Learn how to model convertible financing structures, options, and warrants

Today more than ever, it's important to know how fundraising structures impact ownership and dilution as valuations change, but the terminology and structures can often be confusing and opaque even to people experienced in finance. Even if you are working with experienced investors, lawyers, and founders, knowing the fundamentals of how venture financing structures work can save you from costly misunderstandings and errors.

I've helped over 35,000 founders, venture capitalists, and lawyers from around the world with tools and classes to understand how equity, convertible notes, SAFEs, and tokens impact their cap tables, dilution, and ownership. This six session workshop provides a comprehensive education on modeling equity fundraises, convertible financing instruments (e.g. convertible notes and SAFEs), options, warrants, exit waterfalls.

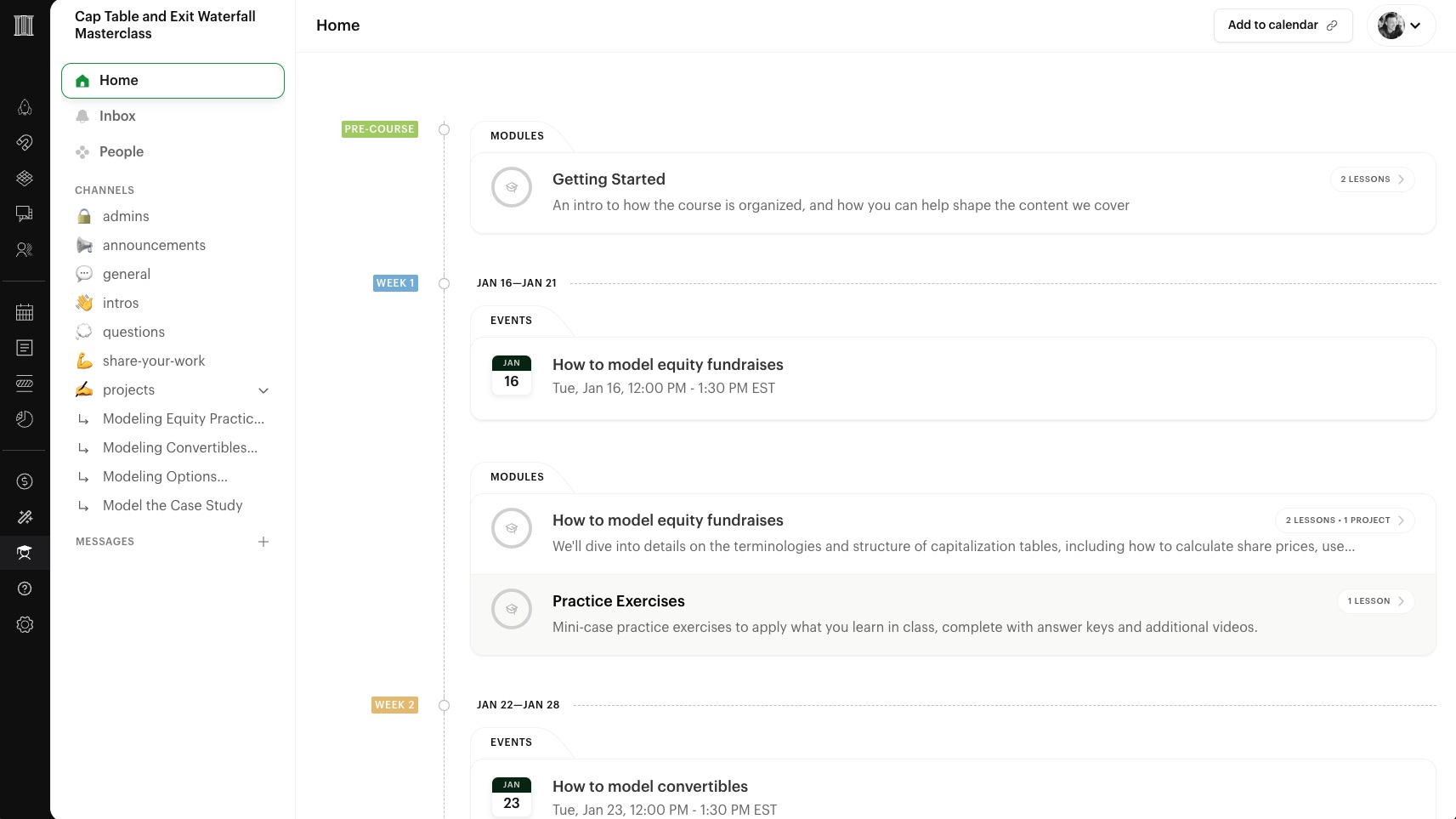

The course features live sessions on Zoom with Taylor and the rest of the cohort for going over the material, Q&A, and exercises to dive deeper into that week's material. If you miss a session, all class materials including the session recordings are available for you to catch up.

If you're not interested in joining for the live sessions (and not interested in CPE credits), consider the Cap Table and Exit Waterfall Course, a self-paced option without the live sessions that still covers all the same material.

