Using the Standard Financial Model for Ecommerce

The Standard Financial Model for Ecommerce is identical to the Standard Financial Model, as the Standard Model works well for ecommerce businesses by default, with no edits required, and is easy to customize for specific requirements for different types of ecommerce businesses around growth channels, conversion funnels, and business model mix. The video above details the acquisition, conversion, retention, revenues, and billings structure and how to use it for different types of SaaS businesses, and you can read more at How to model Ecommerce using the Standard Financial Model

For an alternative, simpler revenue build for Ecommerce, consider the Ecommerce Forecasting Tool, which handles revenue forecasting only (meaning, it does not include expenses, financial statements, and the comprehensive view of the Standard Model).

Prebuilt Revenue Model, Easy to Customize

The Standard Financial Model for Ecommerce is essentially separated into two integrated components:

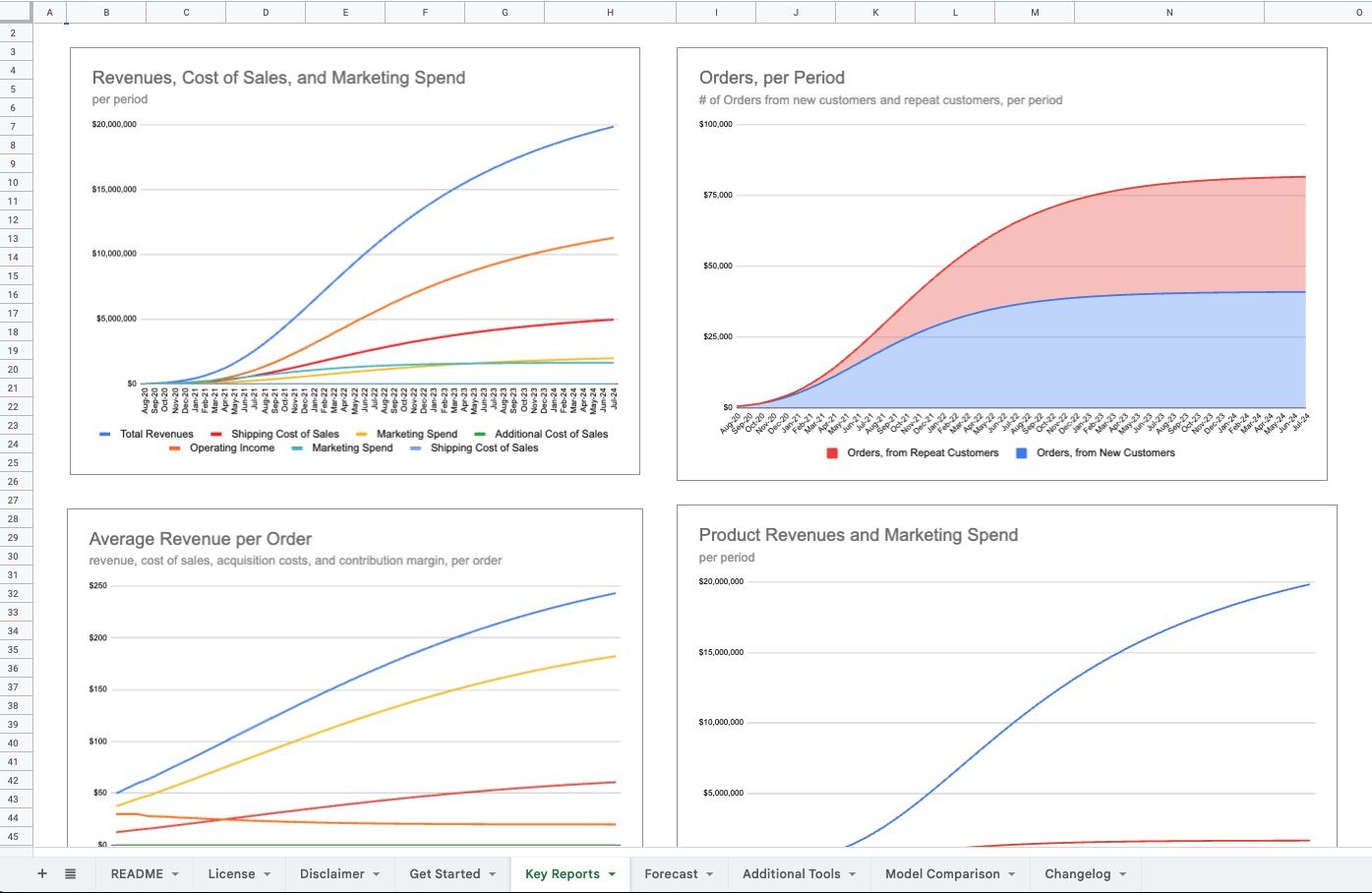

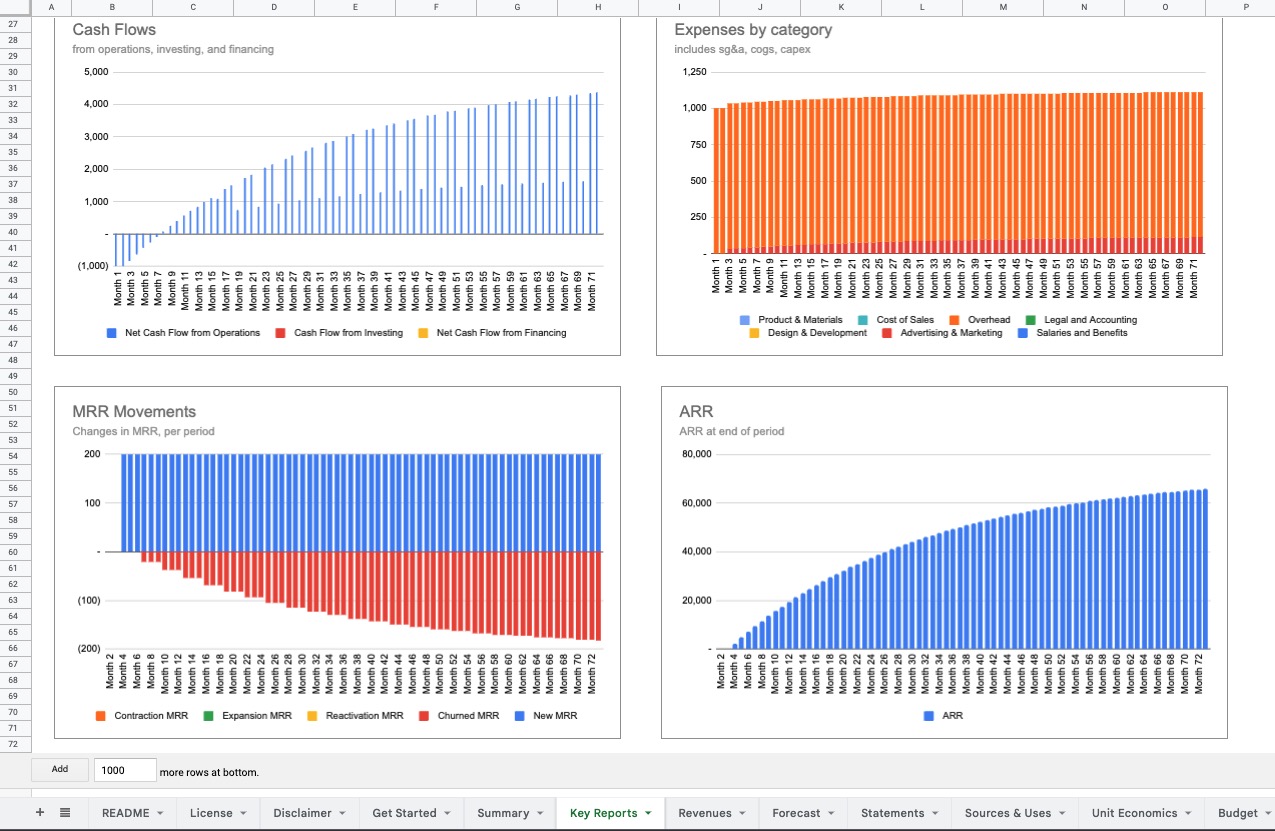

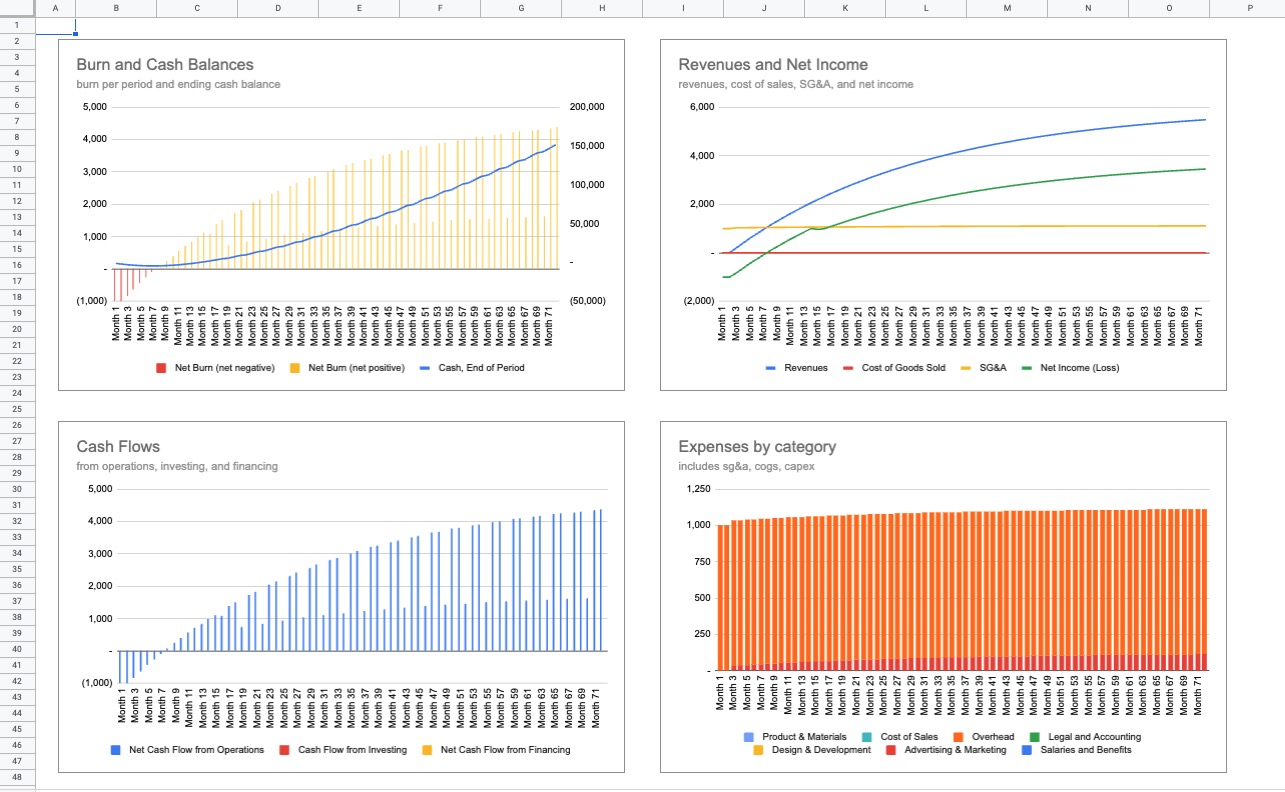

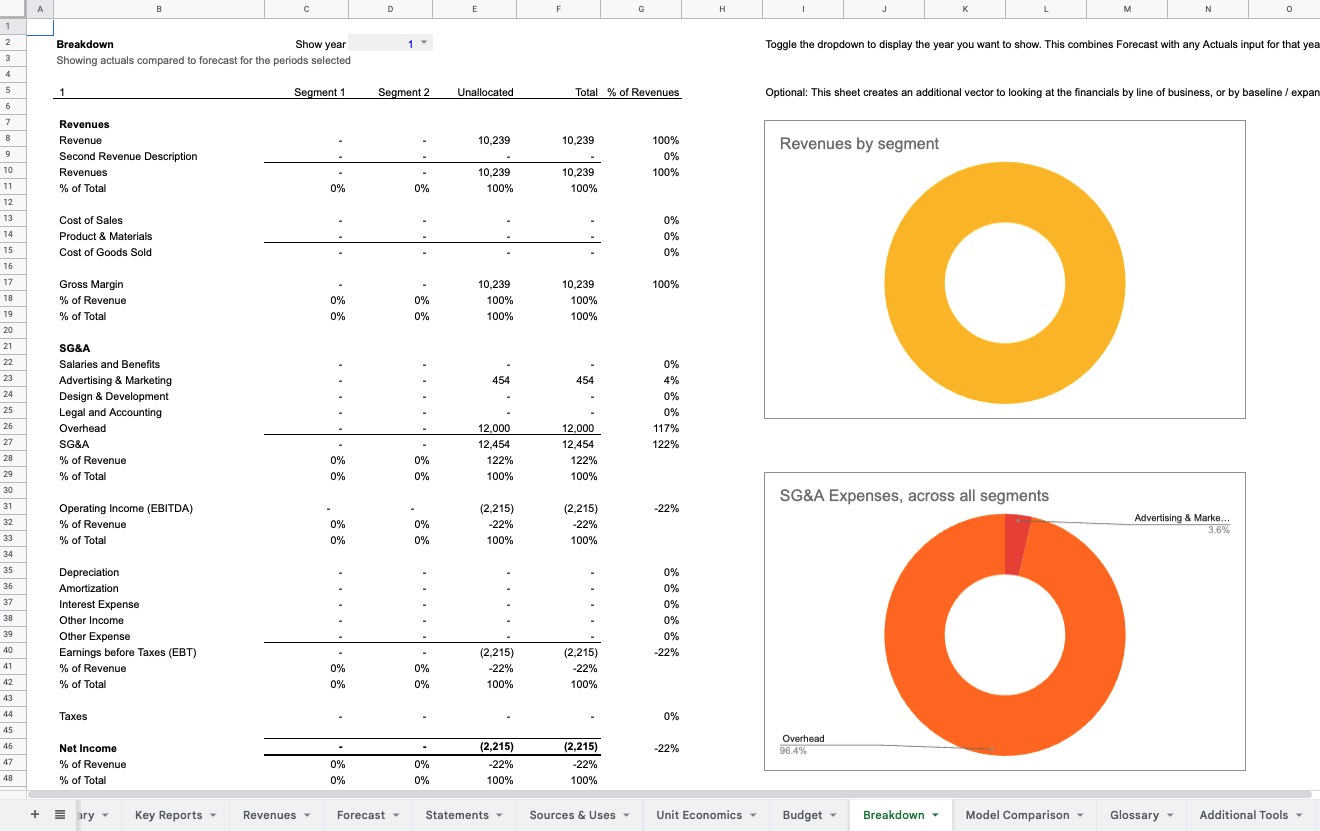

