First, a disclaimer: I am not a lawyer or a financial advisor and am not offering financial or legal advice.

What is anti-dilution?

Anti-dilution protection protects existing shareholders from ownership dilution or value dilution.

- Ownership dilution is when an investor's equity ownership decreases as a percentage of total equity because of the issuance of new equity (e.g. new shares, options, warrants). Rights of first offer (pre-emptive rights) provide protection from ownership dilution.

- Value dilution is when the value of an investor's equity ownership of a company decreases, which occurs new equity (e.g. new shares) are issued at a premoney valuation less than the postmoney valuation of the prior round. Anti-dilution provisions provide protection from value dilution.

Anti-dilution provisions work by adjusting the conversion ratio from preferred to common stock. Typically, one share of preferred stock converts to one share of common stock, but anti-dilution provisions adjust the conversion ratio to offset value dilution by increasing the number of common shares that one share of preferred stock converts into.

I say "offset" because anti-dilution provisions vary in the degree of protection:

- Full ratchet anti-dilution provides complete protection from value dilution by adjusting the conversion ratio so that existing shares are effectively repriced to the new round. Very dilutive to common shareholders, not in favor at the moment.

- Weighted average anti-dilution provides partial protection from value dilution, by adjusting the conversion ratio so that the new conversion price ends up between the original issuance price and the new equity share price. The two methods are broad-based and narrow-based, broad-based being more common in practice; the difference between the two is that broad-based uses fully-diluted shares in the calculation, whereas narrow-based uses issued and outstanding, meaning that narrow-based excludes options and warrants from the calculation.

How does anti-dilution protections impact cap tables?

Cap tables are constructed to list out shareholders, or classes of shareholders, with the number of shares they own per class of share. There are two main ways at looking at the share count:

- Issued and outstanding, which includes shares issued to shareholders

- Fully-diluted, which includes shares reserved to be issued for options and warrants

Value-based anti-dilution changes the conversion ratio per share, changing the fully-diluted number of shares, but not changing the issued and outstanding number of shares. Typically you'll see the conversion ratio listed on the cap table for each class of share, and it will be 1.00, meaning 1 preferred share converts to 1 common share, if the preferred shareholder chooses to convert their shares to common. If there has been an event that triggered anti-dilution protection, you'll see something different than 1.00 listed as the conversion ratio, and the fully-diluted number of shares will differ from the issued and outstanding number of shares.

How do you calculate the conversion ratio? It's just the ratio of original equity issue price (the amount per share the equity investor paid for the share) to the conversion price, and usually, those are equivalent, so the conversion ratio just equals 1.00. But when a company raises a down round, meaning they issue new shares at a lower price per share than previous investors paid, if those original shares had anti-dilution protections attached to them, the conversion price is recalculated, which adjusts the conversion ratio.

New Conversion Ratio = Original Equity Issue Price / New Conversion Price

With full ratchet anti-dilution, the calculation is simple, since the new conversion price equals the price of the new financing.

New Conversion Ratio = Original Equity Issue Price / New Equity Issue Price

With weighted-average anti-dilution, the formula gets a bit more complicated.

New conversion price = Prior Conversion Price * (Fully-diluted Shares prior to the dilutive round + Number of shares that would have been issued in the new round using the prior conversion price) / (Fully-diluted Shares prior to the dilutive round + Number of shares that were issued in the new round using the new equity share price)

With broad-based weighted average, you would use fully-dilted shares in the formula above; with narrow-based weighted average, you would replace fully-diluted with issued and outstanding shares prior to the dilutive round. The key difference in the formula is in calculating the number of shares that would have been issued at the prior conversion price (usually just the original equity issue price) and the number of shares that were issued at the new equity share price. That ratio adjusts the prior conversion price and thus the conversion ratio.

For a great, detailed example of the math, check out Allen Latta's Anti-Dilution Protection: An Overview, which showcases an example of how this works with a sample cap table using both full ratchet and weighted-average.

How does anti-dilution protections impact exit waterfalls?

The crux to calculating the returns to preferred shareholders in a liquidity distribution is to calculate whether they choose to keep their preferred shares (take their liquidation preferences) or convert their preferred shares to common (take the distribution due to common shareholders), accounting for potential participation rights with their preferred shares.

Anti-dilution protection does not change their liquidation preference - that remains what they paid for their shares - but does change the ratio at which preferred shares convert to common shares, so in calculating this decision you must use the conversion ratios in the calculations of potential proceeds to the preferred shareholders and the number of fully-diluted shares.