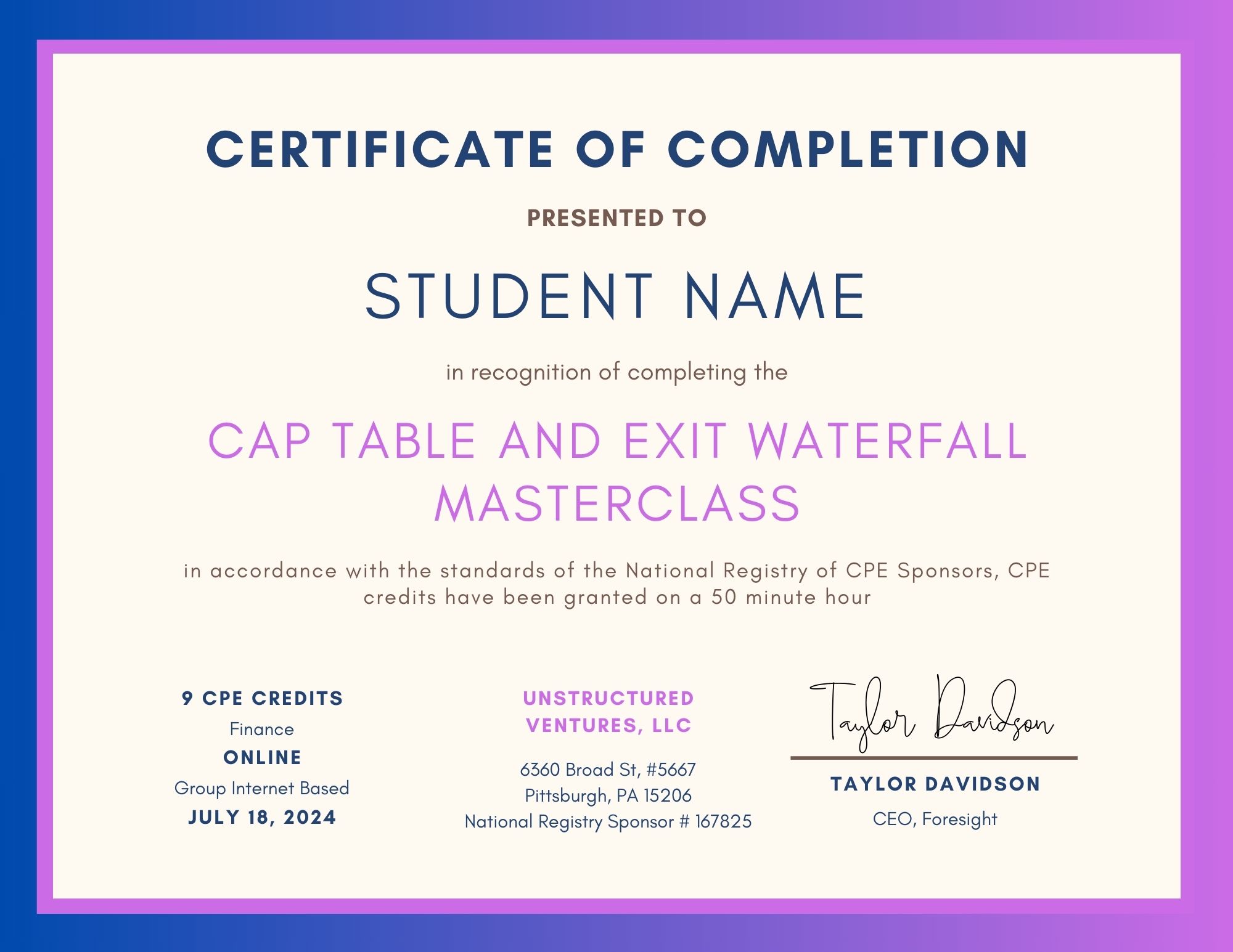

Earn continuing professional education (CPE) credits

New in Fall 2024, students have the option to earn 9 continuing professional education (CPE) credits by attending the five instructional lessons and participating in the course (answering at least 3 polling questions per instructional hour). The credits are for the Finance field of Study at the Basic Program Level, and offered through the Group Internet Based delivery method. Unstructured Ventures, LLC is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. Full details on requirements and earning credits are detailed below.

Learn how to read, understand, and create cap tables and exit waterfalls

The learning objectives for the course are tied to the practical skills required by venture capital lawyers, investors, and startup executives to forecast, understand, and manage capitalization table and liquidity distributions.

Build a cap table from scratch.

Understand the math and structures necessary to create fundraising rounds, convert notes and SAFEs, calculate proratas, antidilution, and more.Understand how fundraising rounds impact cap tables.