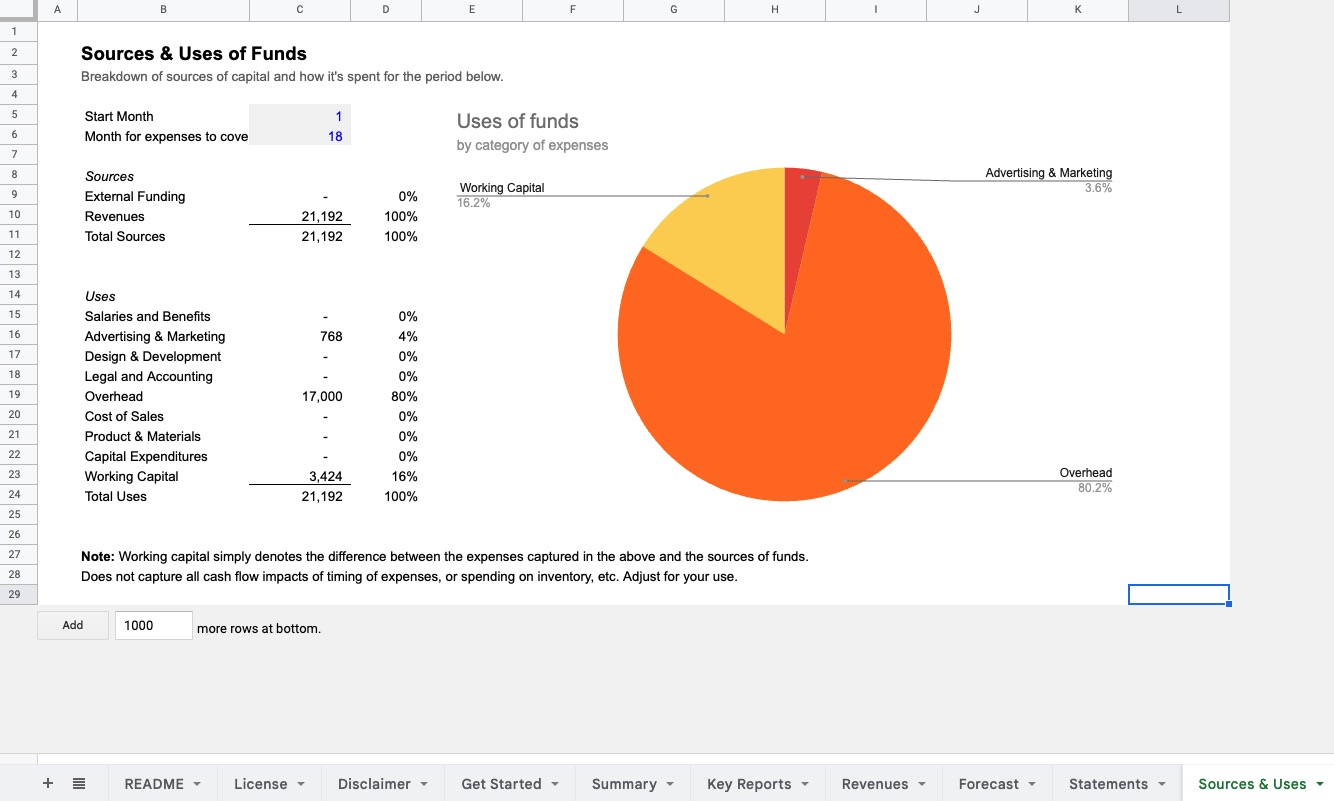

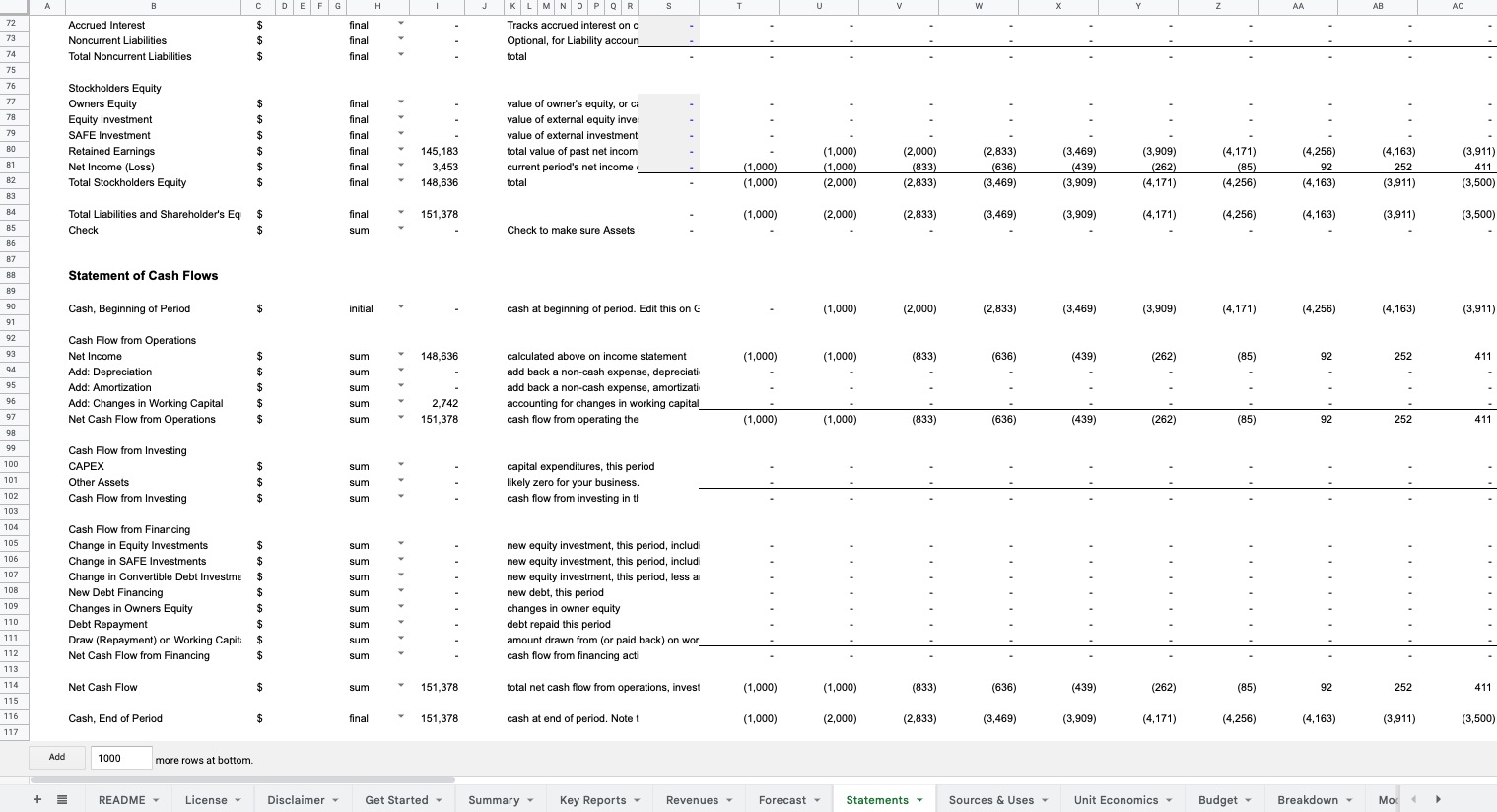

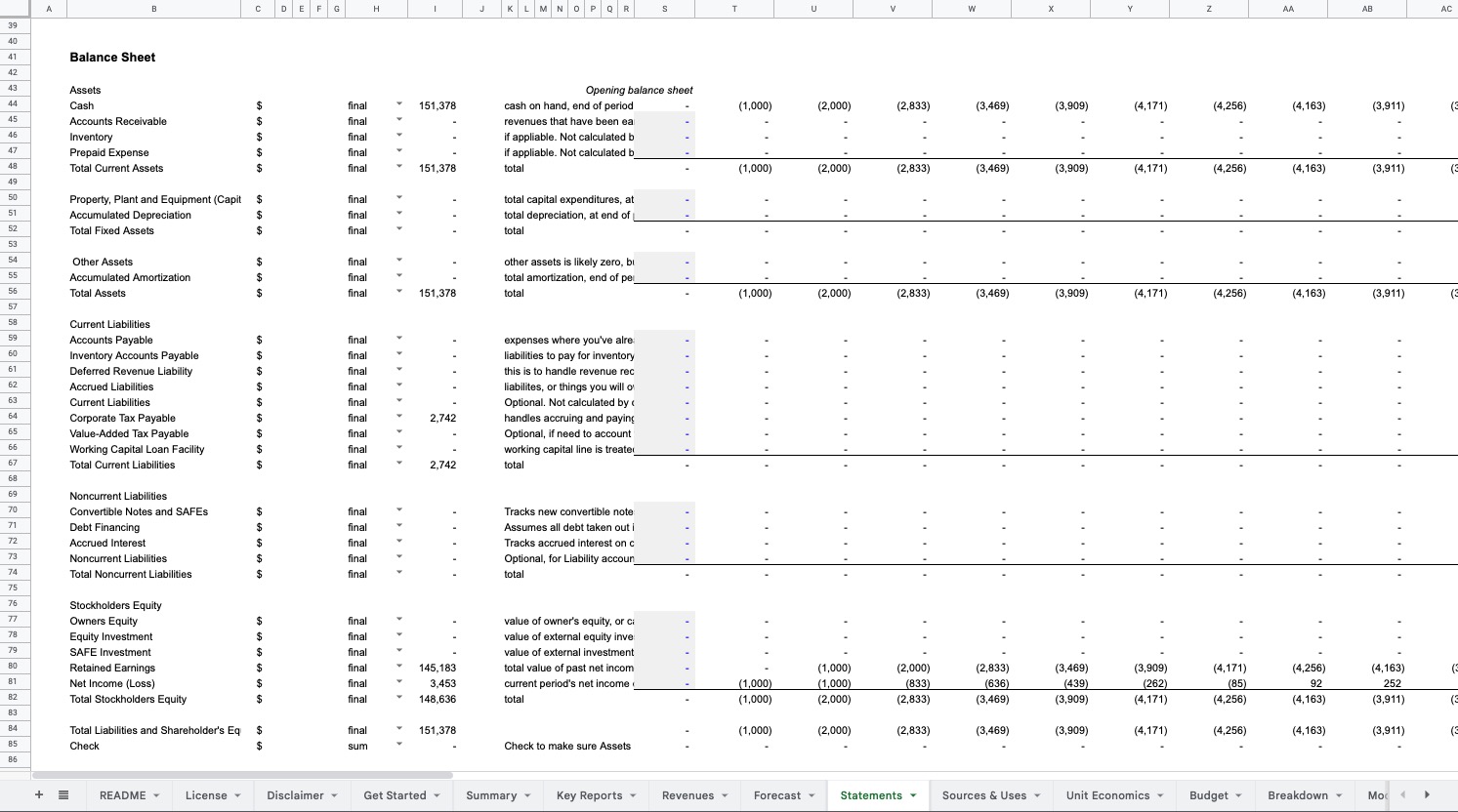

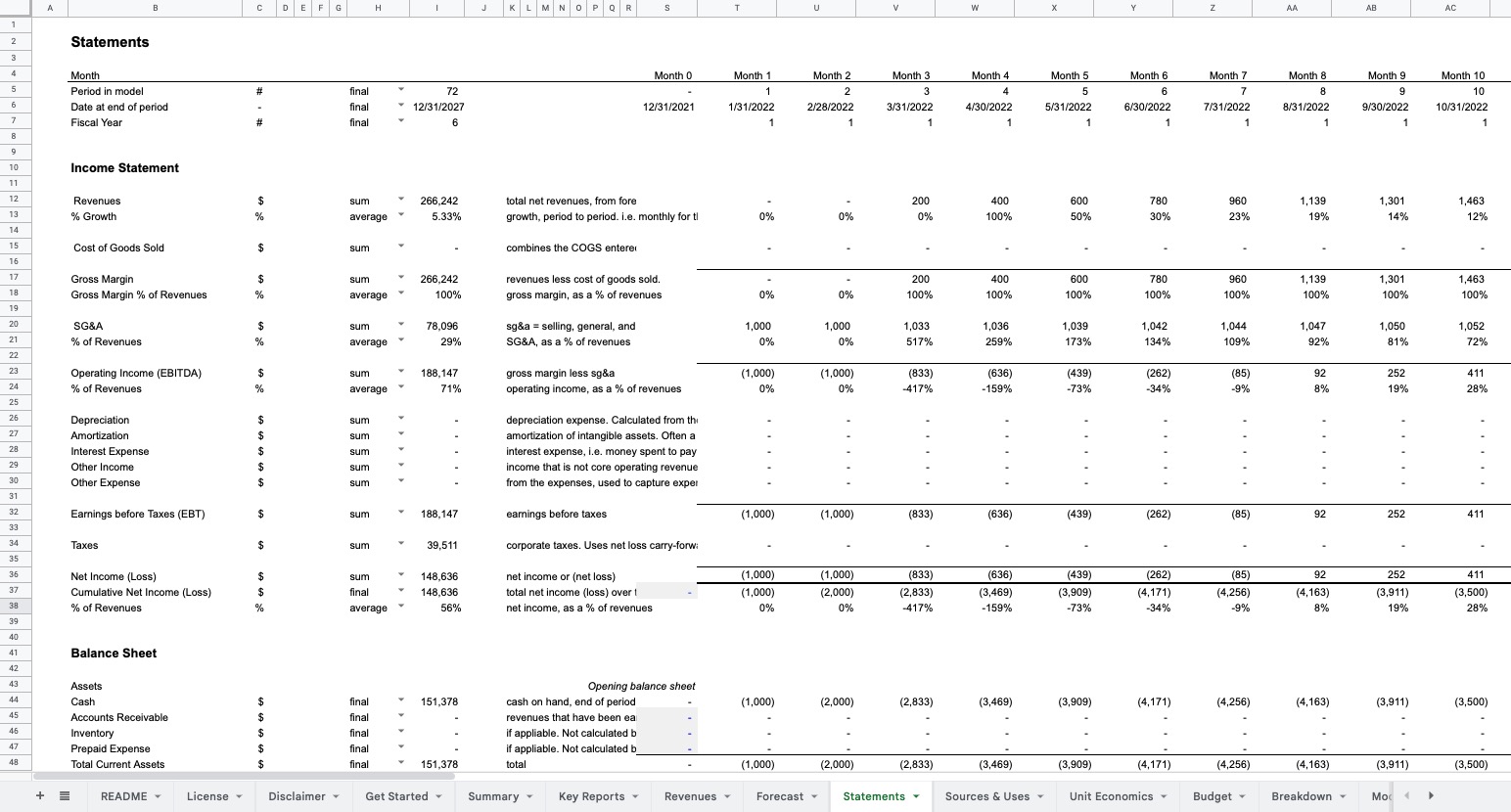

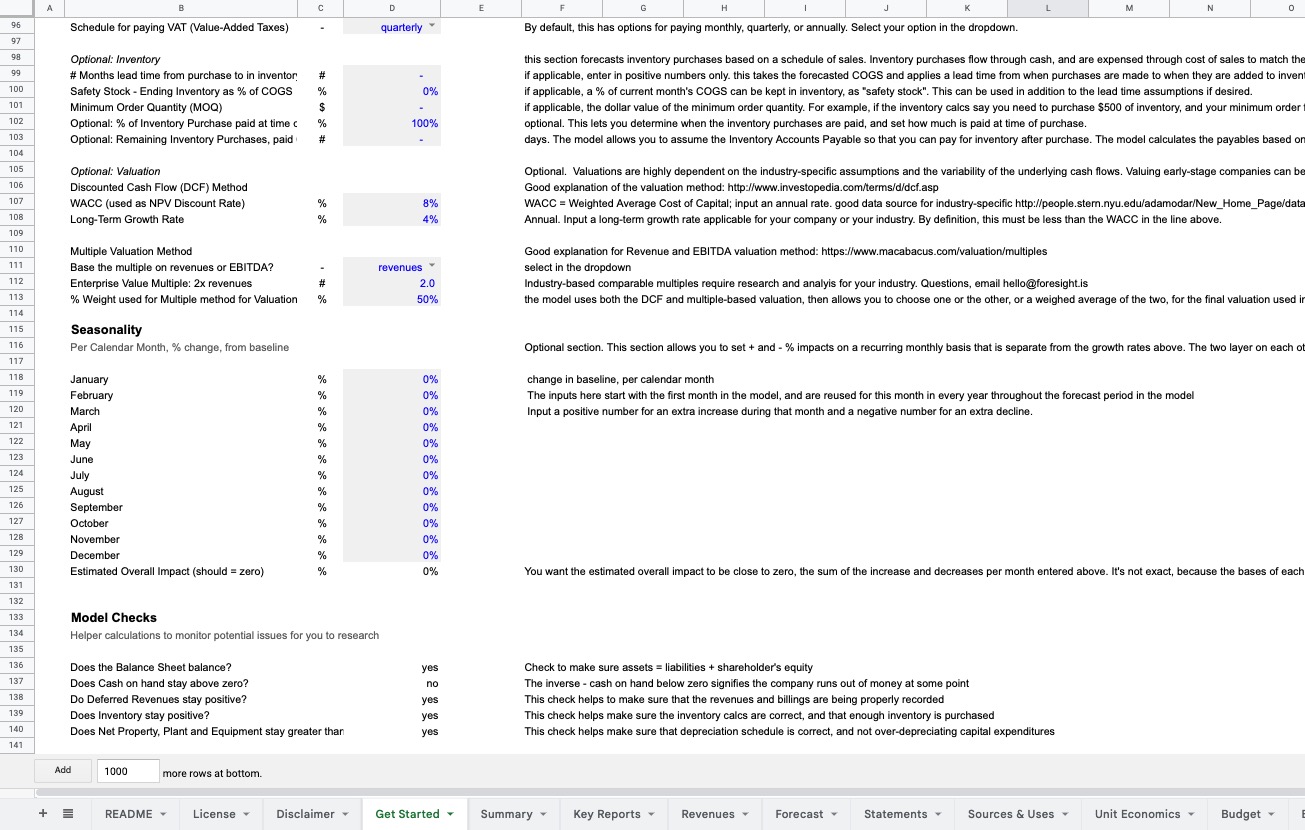

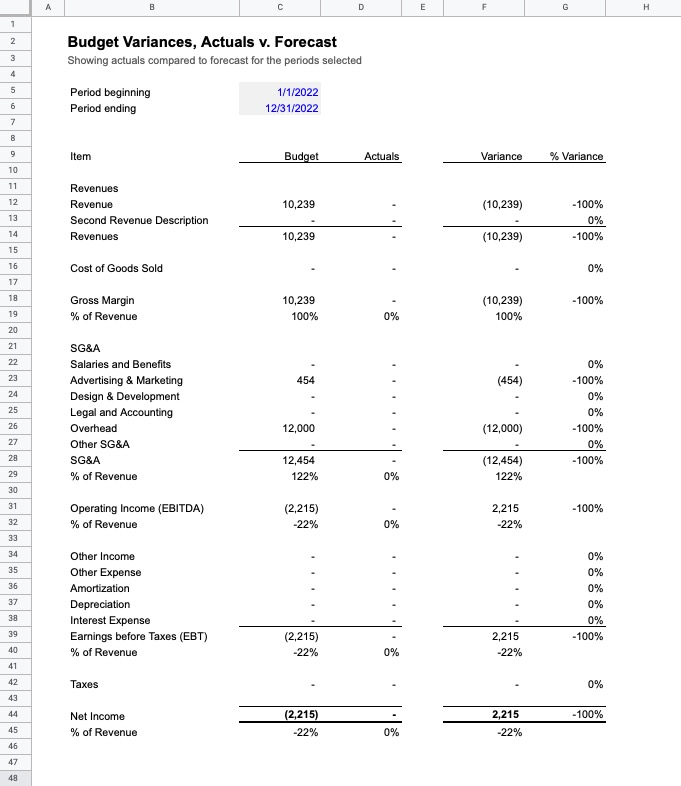

- The financial core, consisting of the consolidated financial statements, operating costs, cash forecast, valuation, actuals reporting, summary, key reports and metrics.

