Prebuilt for Services and Consulting Businesses

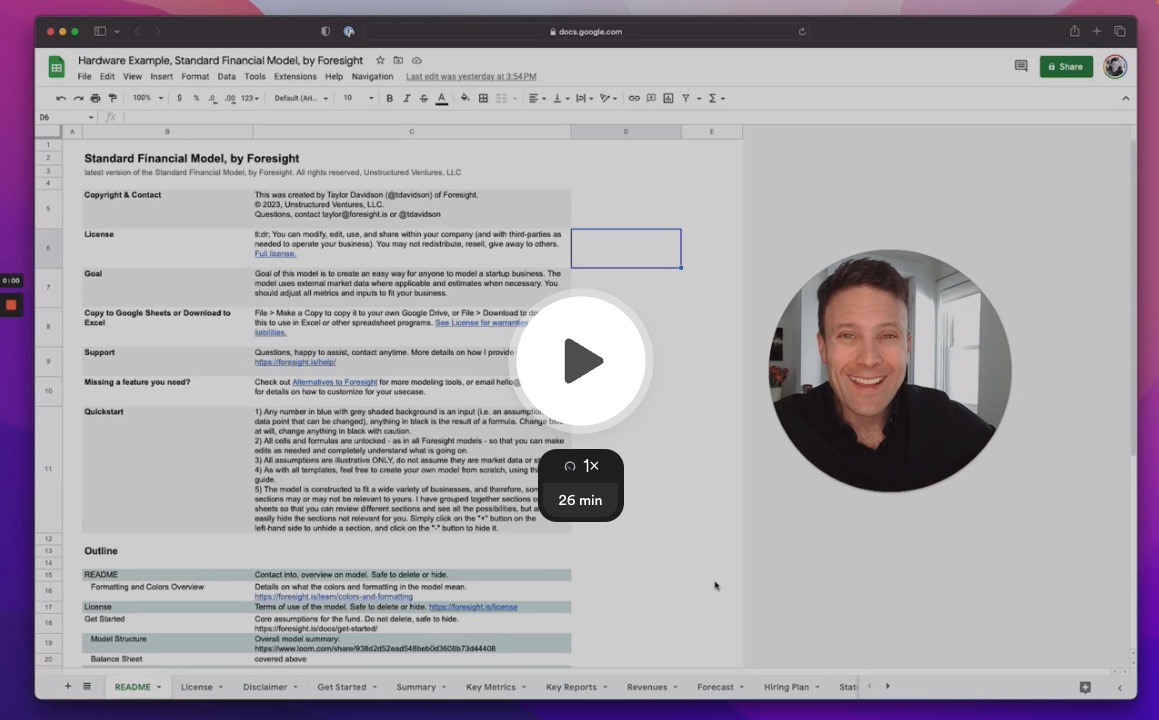

The Standard Financial Model works well for services and consulting businesses by default, and is easy to customize for specific requirements for the conversion funnel, sales team-led growth, custom project types and lengths, billing structures, specific and generic hiring and staffing structures, and overhead and expense modeling. The video above goes into detail in how to use the Standard Model for service and consulting businesses.

Standard Financial Model

4.7

Prebuilt for services and consulting busineses, for many different project and client billing specifics.

Download for $149 USD >

1002

Common Modifications

- Adding more growth channels. It is common to add more growth channels to detail the acquisition strategy in more detail, and to assume different growth rates by channel. Straightforward to do: simply replicate the existing growth block of calculations on the

Revenuessheet, replicate the relevant assumptions onGet Started, or create your own set of calculations using the logic relevant for that channel, and add it into the line used to calculate conversions. - Expanding the sales funnel. By default the model assumes one conversion point (for example, leads converting to subscribers), but often users will want to model a conversion funnel with multiple conversion steps (for example, leads converting to qualified leads converting to subscribers). The simple way to model that is to use a conversion rate on

Get Startedthat is reflective of the overall conversion rate (just multiply each conversion rate), or if more detail is required, an additional conversion step can be added onForecastby replicating the structure using the same or simpler methodology for conversions. - Adding multiple project types. This can be done with a simple edit to the assumptions on

Get Started. Create a table with the different project types (onGet Startedor a new sheet), input the pricing tiers, assume the percentage of projects/clients/etc that are on each project type, and calculate the weighted-average using SUMPRODUCT, and input that into the average revenue assumption onGet Started. If more detail is required, then you can add additional revenue builds using the same methodology as the annual and monthly split detailed below. - Modeling contractors, project costs, and client-related expenses. Modeling the associated cost of sales is a default part of expense forecasting on the

Forecastsheet. You can add in any cost component, use a forecasting driver or manually input the cost, and the model will handle all the financial impacts automatically. This is covered in the video above. - Modeling specific clients with unique revenue agreements. It is common for services and consulting businesses to use the prebuilt revenue model to model average clients or projects, and/or to model specific clients and projects with different contract lengths, billing structures, or revenues. These can be entered directly into the inputs on the

Forecastsheet, providing the ability to model each specific, known or forecasted client or project with their own terms - Using the Enterprise Forecasting Tool. The free Enterprise SaaS Tool provides an alternative way to model unique clients and projects, if you prefer this structure to the default entry of specific clients. It is straightforward to use the tool to replace the prebuilt revenue model in the Standard Model if desired.

- Using your own revenue build. The model can be used for a wide variety of ecommerce, wholesale, and retail commerce businesses, and you can also import and use any model or other template you are using. Details at How to integrate any model with a Foresight base model.

Common Questions

Common questions and more details at Standard Financial Model. I provide free and paid onboarding support and custom model services, and contact me anytime for questions.