Understand how to calculate dilution and ownership over time to understand the impact of different fundraising structures (equity, notes, SAFEs). Understand how to calculate share counts and share prices for new equity rounds (up and down rounds) and conversions of convertible notes, premoney and postmoney SAFEs, and other convertible structures, through different conversion methods and including the impact of new and refreshed option pools during rounds of financing.Build an exit waterfall from scratch.

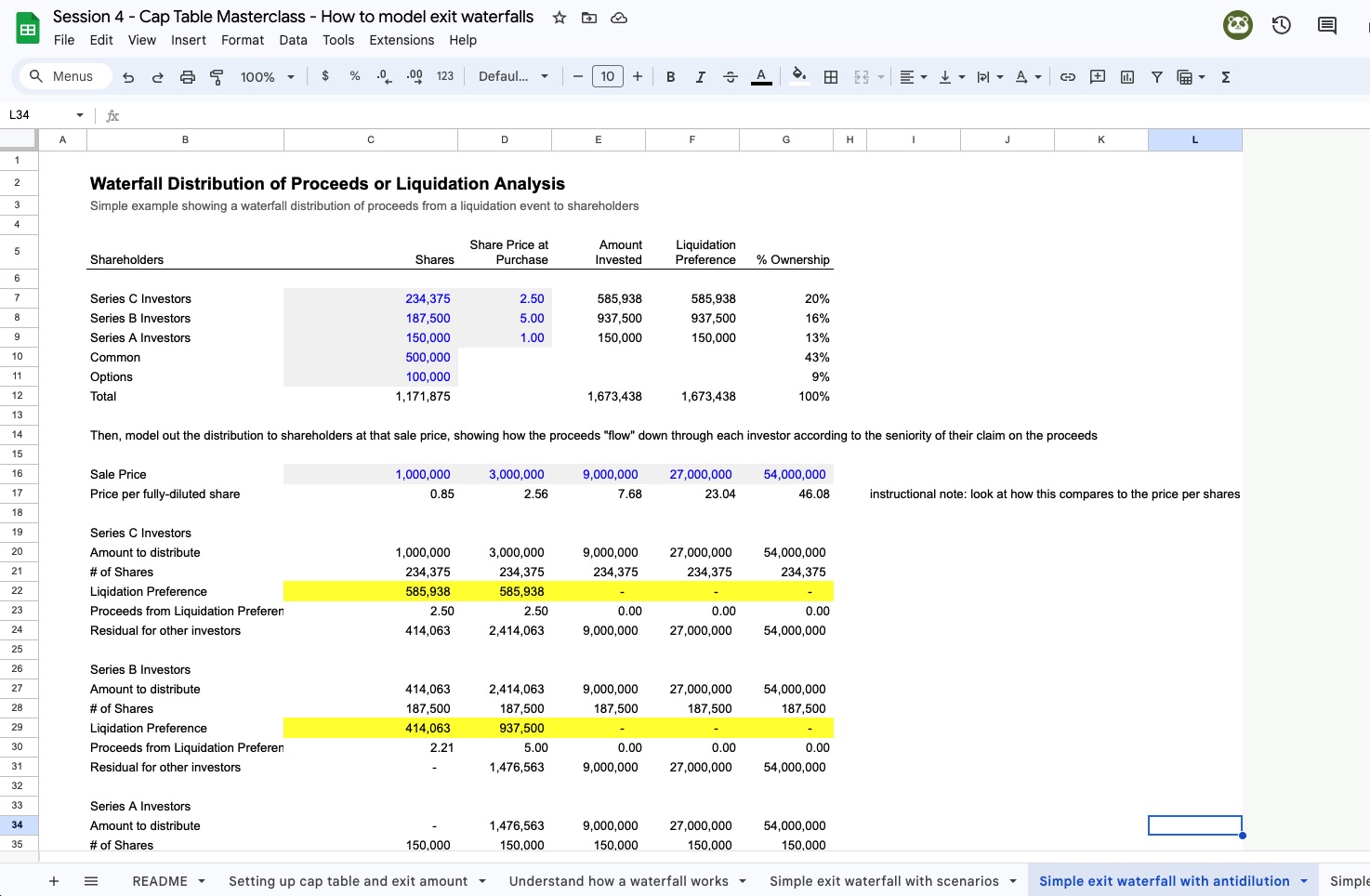

Understand the terminologies and math involved in showing how proceeds from an exit are distributed to the owners of a business, and be able to build your own. Understand how preferred shares and liquidation preferences impact liquidity distributions, including various participation rights, conversion ratios, liquidation preferences, and seniority. Learn how to use that waterfall to model investor returns and assist with valuation decisions.Create scenario analyses around fundraising events.

Be able to take a list of shareholders, rounds, share prices, and more from any cap table management software and create your own custom scenario analyses around future fundraising rounds or exits.Case Study

Apply what you've learned through a practical example of modeling a proforma cap table through multiple financing rounds and an exit. Students may submit their completed case studies for instructor review and comments.