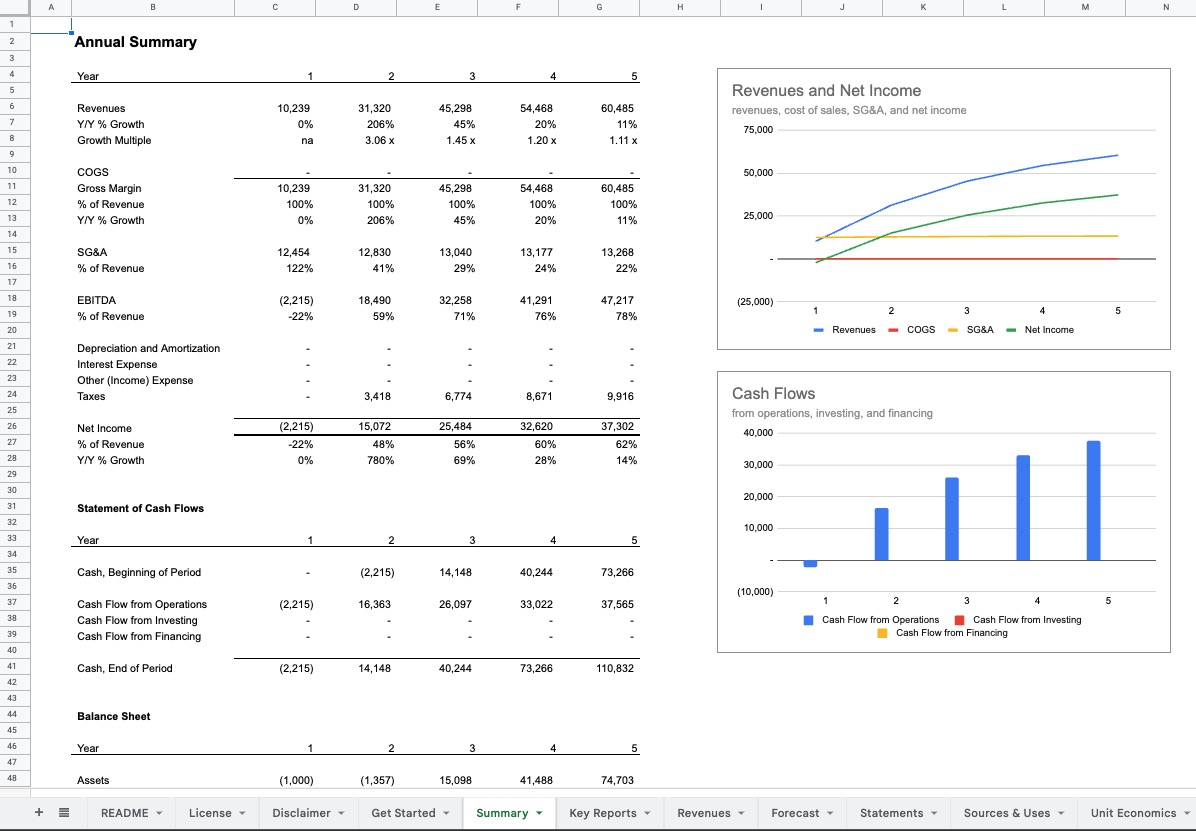

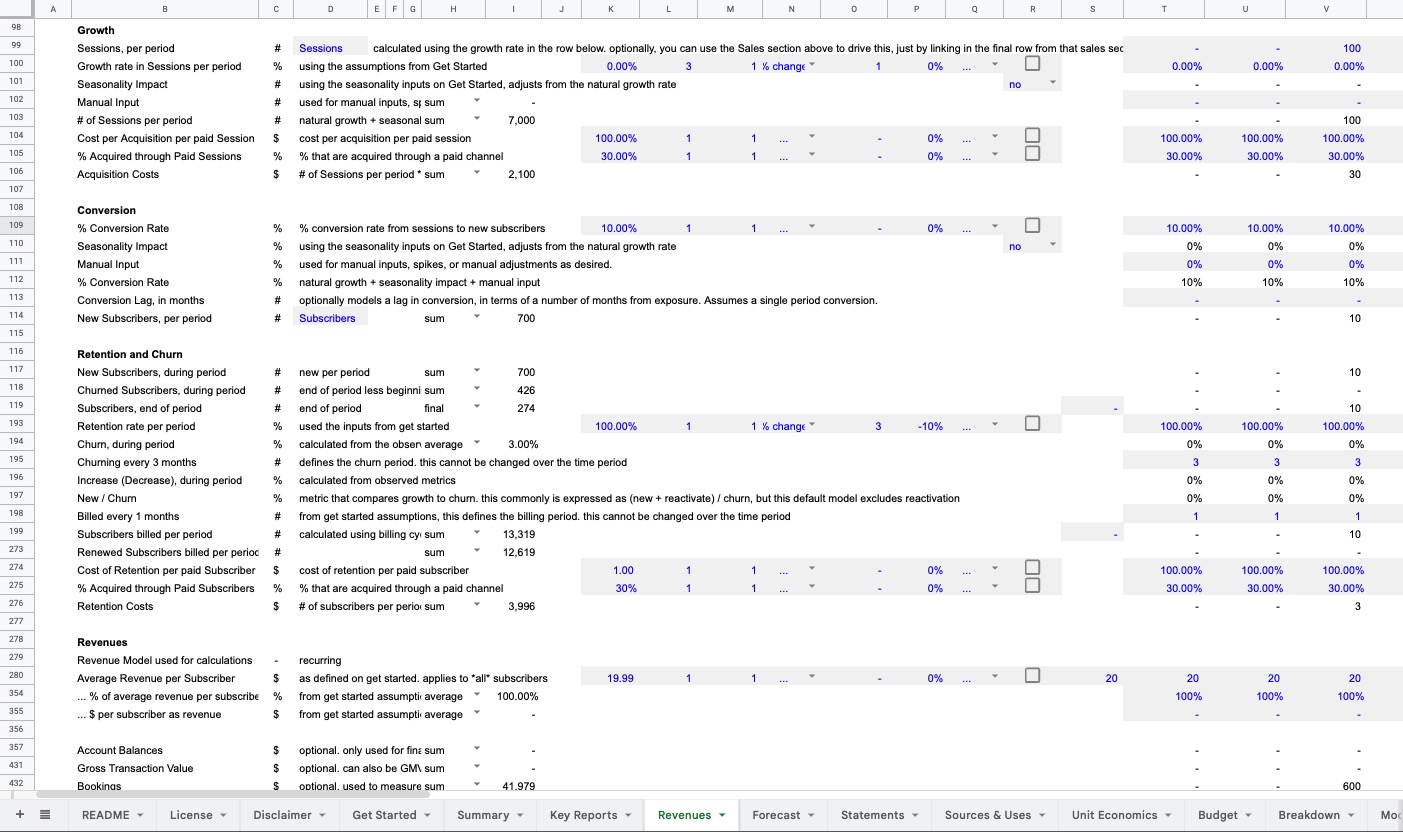

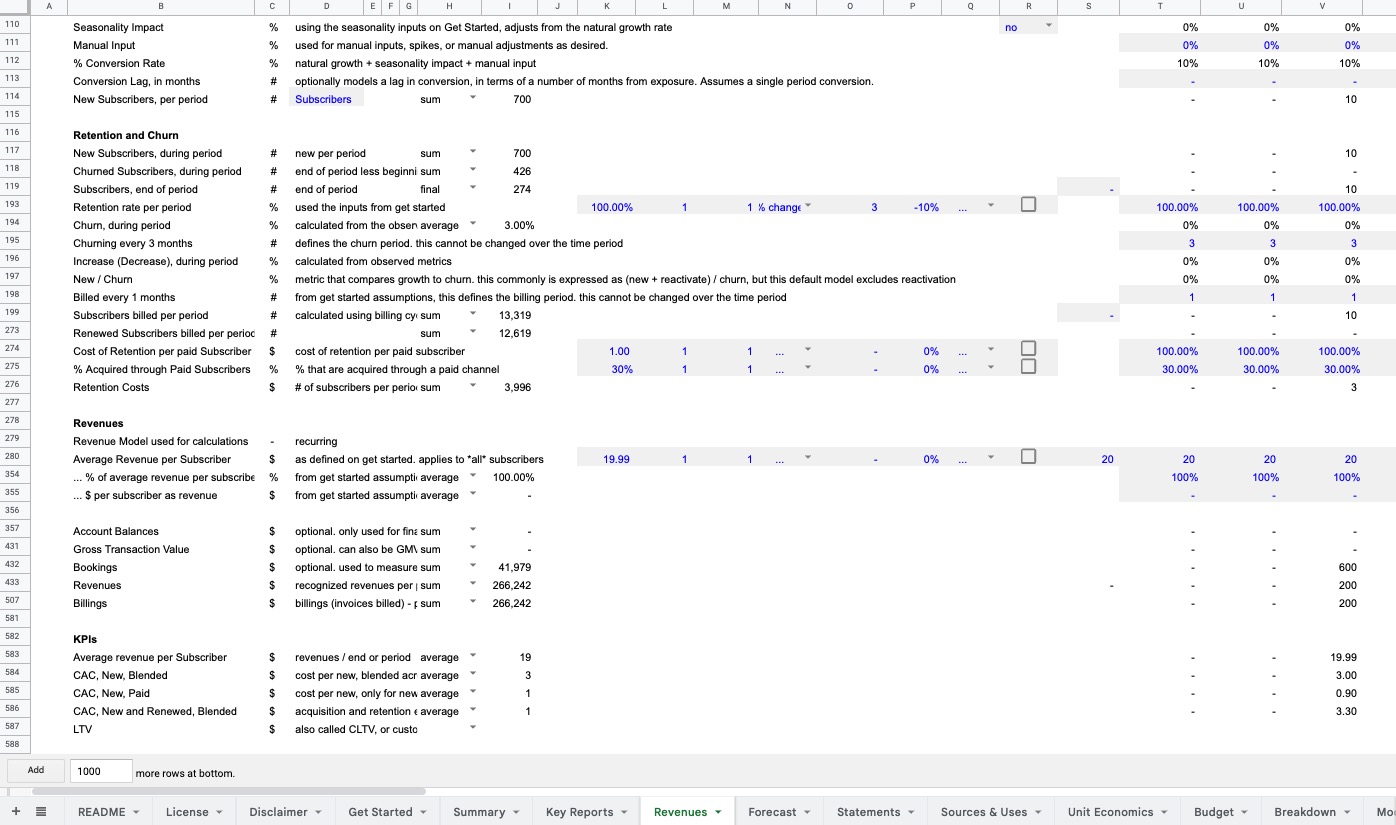

