Venture capital funds are typically compared and analyzed based on a few key performance indicators. Here are a few that are important to understand and use in your venture fund model.

Key terms to use in performance metrics

A few terms to understand to use in these calculations:

- Paid-in Capital: PIC, or called capital, this is a measure of the capital contributed by limited partners (LPs) to the fund. Also known as contributed capital, or drawn capital. This will increase as capital is called, and at the end of a fund, this should be equal to committed capital.

- Proceeds: proceeds to the fund from the investments, this is typically from exits through IPOs or acquisitions of the investments, or selling shares through secondary transactions, proceeds from revenue-sharing agreements, or other receipts of capital from investments.

- Distributions: distributions from the fund to limited partners. This will typically be net of fees, carried interest, etc. paid to general partners.

- Residual Value: current market value of the investments. This will include the value of any unrealized gains that come from markups in valuations of the investments. Typically used to understand the unrealized value in a portfolio. This can be used to measure Investment Book Value or NAV (Net Asset Value), which will include the value of the capital invested plus the unrealized gains on those investments.

Multiple-based Performance Metrics

Here are a few multiple-based metrics valuable to understand fund performance.

Gross Multiple

Gross multiple is typically used to understand the performance of the underlying investments, and is calculated as:

Total Proceeds from Investments / Total Invested capital

By default this represents realized proceeds and does not include the unrealized value of existing invested capital.

Sidenote, if you added the unrealized value of existing invested capital, that would be equivalent to Gross MOIC.

Net Multiple

Net multiple helps you understand the performance of the fund, by including the fees paid by limited partners to the management company

Total Distributions from the Fund / Total Paid in Capital

Net returns are the returns to limited partners, net of management expenses, fund expenses, and carried interest.

By default this represents realized proceeds and does not include the unrealized value of existing invested capital.

Sidenote, if you added the unrealized value of existing invested capital net of accrued carried interest and other liabilities, that would be equivalent to Net MOIC.

MOIC

Multiple on invested capital (MOIC) measures the value of an investment compared to the capital invested. If applicable, it will include unrealized and realized gains and losses.

Gross MOIC

Gross MOIC would reflect the performance of an investment, including the value of current invested capital. If cited for an individual investment:

( Proceeds from Investment + Investment Book Value ) / Value of Invested Capital

If cited for a fund of investments:

( Proceeds + Investment Book Value ) / Value of Invested Capital

Note, the Investment Book Value above will include the value of the invested capital plus unrealized gains and losses.

At fund exit when there are no unrealized positions, Gross MOIC is equivalent to the Gross Multiple detailed above.

Net MOIC

Net MOIC would reflect the performance of the investment including the impact of expenes (management fees, other operating expenses, and carried interest) and the value of current invested capital. If cited for an individual investment:

( Distributions from Investment + Investment Book Value ) / (Value of Invested Capital + Cost Basis)

If cited for a fund of investments:

( Distributions + Residual Value ) / Paid in Capital

At fund exit when there are no unrealized positions, Net MOIC is equivalent to the Net Multiple detailed above. Net MOIC is equivalent to TVPI detailed below.

Distributions to Paid-in Capital (DPI)

Distributions to Paid-in Capital, or DPI, represents the value of realized distributions from the fund divided by paid-in capital, at that point in time.

Total Distributions / Total Paid-in Capital

By default, DPI is a net metric, meaning it includes the expenses of investing the fund.

Residual Value to Paid-in Capital (RPI)

Residual value to Paid-in Capital, or RPI, represents the unrealized value in the portfolio, divided by paid-in-capital, at that point in time.

Total Residual Value / Total Paid-in Capital

Residual Value is equivalent to Net Asset Value (NAV) of current invested capital, which will include current invested capital (capital that has been invested, less any written off or exited), current unrealized gains, less liabilities, which should include accrued carried interest. If the calculated residual value includes liabilities, then residual value will be a net metric, and RVPI will be a net metric.

Total Value to Paid-in Capital (TVPI)

Total value to Paid-in capital, or TVPI, measures the total performance of the fund by adding the realized and unrealized performance.

Net TVPI can be expressed as:

TVPI = DPI + RVPI

By default, TVPI is a net metric if DPI and RVPI are also net metrics.

In the Foresight models, I typically report net TVPI, and calculate TVPI = DPI + RVPI

Allen Latta covers some pros and cons with using multiple-based performance metrics, well worth reading.

The key with these metrics is just to be clear how it is calculated, and use "gross" and "net" when citing a metric so that it is clear what the metric means. There's actually less difference between the metrics than people usually think, and often people will use different terms to describe the same concept.

Time-based Performance Metrics

Rate of return metrics can be used to understand the performance over time, accounting for the time required to create the investment returns. The most common rate of return metrics are Gross IRR (Internal Rate of Return) and Net IRR.

Gross IRR

Similar to Gross Multiple, Gross IRR measures the performance of the investments on invested capital. Gross IRR can be reported on a realized or total value basis; in the Foresight models, I calculate realized Gross IRR, not including fees:

Net cash flow per year = proceeds from investments - invested capital

Then use the net cash flows per year in the XIRR formula in Excel or Google Sheets to calculate IRR.