Who this course is for

- Venture Capital analysts and associates, lawyers and accountants looking to learn how to build cap table models

- Founders, CFOs, Controllers, VPs of Finance, and finance executives raising capital for the first time wanting to understand how raising money impacts their ownership

- Anyone looking to cut through the jargon and understand the practical aspects to modeling cap tables

This is an basic level course that starts with basic cap table structures and how to do the calculations for issuing equity (e.g. valuations, share prices, share counts), through more detailed topics around convertibles, options, and exit waterfalls. No prerequisite education or experience is required. Expectation is that participants will have a knowledge of what venture capital is, although no experience, formal education, nor degrees on the subject are required. Applicable for early, mid, and late career professionals.

Many companies offer an L&D or education budget that can cover the cost of this course. If you need help with a letter to submit for reimbursement, contact me. If you need an invoice, you can generate an invoice from your email purchase receipt and fill in the necessary information.

Six live sessions combining theory, math, and practical implications

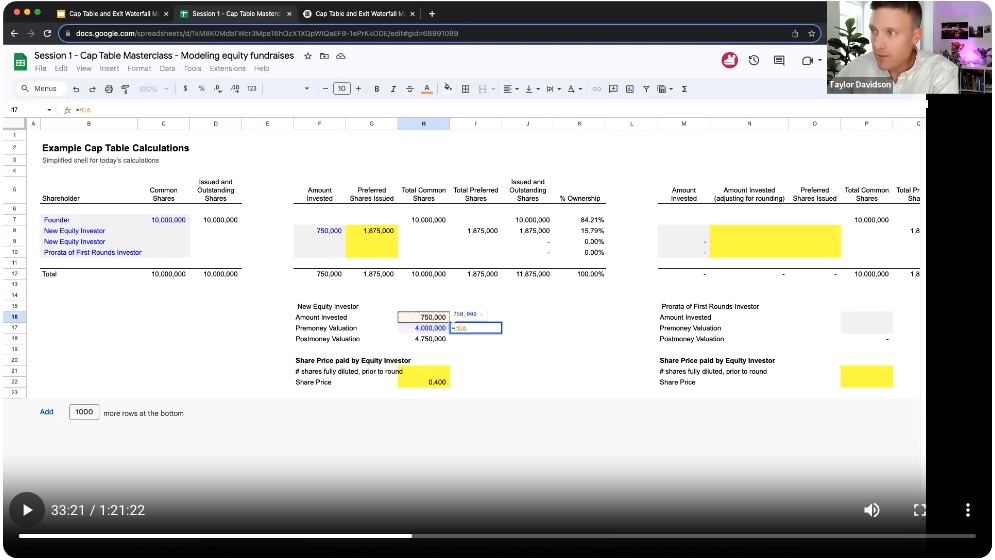

Each of the six sessions are conducted over Zoom, led by me and tied to the learning objectives and includes a lecture, optional reading, in-class discussion, spreadsheet examples, and practice exercises. Each class uses slides and a spreadsheet in-class to cover the material, and the practice exercises provide you the opportunity to apply what you've learned (and check your work with the included answer keys).

How to model equity fundraises and convertibles.