- The revenue forecast, consisting of the revenue model

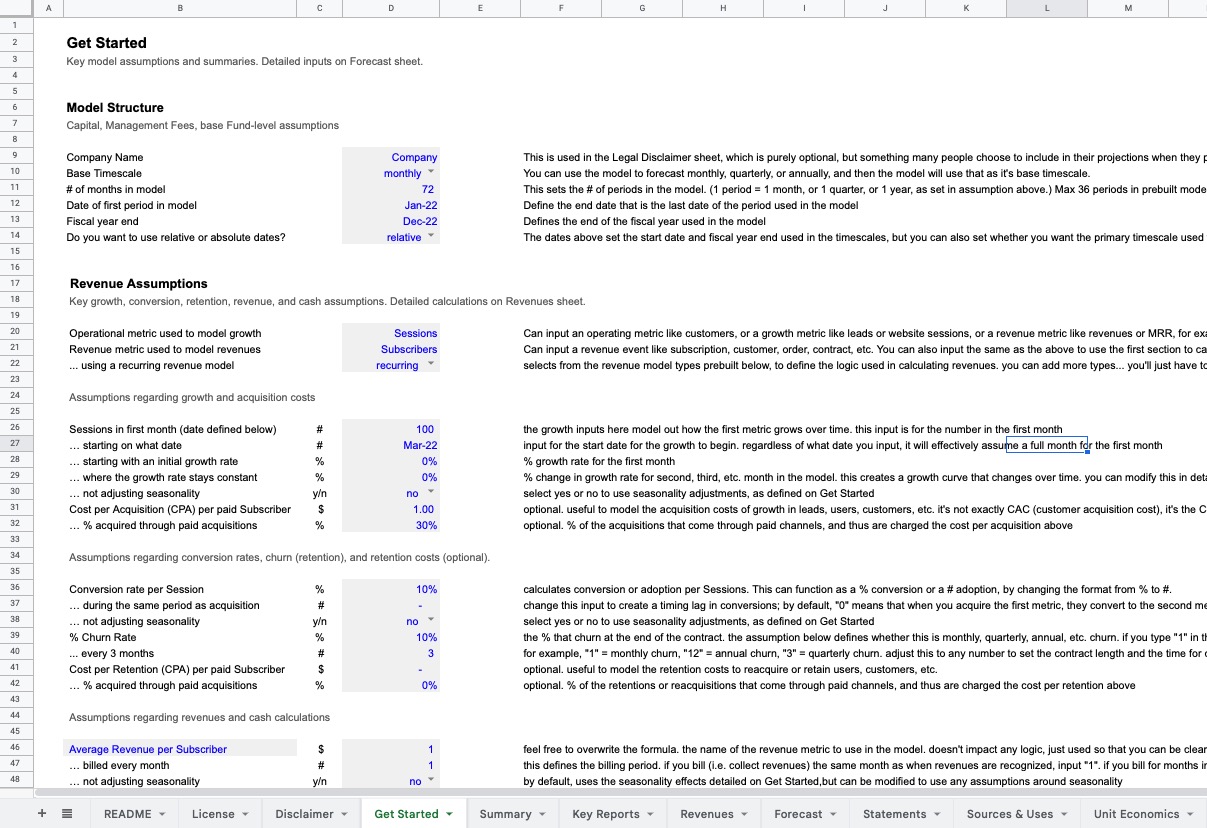

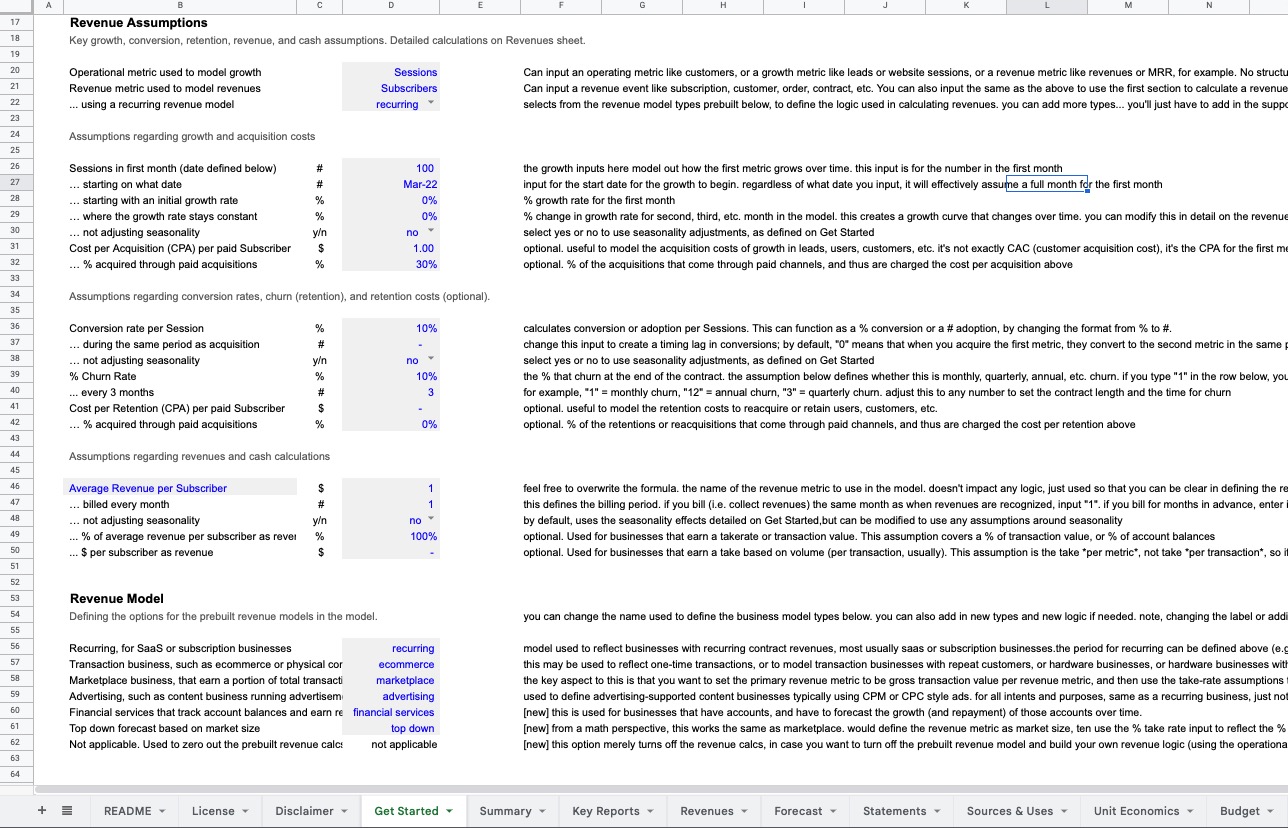