Net IRR

Similar to Net Multiple, Net IRR measures the performance of the fund on paid-in capital, accounting for the fees involved in operating the fund. In the Foresight models, I calculate realized Net IRR:

Net cash flow per year = distributions from the fund - paid-in capital

Then use the net cash flows per year in the XIRR formula in Excel or Google Sheets to calculate IRR. By default this does not include the value of existing investments, although you can include that to cite Interim IRR, detailed below.

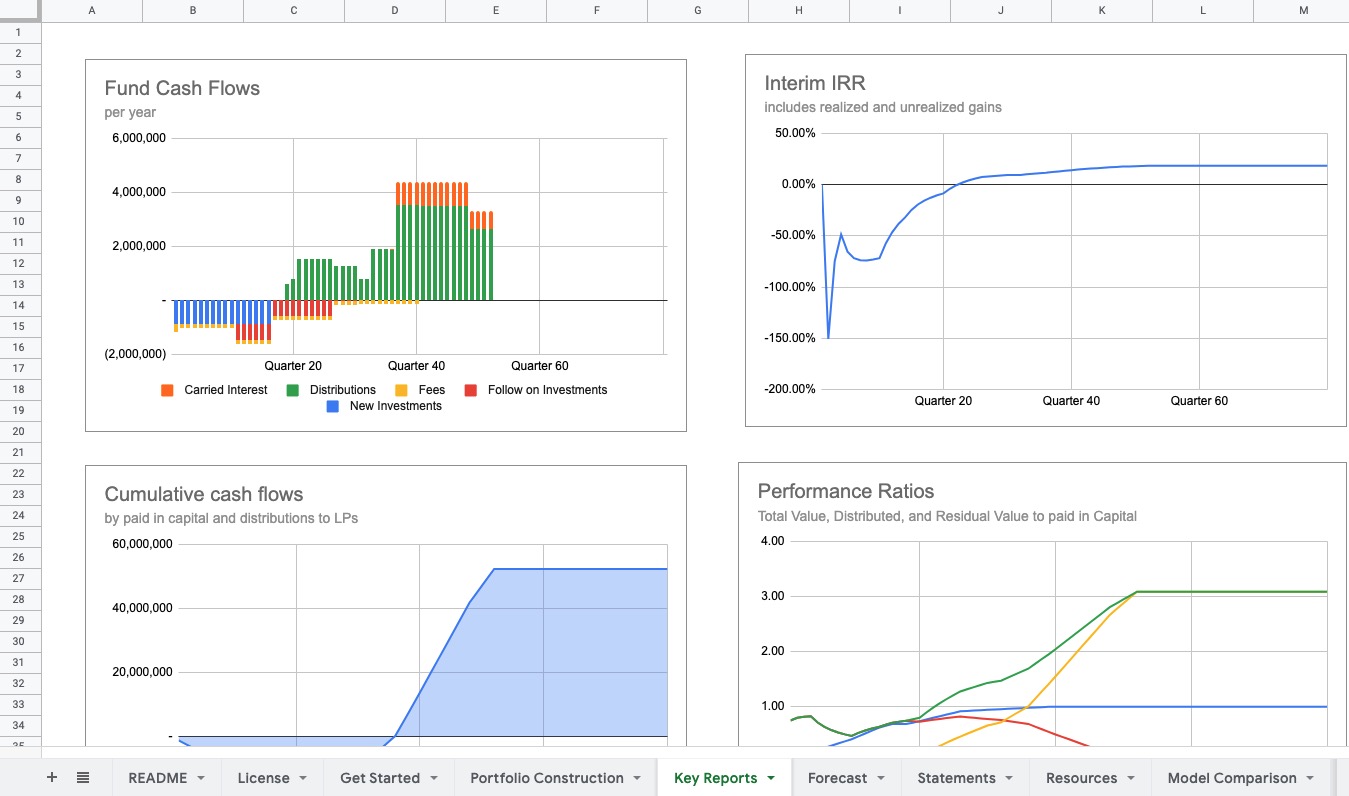

Interim IRR

I use Interim IRR to measure the imterim performance of the fund, including the realized proceeds and unrealized value in the portfolio, to create a "J curve" that shows the early negative returns (because of the effect of management fees and fund expenses) that increase over time as the underlying investments are marked up and/or generate proceeds to the fund.

Interim IRR involves a detailed calculation that includes the residual value in the portfolio at the end of each period - a critical assumption - but a valuable one to understand the underlying potential performance of the fund.

Interim IRR is included in all Foresight venture capital models.

Max Expected Exposure

This metric measures the actual cash commitment, compared to the total capital commitment, to understand the maximum net capital invested. The goal of this is to help a limited partner understand their capital commitments, to account for the fact that capital calls happen over time, and potentially, a fund will see proceeds and distributions before their total capital calls have been made.

This can be expressed as a total amount, or as a percentage of committed capital.

Maximum expected exposure = Cumulative distributions - cumulative capital calls

Maximum expected exposure / total committed capital

This concept is also explained at Newfund Capital, VC Calculator.

More resources:

- Need to build a fund model to report these metrics? Find examples and templates at Templates and Resources for Modeling Venture Funds.

- Diligent Equity has a good overview of venture capital fund metrics at Venture Capital Fund Metrics Cheat Sheet

- Allen Latta also dives into more methods for comparing venture fund performance in his series on fund performance metrics. I highly encourage starting with his first post, LP Corner: Private Equity Fund Performance – An Overview and reading the entire series.