Understand venture fund economics and metrics

Starting a fund, syndicate, or getting started with angel investing? It's important to understand how to budget for investments and forecast returns for your limited partners. In this hybrid three week class we will unpack and build models to forecast the building blocks and key metrics of venture funds. Come for the education, leave with a model you can use.

The course is self-paced and can be watched on your own time. Students will receive slides, example spreadsheets, a case study, and recordings of lectures covering the key topics, and the slides and spreadsheets can be downloaded for viewing (and using!) on your own time.

For an intro to the topic, check out How to Model a Venture Capital Fund on OpenVC.

If you previously took the live course on Maven, you can continue to login and access the recordings and materials from your cohort on Maven. If you want to access updated content in this self-paced course, email me and I can register you on Gumroad.

Learn how to model venture funds

Model fund capital budgeting and deployment

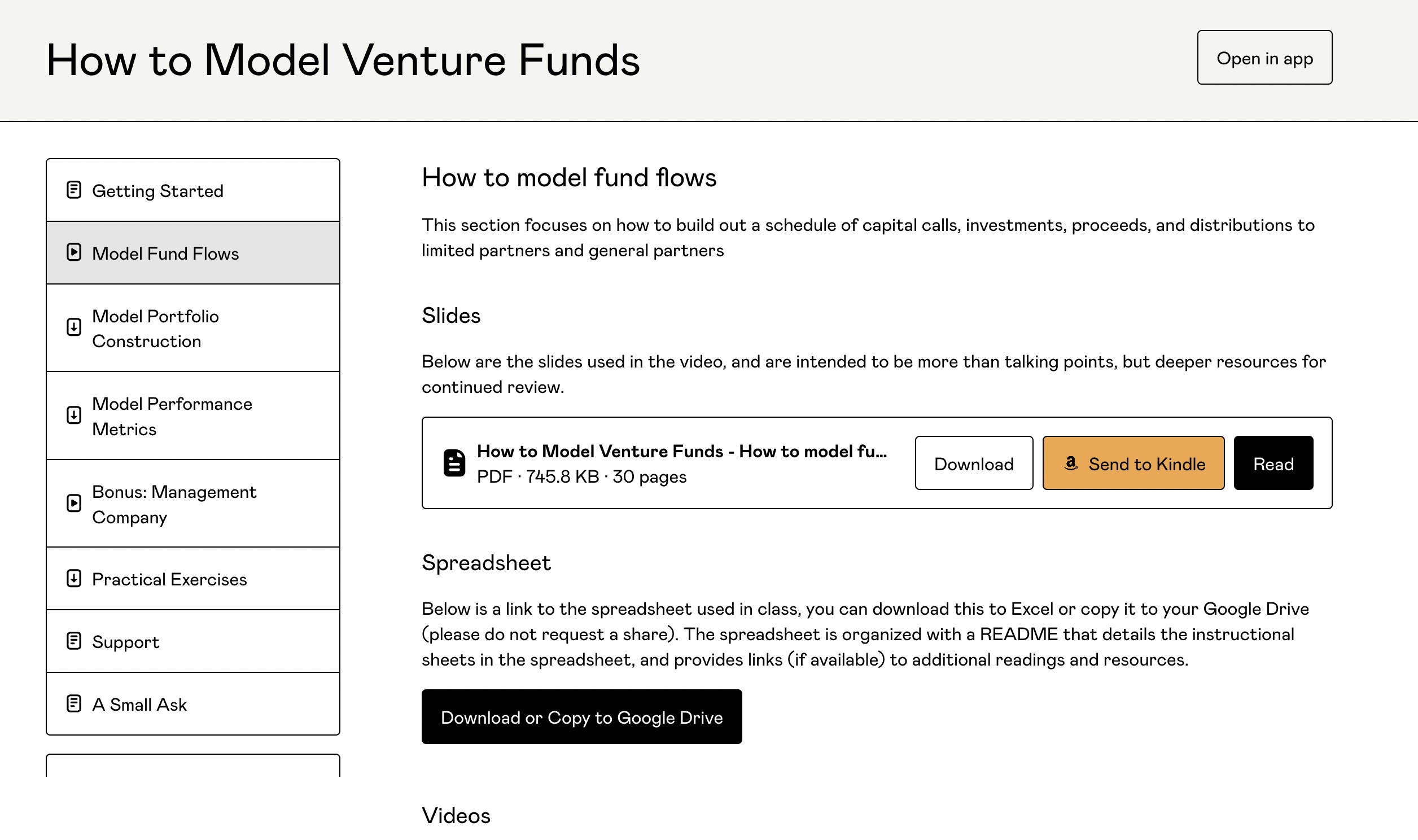

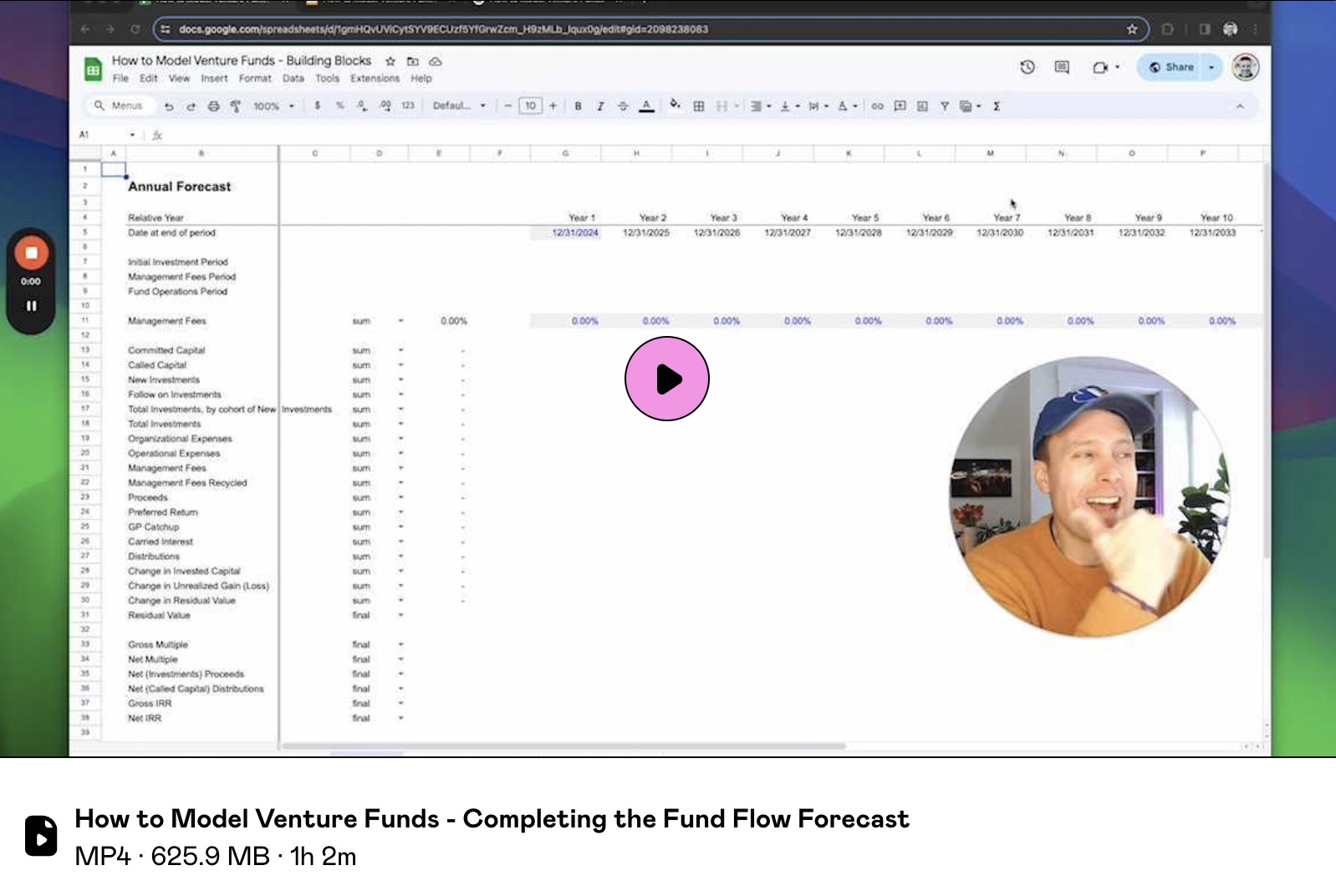

We will cover how to use assumptions around fund size, management fees, and expenses to create a forecast of called capital, expenses, and invested capital over time.Create a portfolio construction model

We will cover a few common ways of approaching portfolio construction models and discuss the pros and cons of each, and how to use them in our forecast of investments and proceeds. We will cover simple and complicated ways of forecasting portfolios, as well as ways to create manual forecasts and track actual investments.Model proceeds and distributions

Using our forecast of invested capital and our portfolio construction logic, we will cover how to create a forecast of proceeds from investments and a waterfall of distributions, including preferred returns, GP catchups, and carried interest.Present key metrics and key reports

