights, conversion ratios, liquidation preferences, and seniority. Learn how to use that waterfall to model investor returns and assist with valuation decisions.Create scenario analyses around fundraising events.

Be able to take a list of shareholders, rounds, share prices, and more from any cap table management software and create your own custom scenario analyses around future fundraising rounds or exits.Case Study

Apply what you've learned through a practical example of modeling a proforma cap table through multiple financing rounds and an exit.

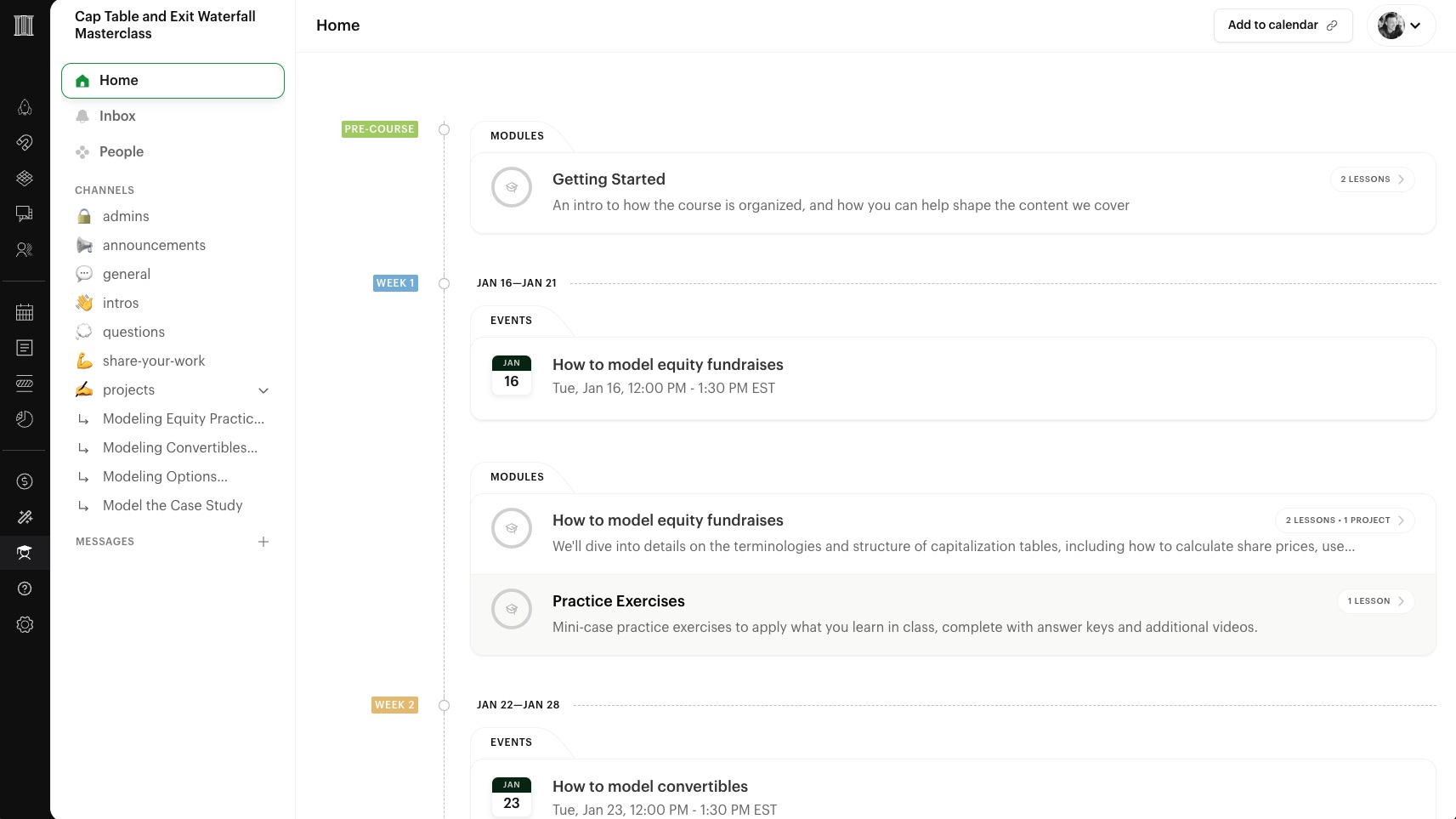

Six self-paced modules combining theory, math, and practical implications

Each of the six modules is available for your immediate viewing and access to slides, spreadsheet examples, and practice exercises, for you to go over the material self-paced and practice what you learn. My expectation would be for you to spend 1.5 hours watching the recorded sessions and optionally 0.5 hours on the practice exerices per module. I am available to answer questions throughout the course, email anytime.

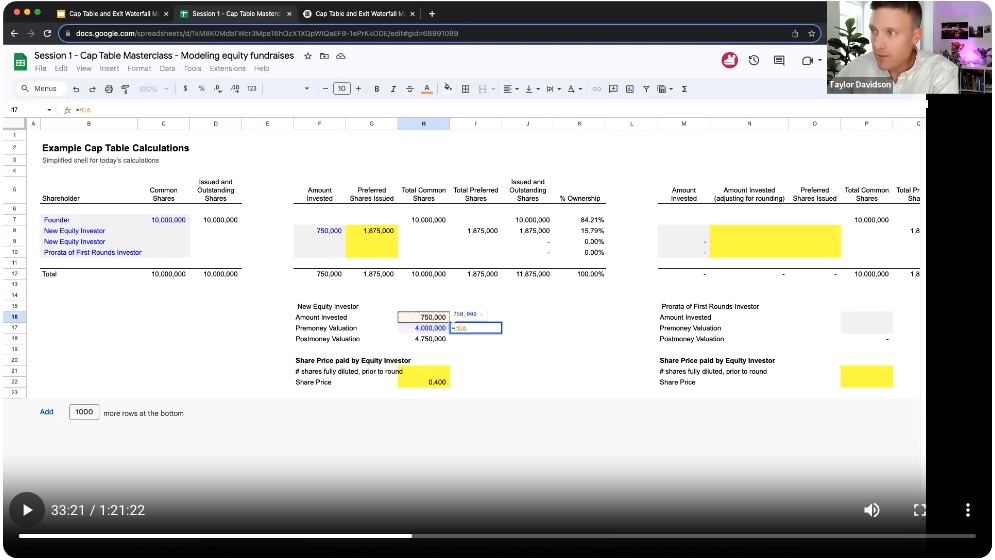

How to model equity fundraises (up and down rounds).

