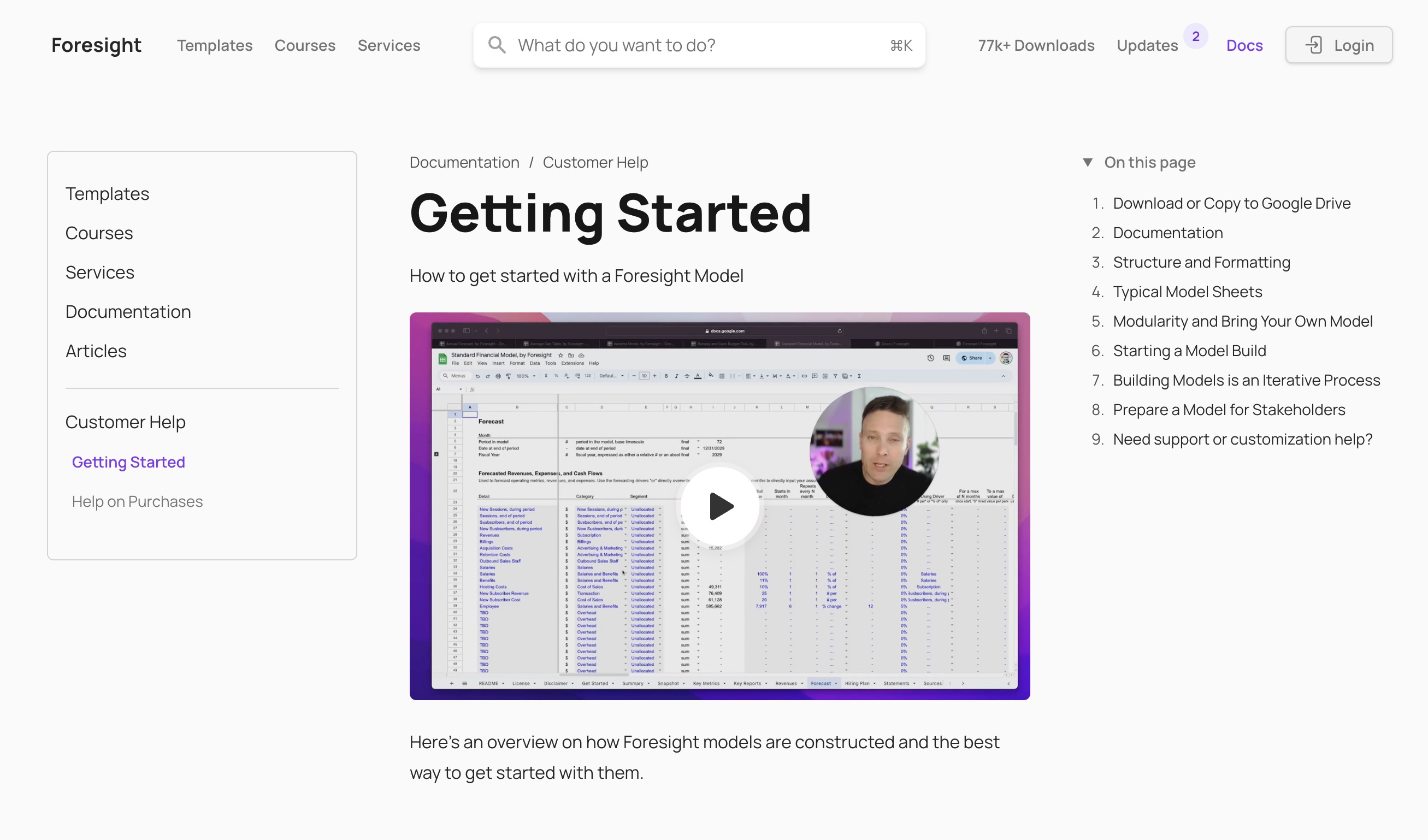

Here's an overview on how Foresight models are constructed and the best way to get started with them.