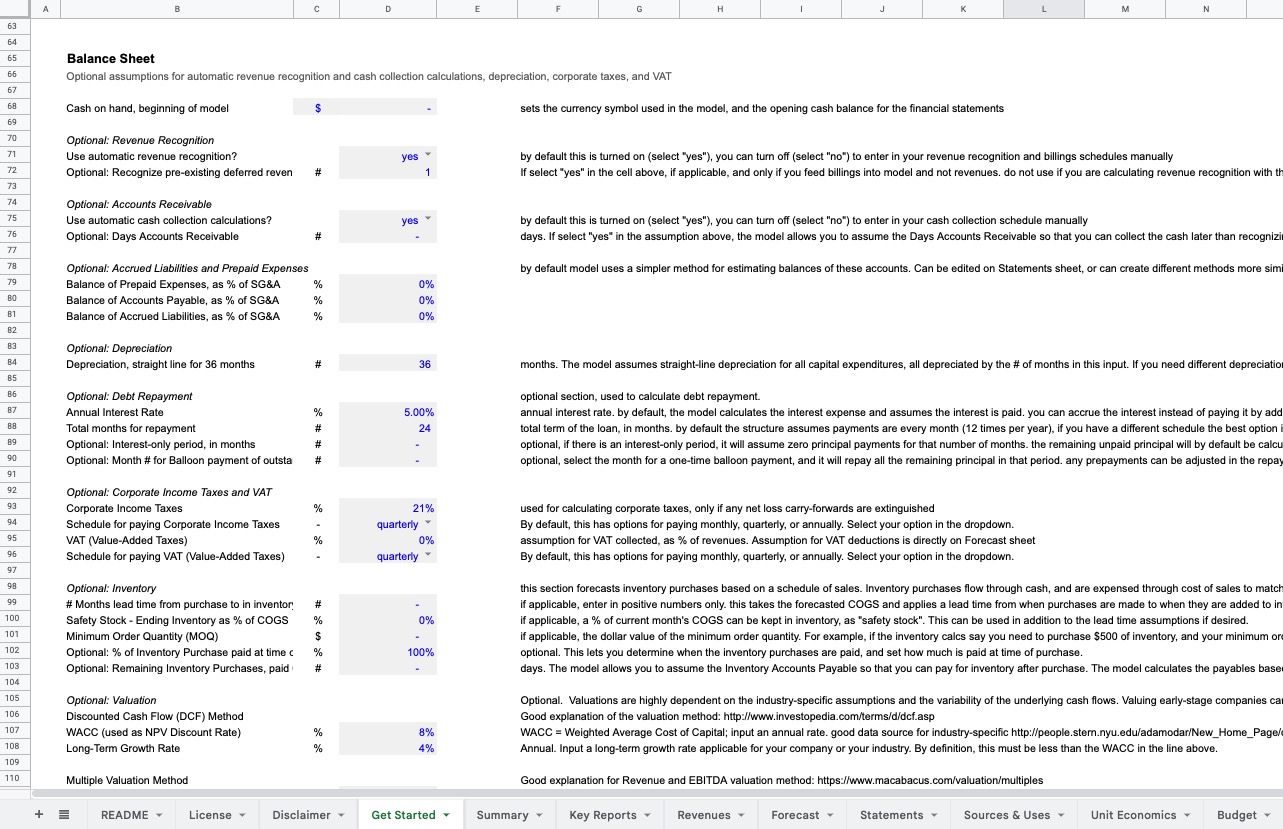

Get Startedsheet and the revenue calculations on theRevenuessheet.

