Prebuilt for SaaS Businesses

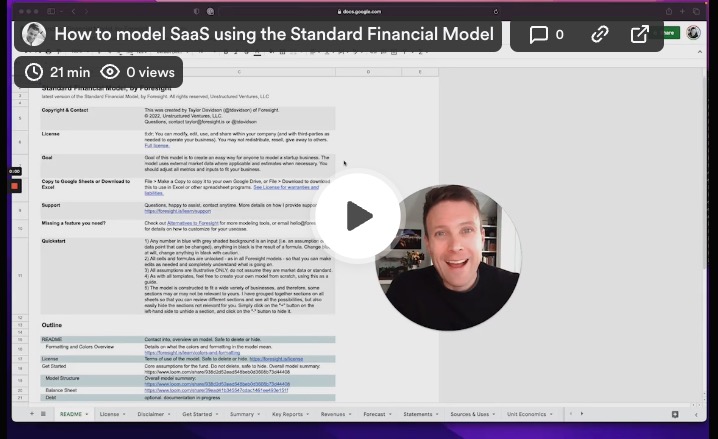

The Standard Financial Model works well for SaaS businesses by default, with no edits required, but easy to customize for specific requirements for the conversion funnel, business model mix, and type of SaaS business. The video above details the acquisition, conversion, retention, revenues, and billings structure and how to use it for different types of SaaS businesses.

Common Modifications

- Adding more growth channels. It is common to add more growth channels to detail the acquisition strategy in more detail, and to assume different growth rates by channel. Straightforward to do: simply replicate the existing growth block of calculations on the

Revenuessheet, replicate the relevant assumptions onGet Started, or create your own set of calculations using the logic relevant for that channel, and add it into the line used to calculate conversions. - Expanding the sales funnel. By default the model assumes one conversion point (for example, leads converting to subscribers), but often users will want to model a conversion funnel with multiple conversion steps (for example, leads converting to qualified leads converting to subscribers). The simple way to model that is to use a conversion rate on

Get Startedthat is reflective of the overall conversion rate (just multiply each conversion rate), or if more detail is required, an additional conversion step can be added onForecastby replicating the structure using the same or simpler methodology for conversions. - Using the sales team channel. This is prebuilt in the model on the

Revenuessheet, but not prelinked. Usage is covered in the video above, but in short, you can use this section to assume the growth in your sales team, your assumptions on the time it takes them to ramp up to full productivity, the leads/clients/sales they generate per month, and use that in the existing growth calculations. - Adding pricing tiers. This can be done with a simple edit to the assumptions on

Get Started. Create a table with the different tiers (onGet Startedor a new sheet), input the pricing tiers, assume the percentage of subscribers/clients/etc that are on each tier, and calculate the weighted-average using SUMPRODUCT, and input that into the average revenue assumption onGet Started. If more detail is required, then you can add additional revenue builds using the same methodology as the annual and monthly split detailed below. - Adding non-recurring revenues. Many companies will have a mixture of recurring (MRR/ARR) and non-recurring revenues. Easy to do with the existing structure, and you can do that by (a) building the non-recurring revenue stream as a function of the recurring subscribers already modeled using the prebuilt drivers, (b) creating a simple non-recurring revenue stream on it's own growth path, or (c) building a custom forecast for any type of non-recurring revenue stream and linking it in, detailed at How to integrate any model with a Foresight base model.

- Creating a custom billing schedule. The prebuilt revenue model has prebuilt options to set billings separate from revenue recognition, with a mixture of options for different subscription length and billing period length, as well as the ability to set a percentage to be billed upfront and the remaining at the end. In addition, you can create any custom billing schedule you want and link it into the

Forecastsheet to replace the prebuilt option. - Adding hardware sales as a function of subscribers. Many hardware/software companies have a mixed revenue model that combines a one-time hardware sales with a recurring subscription revenue component. Easy to do using the existing structure; use the existing growth channel to reflect the new customers, and use the existing revenue build to model the subscription revenues. Then add in the hardware sales using the prebuilt drivers, setting a line to be the hardware sale, and using the drivers to input the revenue per hardware sale, and select the driver reflecting the number of new customers / subscribers / etc. (To model cost of sales, see the details on the How to model Ecommerce with the Standard Financial Model post.) You can also partition the hardware and software revenues into different revenue buckets using the existing categories on the

Forecastsheet, and also use the Breakdown sheet to segment revenues and costs from the two business models into separate categories to see the relative revenues, cost of sales, margins, and more and their contribution to the total business. - Modeling land and expand revenue models. A land and expand revenue strategy is where a company works to increase usage, seats, or add services over time as the customer grows ("expands") their usage of the service. The model is prebuilt to handle that, just go to the

Revenuessheet and use the Average Revenue per Subscriber/Client/etc assumption to increase average revenue over time to reflect that revenue growth over time. This will automatically be applied as a lag from when customers start. Optionally, even though it's not an input, you can also modify this per monthly cohort if you have a need for that level of detail. - Modeling upsells and downsells. The model uses the same method used above to model upsells and downsells. Changing the Average Revenue per Subscriber/Client/etc assumption on the

Revenuessheet to increase over time will model upsells, changing it to decrease over time will model downsells, and the model will calculate expansion/contraction revenue accordingly. This is a simpler method than modeling the discrete shift between plans, to do that requires a custom approach to model the shifting of subscribers/clients/etc. from one subscriber build to another (requires creating a separate revennue calculation for that, as a new custom revenue stream to add in). This also combines upsells and downsells, in that this will only model the net of upsells and downsells, and net expansion/contraction. If you need to seperate those out, then you will need to create separate subscriber builds for upsells and downsells, and calculate revenues accordingly. (This would require a more complex set of calculations that not all users need, thus why it is not prebuilt into the model.) - Adding annual and monthly subscribers separately. Prebuilt into the model are two assumptions for churn, churn period, average revenue per month, and retention costs. These are used to create separate calculations for two sets of subscrubers converting from the acquisitions, and can be used to assume the annual and monthly subscribers churn and revenues. These are prelinked into the

Forecastsheet and the model will aggregate the revenues and billings from each accordingly, and automatically handle the impact on cash and deferred revenues. More details here. - Using the SaaS Forecasting Tool. The free SaaS Forecasting Tool is an alternative way to forecast SaaS businesses with a simpler build structure, in approximately 10x less lines of code (a pro!) but with less features around growth, conversion, and cohort modeling (a con). It is straightforward to use the tool to replace the prebuilt revenue model in the Standard Model, or to use it to model additional SaaS revenue components in an easier way than replicating the prebuilt revenue model.

- Using your own SaaS revenue build. The model can be used for a wide variety of SaaS businesses, and you can also import and use any model or other template you are using. Details at How to integrate any model with a Foresight base model.

Cost of Sales and Operating Expenses

While the video above does not cover how to model the associated expenses with operating a SaaS business, the model is prebuilt to handle marketing and growth expenses, cost of sales (e.g. hosting, infrastructure, customer support) and other operating expenses (staff, overhead, and more). Modeling expenses is covered at Forecast.

Common Questions

Common questions and more details at Standard Financial Model. I provide free and paid onboarding support and custom model services, and contact me anytime for questions.

Related: Building an Early-Stage SaaS Financial Model, on the Role Forward podcast with Mosaic.