Download or Copy to Google Drive

Foresight's models are Microsoft Excel™ or Google Sheets™ files, and they are available for download and access immediately after purchase. I recommend using Excel or Google Sheets with these templates. I typically offer the options to Download to Microsoft Excel or Copy to Google Drive to make it easier to get started in your preferred platform, but the models can be used in both Excel and Google Sheets interchangeably; simply upload the Microsoft Excel model template from Foresight into Google Sheets, or download the Google Sheets to Excel, and everything will structurally work fine.

The models are built in Google Sheets, and the default formatting is a bit better in Google Sheets; in Excel you may want to adjust the row spacing, fonts, and chart formatting to get the aesthetics you want. Regardless, all calculations will work without edits needed.

You can always redownload (Microsoft Excel default) or recopy (Google Sheets default) the latest version of the models via your original email receipt (the link provides access to the latest file) or by logging into my transaction provider Gumroad (if you do not have an account, simply create one with the email address used for purchase and you will have access).

If you're interested in using non-Microsoft or Google Sheets alternatives that are either customized for Financial Planning and Analysis (FP&A) or are generalized spreadsheet tools with native data integrations, check out the Tools for details on many other tools you could potentially use.

Documentation

Documentation for each model is contained at Docs, which includes pages for many sheets and components of the model. You can also search in the header of the site, and ask questions anytime at Contact.

Structure and Formatting

All models follow a general aesthetic and set of principles in building good financial models. In general, I strive to separate inputs, calculations, and presentations, and use sheet structure and formatting to provide clarity in how sheets should be used. I generally ascribe to the Fast Standard in terms of model best practices, although I deviate in a few ways to make it simpler for a wide range of users and people less familiar with spreadsheets and models.

The formatting is intentionally "flat", so you can add in any formatting you want easily. The colors in the cells are used to signify inputs and calculations, and make it easy to scan to see what to change and what not to change.

You don't need to be an Excel expert to use the model, if you pay attention to the formatting to signify the inputs and the notes for the inputs. If you need to brush up on your Excel, here are the most important and common functions I use.

I use extensive notes throughout the model to note what each line is doing. You may delete them when you start sending it to stakeholders, but I would also note that notes are the sign of a quality model, to allow someone to understand the process of the model in addition to the numbers.

A couple other guiding principles behind using Foresight templates:

- Any numbers currently entered as assumptions are illustrative, and you should change them to fit your business.

- The revenue models are built to be detailed and flexible to use for a variety of businesses, but some users will want to modify the structure or replace the prebuilt revenue model with a custom revenue model to accurately model your business; that's a normal use of the model that takes advantage of Bring Your Own Model

- The model can be used for cash or accrual accounting by GAAP, IFRS, and other accounting standards. Details on finance and accounting basics ›

- As with all templates, feel free to use it as an instructional tool, inspiration, and a guide to create your own model. The intent is for this model to be easy to plug and play and answer the major business questions, but I would expect you to need to make changes or build custom analyses for your specific business.

- Be careful with attempting to understand or apply the formulas I use for your situation. If you work to break down and audit each formula, there will likely be things that aren't immediately obvious to you why I do it that way, but are the result of having spent thousands of hours building financial models and hundreds of hours iterating on this model specifically, and are tied to looking to create a generalized solution to a wide variety of specific needs. But, if you are building your own model, you possibly don't need to create the same formulas for your usecase, so be careful in applying the detailed tactics of the model in the same way.

Typical Model Sheets

Models typically have a set of informational sheets that can be hidden or deleted without impacting the model - README, License, Disclaimer, Additional Tools, Model Comparison, and Changelog - although I recommend hiding and not deleting the Changelog, so that you can always compare what's changed between the version you are using and a future version.

Get Started contains the overall model-level inputs, and Forecast contains the detailed assumptions and inputs. Forecast is a hybrid inputs and calculations sheet, a deviation from my normal guidance, but it's an intentional choice so that the assumptions can be as detailed as needed in making specific changes over time.

Modularity and Bring Your Own Model

The Standard Model essentially consists of two components, the growth and revenue calculations (Revenues, and the related inputs on Get Started) and the financial reporting and management analysis (everything else). Setting up the growth and revenue model for your specific business is always the hardest part - more at the default revenue model - and feel free to contact me if you have any issues. If it's too complicated for your use, remember you can always delete the prebuilt growth and revenue structure and build in a specific, custom, or simpler structure, and that's a normal and common use of the model, detailed at Bring Your Own Model.