More context to the terms and calculations at Modeling Exit Waterfalls

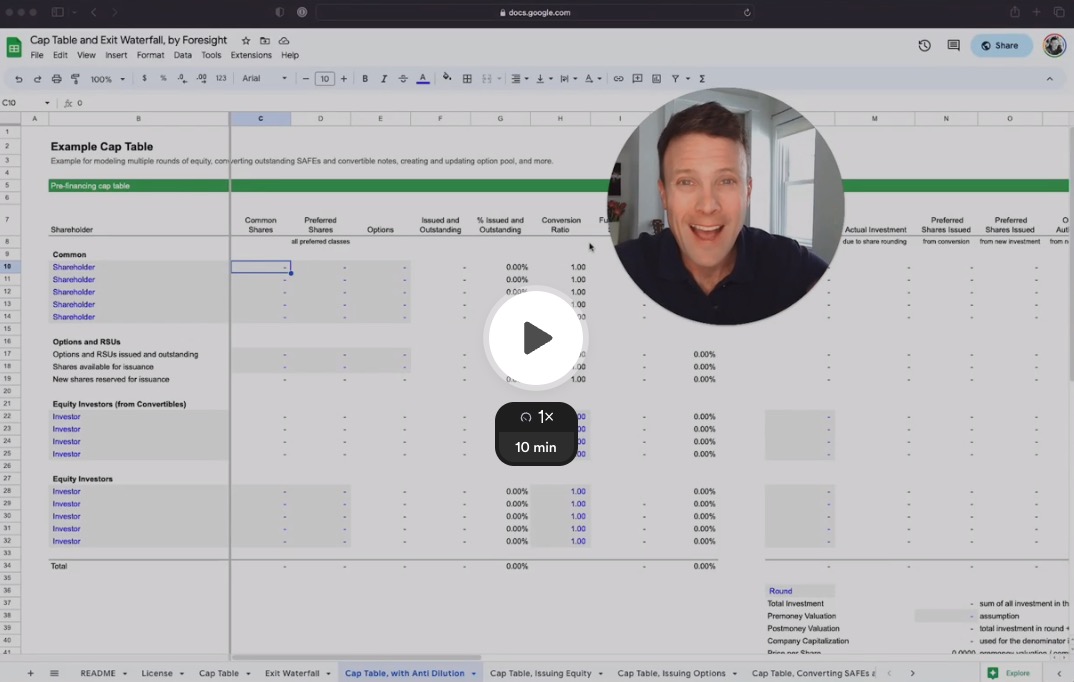

How does the Cap Table and Exit Waterfall Tool calculate anti-dilution?

The free Cap Table and Exit Waterfall Tool includes a sheet with prebuilt anti-dilution protection. This is a beta release of the feature, with a couple key things to note:

- The cap table includes a new column for the conversion ratio in between the columns for issued and outstanding shares and fully-diluted shares.

- The new anti-dilution section has an input for the prior price paid per preferred share.

- If anti-dilution protection is turned on (checked box in Google Sheets or TRUE in Excel), the section calculates the new conversion for full ratchet, broad-based weighted average and narrow-based weighted average, and then in the dropdown at the bottom of the section you choose which conversion ratio to use.

- The model does not draw the original preferred equity purchase price per share from the model, to allow for a bit more flexibility to use the prefinancing cap table and list all the preferred shareholders without having to model all of the past rounds

- The model thus does require you to input the original preferred equity purchase price per share.

- By default the model will only change the conversion ratio for old equity, and not new equity raised in the new round. To make things clear, I recommend splitting out shareholders investing in multiple rounds into multiple rows, and then adding together for any analyis, so that the shareholdings from each class of share are clear/

- The default anti-dilution protection assumes the conversion ratio is the same for all previous preferred equity investors; if investors invested at different equity prices than you would need to adjust the conversion ratio accordingly for each investor, by replicating the anti-dilution calculations for each relevant shareholder class, and calculating each conversion ratio separately, and then simply linking that into the conversion ratio column on the cap table.

- That also enables you to set the conversion ratio for all different classes of shares completely independently, allowing a lot of flexibility, but requiring you to understand how the conversion ratio is calculated for different share classes and how to apply it to past rounds.

- The exit waterfall already included an input for conversion ratio and thus there were no changes to the setup; the exit waterfall was changed so that you can turn on the more complicated calculations to test the keep preferred or convert to common condition for each shareholder, using the proceeds per share to common instead of the residual per share prior to the round.

Questions or feedback, contact here. Need assistance in modeling a cap table or waterfall? I provide custom assistance with cap table and liquidity waterfall scenario modeling and analysis.

Additional Resources

- Down Round: Understanding Down Round Funding and How to Avoid It

- Anti-Dilution Provision: Definition, How It Works, Types, Formula

- What is Anti-Dilution Protection?

- Anti Dilution: Everything You Need to Know

- Anti-Dilution Provisions: Which One Is Better for Founders?

- What you need to know about down round financings

- Anti-Dilution Protection Sample Clauses