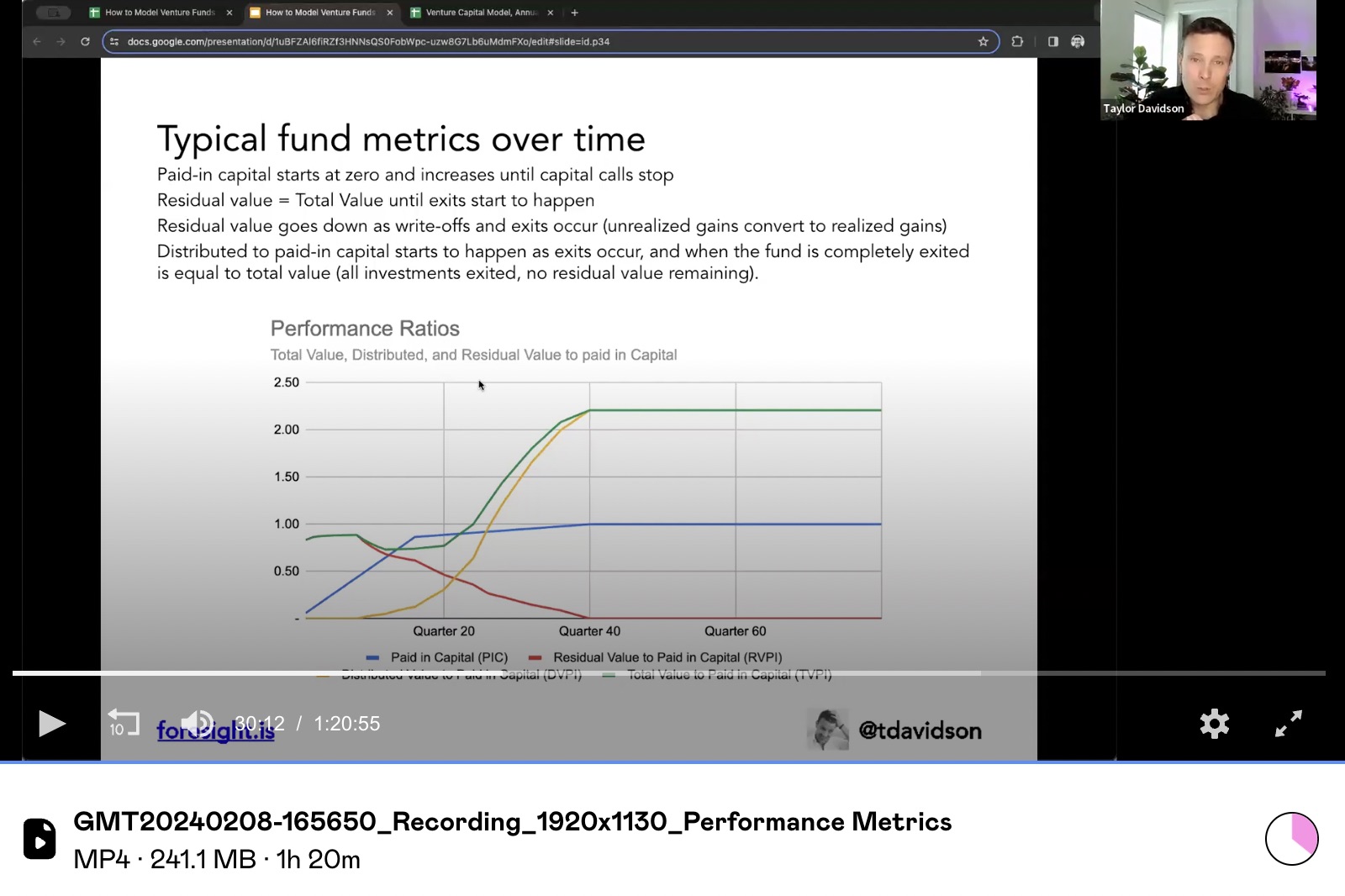

Using our forecast of fund cash flows, we will introduce how to calculate unrealized gains and residual values, using our portfolio construction approach to forecast the underlying changes in value in the portfolio not captured in our realized cash flow forecasts. Then we will build out typical fund metrics and reports used for performance reporting, understanding the differences in interpretation between gross and net metrics, rate of return and multiple metrics, and more.Bonus: Model a management company

How to model the forecasted revenues and expenses for the management company. This is a bonus session using prerecorded video, and will address questions and comments in the session.

Who this course is for

- Emerging venture capitalists building a new fund or working for a venture capital fund.

- Syndicate leads and angel investors wanting to structure their investing tracking and reporting.

- Founders or executives looking to understand how the economics of venture funds work.

Many companies offer an L&D or education budget that can cover the cost of this course.

How the course is structured

Self-paced lessons

6 hours of videos with slides, spreadsheets, and background readings. Watch the video recordings on the material and work on the practice exercises at your own pace.Bite-sized projects

Practical exercises for you to apply what you learn in class. The time commitment is manageable for busy professionals, with actionable takeaways to use in your business.Focus on first principles

This class does not teach the Foresight venture fund models, but aims to teach you the fundamentals on how to build your own models by focusing on the fundamental concepts and applying them in the mini-cases. The goal is you to learn to build your own models. Always available for questions and support on fund modeling afterward.Available for personal support

I am always available to answer questions you have about the content in the course and applying to your specific needs. Course participants can book 1:1 screenshares with me to review content or ask questions, and I am available by email anytime.

Common questions

Will my employer pay for the course?

This course is highly practical for venture capitalists launching or planning on launching a venture capital fund. If you need help with a letter to submit for reimbursement, contact me. If you need an invoice, contact Maven to request an invoice.What if I can't afford the course?

How to Model a Venture Capital Fund details the processes and many consderations for modeling venture funds, and I also offer many venture fund templates for free or donations. Ask questions anytime.Can you run this live for groups?

Yes! I offer corporate workshops. If you'd like to run this course or components of the syllabus as a workshop just for your firm, contact Taylor to discuss.I have questions, who do I contact?

Happy to help, just contact Taylor by email or setup a quick chat to discuss.