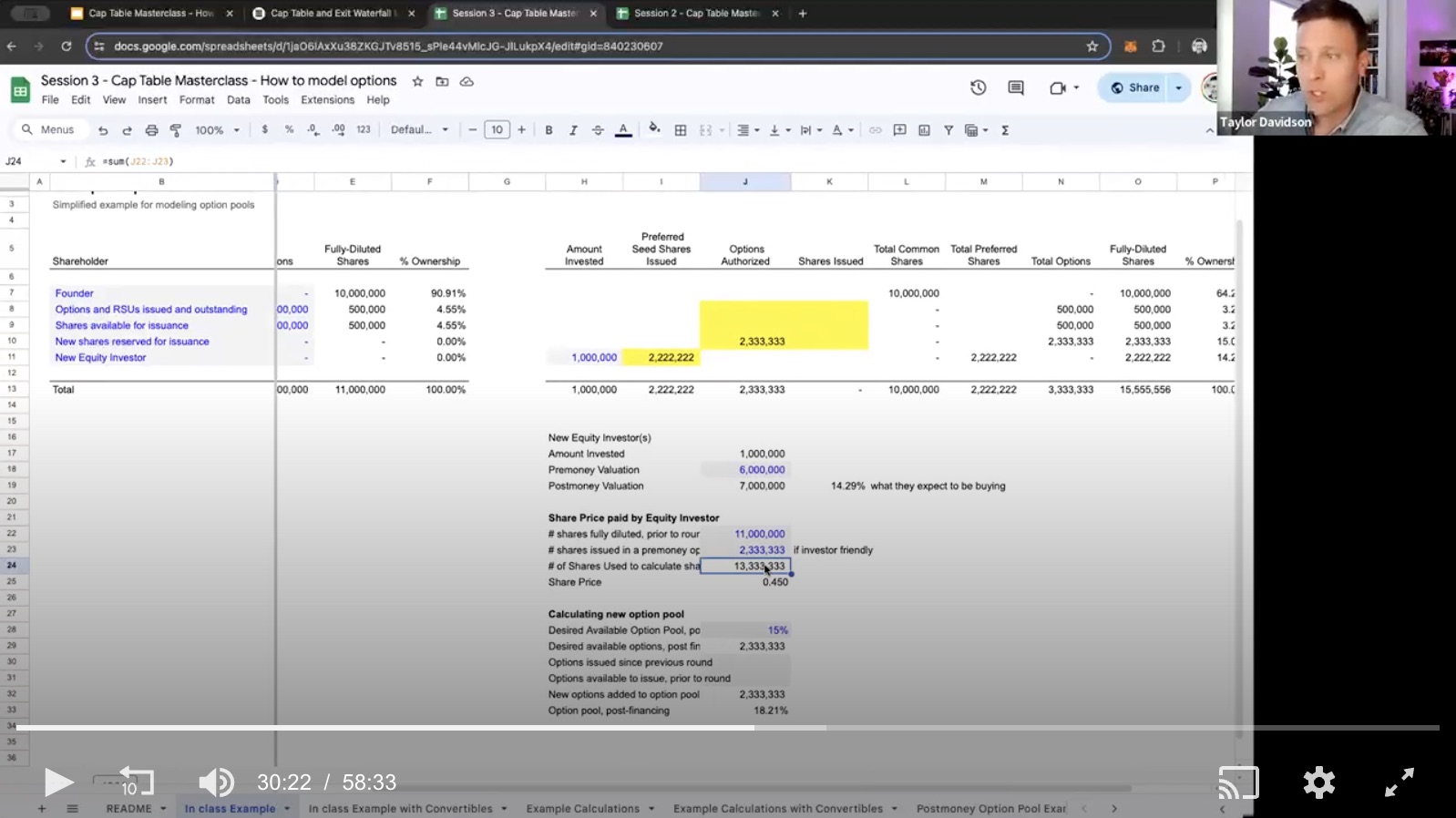

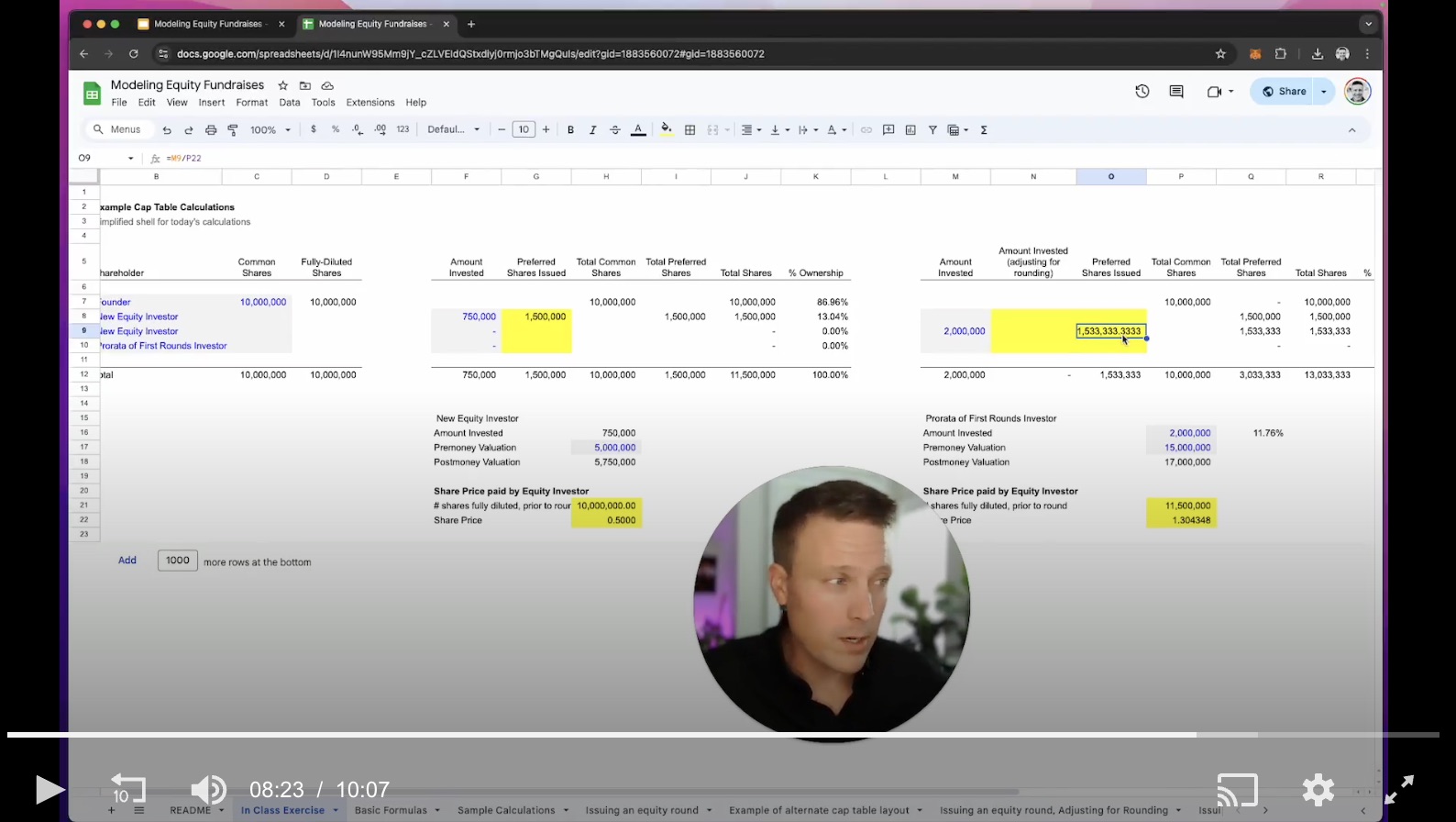

We'll dive into details on the terminologies and structure of capitalization tables, including how to calculate share prices, use valuations, model equity and convertible (SAFEs and convertible notes) fundraising rounds, issue new shares to investors through equity investments and convertible conversions, and calculate ownership percentages.How to model options.

We will cover how to model option pools, from creating, refreshing, and tracking the issuance of options through rounds, and how they impact calculations of share prices and share counts for equity investorsHow to model antidilution.

We will learn how to model antidilution, covering typical terms for ownership and value dilution, including issuance of new shares and changes in conversion rates from preferred to common, and covering the primary ways to calculate antidilution, including full ratchet and weighted average methods.How to model exit waterfalls.