We'll dive into details on the terminologies and structure of capitalization tables, including how to calculate share prices, use valuations, model equity fundraising rounds, issue new shares to investors, and calculate ownership percentages. We will also cover how to model proratas and antidilution.How to model convertibles.

We will cover how to issue convertible securities (SAFEs and convertible notes), and how to convert them into shares, calculating share prices, valuations, and ownership percentages.How to model options.

We will cover how to model option pools, from creating, refreshing, and tracking the issuance of options through rounds, and how they impact calculations of share prices and share counts for equity investorsHow to model exit waterfalls.

We will learn how to create an exit waterfall to model the distribution of proceeds to shareholders, detailing how to handle liquidity preferences, converting preferred shares to common shares, and handle the flow of proceeds to multiple classes of shareholders.How to model investor returns.

Continuing on from the first class on exit waterfalls, we'll dive into how to use the waterfall to understand investor returns across share classes, incentives around the terms and structures around liquidity distributions, and more advanced topics around waterfalls and investor return modeling.Case Study.

This session reviews the case study, a practical example of modeling a proforma cap table through multiple financing rounds and an exit. You can work on the case along with the classes, ask questions in the community, and we will cover it in the course wrap-up and Q&A.

How the course is structured

No prior knowledge of cap tables required

This is a beginner to intermediate level, comprehensive class that starts with basic cap table structures and how to do the calculations for issuing equity (e.g. valuations, share prices, share counts), through more intermediate and advanced level topics around convertibles, options, and exit waterfalls. No prerequisite education or experience required.Self-paced, watch anytime

The video recordings can be watched on your own time, and you can download the slides and accompanying class spreadsheets to go through them during the class and revisit anytime.Simple technical requirements

You will need a computer (Mac or PC), an internet connection, and to create an account on Gumroad to access the course materials.Practical, examples-based learning using case studies

The course comes with slides, spreadsheets, and links to key readings and examples. The example spreadsheets are broken up into many examples so that you can learn the concepts from multiple angles and situations, and you can download them to Excel or Copy to Google Drive to use and review anytime.Focus on first principles

This class does not teach the cap table template, but aims to teach you the fundamentals on how to build your own models by focusing on the fundamental concepts and applying them in the mini-cases. Always available for questions and support on fund modeling afterward.Structured for busy professionals

Structured to be manageable for busy professionals with actionable takeaways that you can use in your work today. The goal is for you to be able to cover the content at your own pace, budgeting for 9 hours of watching the instruction and additional time to review the additional spreadsheet materials and videos, and if you really want to learn the topic, apply them by building your own cap table.Available for questions by email

You can always email me to ask questions about the content in the course or how to apply it to a situation you are facing, and I'll reply as soon as I can.

Common questions

Why do you teach this?

Back when I worked as a VC, even though I talked about the structures and mechanics of fundraising rounds and cap tables, it's only after I left and built out Foresight that I really learned the details and math behind how they work. I learned the hard way, and after helping hundreds of founders and VCs individually, I'm sharing it with you.How do I know if this will be valuable for me?

If you are a founder, CFO, VP of Finance, or similar level executive preparing for a fundraising round, or you are a lawyer or venture capitalists that works on deal execution, then this can be integral to your job.Will my employer pay for the course?

This course is highly practical for founders, venture capitalists, and lawyers working on venture fundraising. Many companies offer an L&D or education budget that can cover the cost of this course. If you need help with a letter to submit for reimbursement, contact me. If you need an invoice, you can generate an invoice from your email purchase receipt and fill in the necessary information.What if I can't afford the course?

The free Cap Table and Exit Waterfall Tool by Foresight has been downloaded for free by over 25,000 entrepreneurs, VCs, accountants, lawyers and finance professionals from around the world, and is structured to be an instructional tool on how cap table exit waterfall math works. Feel free to ask questions anytime.Can you run this live for groups?

Yes! I offer corporate workshops. If you'd like to run this course, the masterclass or components of the syllabus as a workshop just for your firm, contact Taylor to discuss.How often is the content updated?

The content in this course leverages the lessons from teaching the Cap Table and Exit Waterfall Masterclass, which has been updated every cohort to reflect participant feedback and subject matter interest, detailed at How I teach cap tables. The last revision date of the Masterclass was February 6, 2024.Will there be a community with the course?

There is a private community space for participants in the Cap Table and Exit Waterfall Masterclass where you can share your ideas, get feedback, ask for help, and more, but access to that is not included in this self-paced course.Can I change my registration to the live Masterclass?

Yes! Students are allowed to move their registrations to the live session Cap Table and Exit Waterfall Masterclass, and you can apply what you paid for this course towards the Masterclass.What is your refund policy?

I offer refunds on a case-by-case basis, see the rationale for the policy here. For more information regarding refunds, concerns, and course policies, please contact Taylor Davidson or directly at taylor@foresight.is.I have questions, who do I contact?

Happy to help, just contact Taylor by email or setup a quick chat to discuss.