The other base templates Runway Budgeting Tool does not come with a prebuilt revenue structure, but it is easy to add your own calculations in or link in another model.

The components - Ecommerce Forecasting Tool, SaaS Forecasting Tool and others - only model the revenue mechanics for their specific revenue model. They can be easily linked into and used with any of the base templates.

The venture capital models share the same Forecast sheet with most of the same calculations around fund cash flows and performance metrics, the major variation is in the logic for portfolio construction. See any of the venture capital models for the specifics.

Starting a Model Build

I advise taking a step back before diving into the model setup, to write down in text form the main things you want to accomplish with the model, and write down the key numbers and inputs you think you want to reflect in the model. This helps provide a guide to true back to as you dive into the details.

Once you start, I generally advise that it should take 2 hours to build a base model for your business using the template.

If you like to work back from the final goal, here's how I review a model, to help you understand the aspects of the model I look at first to understand and provide feedback on a financial model.

Building Models is an Iterative Process

Once you've started inputting assumptions and building out a revenue and expense forecast, then we start iterating. The process of building a model is by nature iterative, as we use tools to analyze decisions, create scenarios, and explore what-if questions about the business.

Usually I start with a set of baseline assumptions given my understanding of the business and comparable metrics from similar companies, and then iterate to get the model to the growth, top-line revenues, margins, and cash needs that I generally expect to be a fit for my business planning or fundraising situation.

Prepare a Model for Stakeholders

Models are best used for making decisions, and thus will likely need to be shared with others in a decision-making process at a business.

All of my models are created to be used with one's team and investors to make business operational and financial decisions, and thus sharing them is a key part of using them. I build the model with the presentation sheets - Summary, Key Reports - at the beginning, so that they are the first things people look at when they open the model, and they allow someone to get the big picture about the business quickly from the start. Then one can dive into Get Started, Forecast, and Statements to understand the detail.

When sending to external parties for review (e.g. as part of a potential investment due diligence process with an investor or lender), I often advocate for sending summaries by PDF early in the process, and then the full model once the investor has qualified their interest to dig in more. I generally do not advise sending locked models, so that investors and analysts and change inputs to see how the business changes and understand sensitivities. Please make your own judgements on what information should be sent to internal and external parties based on your specific situation.

Need support or customization help?

I'm always happy to take a look at your model and answer questions. I've worked with thousands of entrepreneurs as a VC, consultant, or advisor, and can help on technical Excel questions, financial accounting questions, business model questions, to fundraising and pitch questions.

- Documentation. The Docs is the starting point to understanding the key features of the models. I do my best to keep them updated but am always updating them and adding new sections to address key questions.

- Support. Free support by email is included in the purchase of any product. Simply contact me by email, chat, phone, WhatsApp, Signal, text, et. al. - I’m happy to help. I do my best to respond promptly and advise on how to use the templates for your usecase, and I’m happy to take a look at your model to make sure you are using it correctly for your situation.

- Onboarding. I also provide 1 hour onboarding and personal assistance by screenshare and phone call, more details and booking at Get Started

- Customization. I’ve built custom models for hundreds of clients since 2005 across a wide range of businesses, from ecommerce, SaaS, advertising, digital media, content, media, retail, gaming, in-app businesses, investment funds, and more, varying from pre-Seed, Seed and Series A funded startups to mature multi-million dollar businesses. Most custom revenue model projects are 2 to 6 hours, with a more precise range to be determined after we chat about what you are looking to model and the best way to accomplish it. More about Custom Models

- Advisory. I provide advisory modeling services to CFOs, executives, banks, VCs, and consultancies to help them with complex financial modeling challenges. I have worked on a range of projects including M&A transaction support, complex cap table and waterfall models, valuations, financial and operational planning, and complex custom data analysis in Excel. I provide this support on a per-hour, per-project, and retainer basis. More Services offerings here.