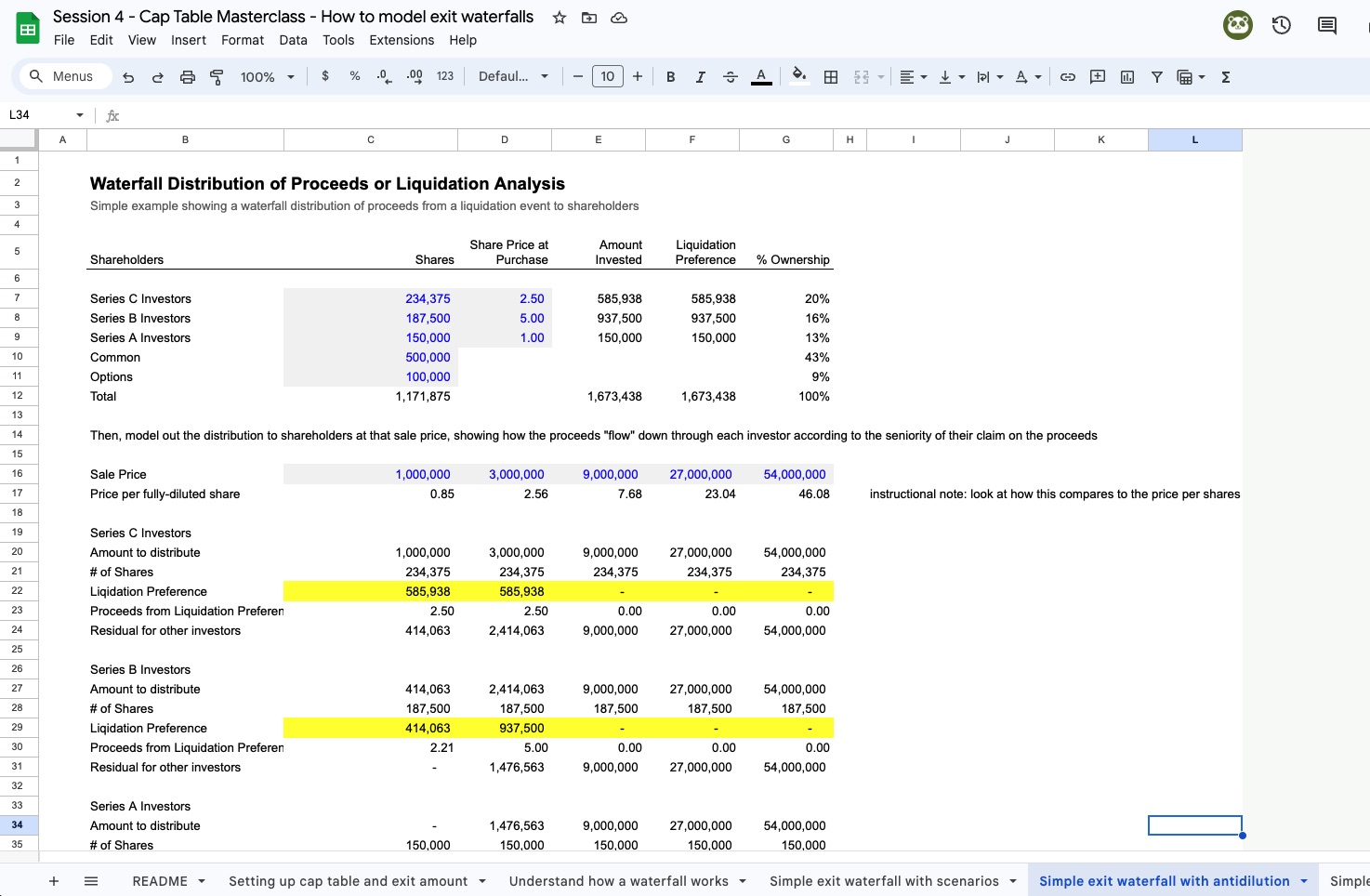

We will learn how to create an exit waterfall to model the distribution of proceeds to shareholders, detailing how to handle liquidity preferences, converting preferred shares to common shares, and handle the flow of proceeds to multiple classes of shareholders.How to model investor returns.

Continuing on from the first class on exit waterfalls, we'll dive into how to use the waterfall to understand investor returns across share classes, incentives around the terms and structures around liquidity distributions, and more advanced topics around waterfalls, valuations, and investor return modeling.Case Study.

This session reviews the case study, a practical example of modeling a proforma cap table through multiple financing rounds and an exit. You can work on the case along with the classes, ask questions in the community, and we will cover it in the course wrap-up and Q&A.

Live session schedule

Each class is 1.5 hours of instruction and in-class practice, and if you really want to learn the topic, expect to budget 0.5-1 hour per week for practice exercises and materials review.

- Tuesday, November 12, 12 PM EST - How to model equity fundraises and convertibles

- Thursday, November 14, 12 PM EST - How to model options

- Monday, November 18, 12 PM EST - How to model antidilution

- Wednesday, November 20, 12 PM EST - How to model exit waterfalls

- Tuesday, December 3, 12 PM EST - How to model investor returns

- Thursday, December 5, 12 PM EST - Case study

Zoom links for each session will be available to you in the course portal.

How the course is structured

No prior knowledge of cap tables required

This is a basic level class that starts with basic cap table structures and how to do the calculations for issuing equity (e.g. valuations, share prices, share counts), through more detailed topics around convertibles, options, and exit waterfalls. While a familiarity of venture capital is encouraged, no prerequisite education or experience is required, and no advance preparation required.Live sessions

1.5 live session on Zoom with Taylor and the rest of the cohort for going over the material, Q&A, and spreadsheet exercises to dive deeper into that week's material. Participants in the United States interested in earning continuing professional education (CPE) credits for the course will be required to attend the five instructional lessons, and your participation in the class will be tracked by the course instructor.Bite-sized projects

Practical exercises for you to apply what you learn in class. The time commitment (1 hour per week) is manageable for busy professionals, with actionable takeaways to use in your work with cap tables.Practical case study

The case study covers all of the material from the class from the perspective of a finance professional needing to create a cap table and exit waterfall for a proposed fundraising round.Simple technical requirements

You will need a computer (Mac or PC) and an internet connection to access the course materials on Gumroad, and to create an account with Gumroad to log into the course portal. You will need a computer (Mac or PC) and an internet connection to use Zoom (no account required) to participate in the live sessions, for which you will get event details with Zoom links in the course portal and by email.Focus on first principles

This class does not teach the cap table template, but aims to teach you the fundamentals on how to build your own models by focusing on the fundamental concepts and applying them in the mini-cases. Always available for questions and support on fund modeling afterward.Interactive and examples-based

My live sessions are structured to be interactive with ample opportunity to ask questions and participate in building the answers to the example models we will build during each session.

Sample Workshop on Modeling SAFEs

Here is a sample of the material covered, from a webinar about cap tables and how to model SAFEs. We did an overview of how to build a cap table model, and focused on issuing and converting premoney and postmoney SAFEs. Replay below, slides here, and Download to Excel or copy to Google Drive the sample spreadsheet here.

Sample Workshop on Modeling Anti-Dilution

This was a free, live workshop on modeling anti-dilution and their impact on cap tables. Understanding how down rounds impact dilution is an important area for companies in today's climate, I covered the theory and practice in modeling anti-dilution protection, with practical examples for you to use. Download the slides and spreadsheet here.

More past workshops at Workshops

Common questions

Why do you teach this?

Back when I worked as a VC, even though I talked about the structures and mechanics of fundraising rounds and cap tables, it's only after I left and built out Foresight that I really learned the details and math behind how they work. I learned the hard way, and after helping hundreds of founders and VCs individually, I'm sharing it with you.How do I know if this will be valuable for me?

If you are a founder, CFO, VP of Finance, or similar level executive preparing for a fundraising round, or you are a lawyer or venture capitalists that works on deal execution, then this can be integral to your job.Isn't all this information already available on the web?

You would think so, but no, and especially not in a highly structured course to guide you through the key things you need to learn about venture financings. I started working in startups in 2000, and none of this was widely available anywhere, it was tucked inside the heads of industry practitioners, accessible by paying an hourly fee. Over time, more and more information, conversations, and data has been shared to the web, and the average founder and investor has access to way more information about the mechanics of venture financings than we used to.But even if you work in venture, you might not work on all of this, to this level of detail.

Back when I worked as a VC, even though I talked about the structures and mechanics of fundraising rounds and cap tables, it's only after I left and built out Foresight that I really learned the details and math behind how they work. I learned this the hard way, thousands of iterations on models with founders, lawyers, and investors, and continue to update the tools to this day.

Does it matter if I do not live or work in the USA?

Good question! From a logistics perspective, it's easier to join the live sessions (12 PM noon EST) if you are in the US or western Europe, but you can always watch the recordings, use the materials, and ask 1-1 questions after the sessions regardless of your timezone. From a content perspective, I do spend more time covering USA-centric investment structures, but have been adding over time a number of structures used in Western Europe, and I spend a lot of time going over the core principles and math that apply to all venture financings everywhere in the world.What if I cannot make the scheduled dates?

If you miss a live session, all sessions are recorded and available to watch after the session, and I am available to answer any questions by email. I encourage people to attend the classes live to take advantage of the opportunity to ask questions and participate in the discussions. For students wanting to get continuing professional education (CPE) credits, your participation in the class in the live sessions is required and will be tracked by the course instructor through polling and questions asked during each class.Can I join a cohort after the live sessions have already started?

Yes. You are welcome to join after the live sessions for a specific cohort have started, as long as you understand it is your responsibility to watch the recorded sessions to catch up to the current class. If you want to earn CPE credits, you will not be able to meet the per-session participation requirements if you sign up late, and it may make more sent to join a future cohort. Alternatively, consider the Cap Table and Exit Waterfall Course, a self-paced option without the live sessions that covers the same material.I work full-time, what is the expected time commitment?

The goal is for you to be able to spend about 2 hours per week (for 6 weeks) attending live session or watching the recordings, and if desired, budget additional time to review the additional spreadsheet materials and videos, and if you really want to learn the topic, apply them by building your own cap table.Can I get Continuing Professional Education (CPE) Credits for completing the course?

Participants in the United States interested in earning CPE credit in the course will be required to attend the five instructional lessons and answer at least 3 polling questions per instructional hour. Participants will earn 9 CPE credits for the Finance field of study for this Group Internet Based course at the Basic Program Level. No advanced preparation is required, basic knowledge of venture capital is recommended. Participants that satisfy the participation requirements will receive a certificate of completion within 30 days.

Will my employer pay for the course?

This course is highly practical for founders, venture capitalists, and lawyers working on venture fundraising. Many companies offer an L&D or education budget that can cover the cost of this course. If you need help with a letter to submit for reimbursement, contact me. If you need an invoice, you can generate an invoice from your email purchase receipt and fill in the necessary information.What if I can't afford the course?

The Cap Table and Exit Waterfall Tool by Foresight has been downloaded for free by over 25,000 entrepreneurs, VCs, accountants, lawyers and finance professionals from around the world, and is structured to be an instructional tool on how cap table math works. Feel free to ask questions anytime.Can you run this for smaller groups?

Yes! I offer corporate workshops. If you'd like to run this masterclass or components of the syllabus as a workshop just for your firm, contact Taylor to discuss.How often is the course updated?

The masterclass has been updated every cohort to reflect participant feedback and subject matter interest, detailed at How I teach cap tables. Content is reviewed and/or updated at least every 6 months to ensure that the content is up-to-date and accurate. The last revision date was February 6, 2024.How can I provide feedback on the course?

The course will have a post-class survey to assess whether learning objectives were met, available to all participants at the end of class. The survey will ask whether the learning objectives were met, the prerequisites were appropriate, the time alloted was accurate, and the instructor was effective, as well as a rating and optional review of the course.Can I change my registration to another cohort?

Yes! Students are allowed to move their registrations to later cohorts if their schedule changes, and I often invite students to participate in additional cohorts if they want to review or refresh themselves on the material, at no cost. For cancellation and scheduling requests, please contact Taylor.What is your refund policy?

You can request a full refund within 14 days of the course ending, provided you have fully participated in the course. Full participation is defined as attending sessions, completing the practice exercises, and responding to engagement attempts by the instructor. The learning experience is designed to help you achieve the course objectives, and participation is required before determining if the course was satisfactory. Refunds are processed through the payment provider and can take up to 10 business days to complete. For more information regarding administrative policies such as complaint and refund, please contact our offices at taylor@foresight.is or +1 646.770.0052.I still have questions, who do I contact?

Happy to help, just contact Taylor by email or setup a quick chat to discuss. For more information regarding administrative policies such as complaint and refund, please contact our offices at taylor@foresight.is or +1 646.770.0052.

Unstructured Ventures, LLC is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.NASBARegistry.org.