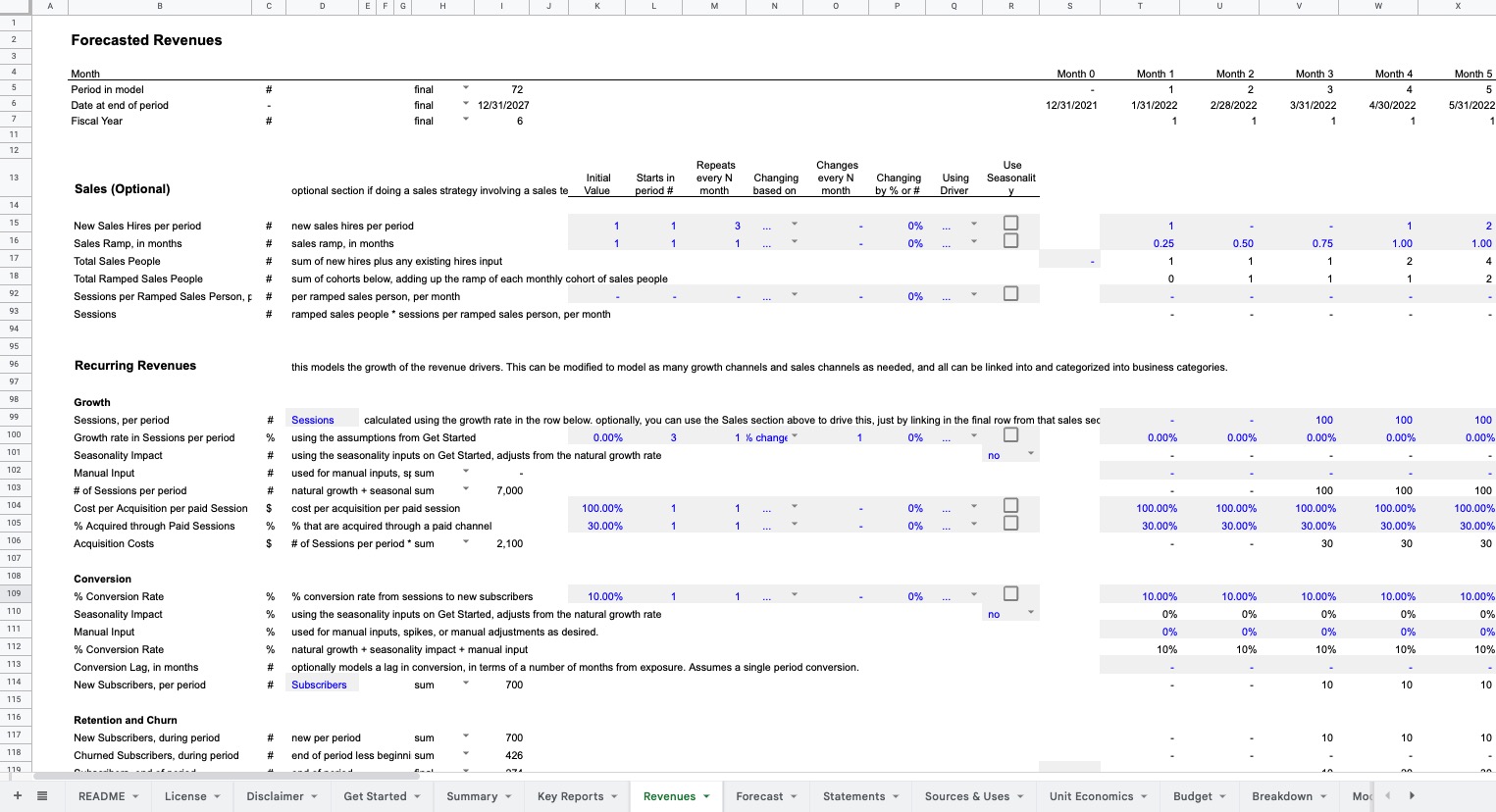

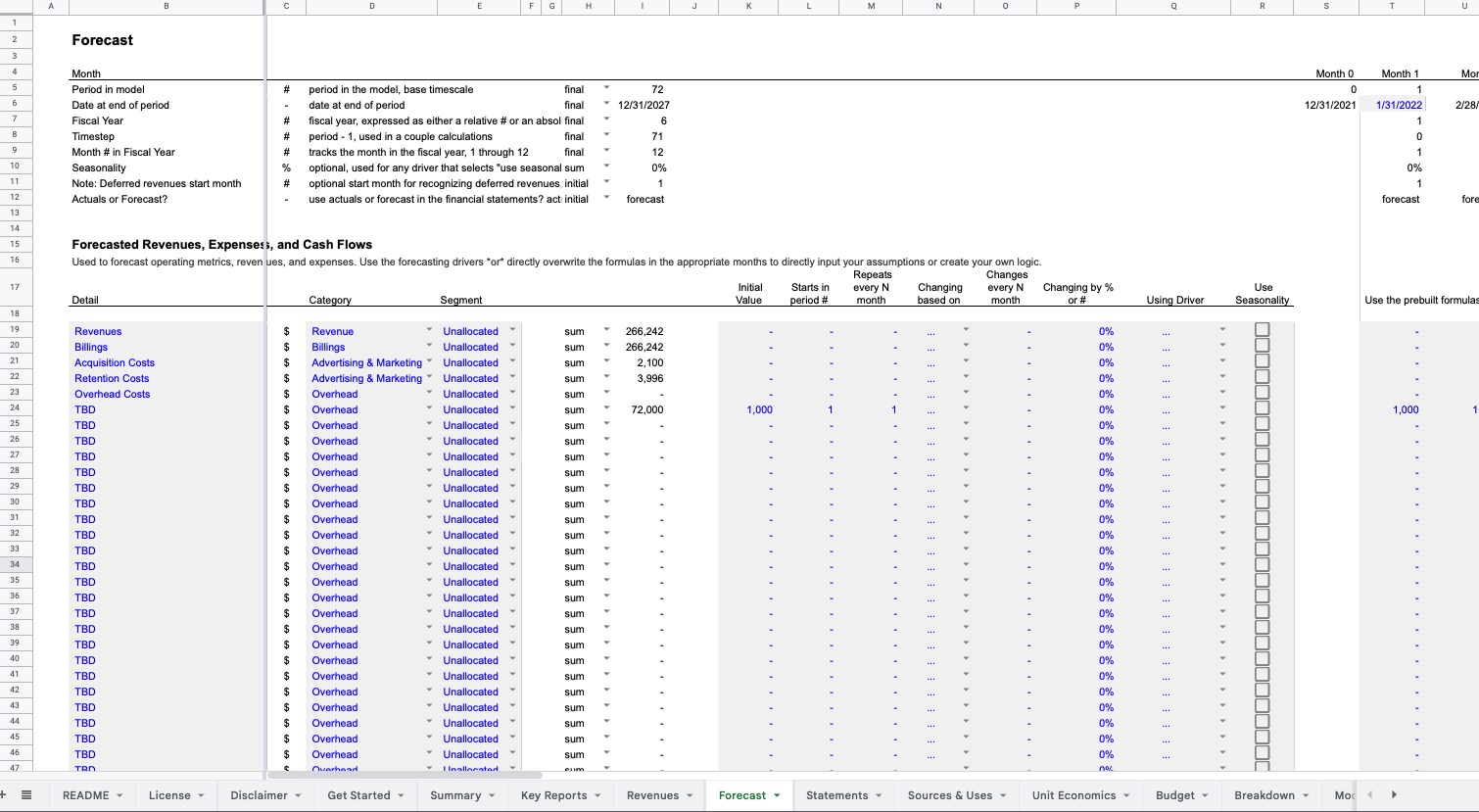

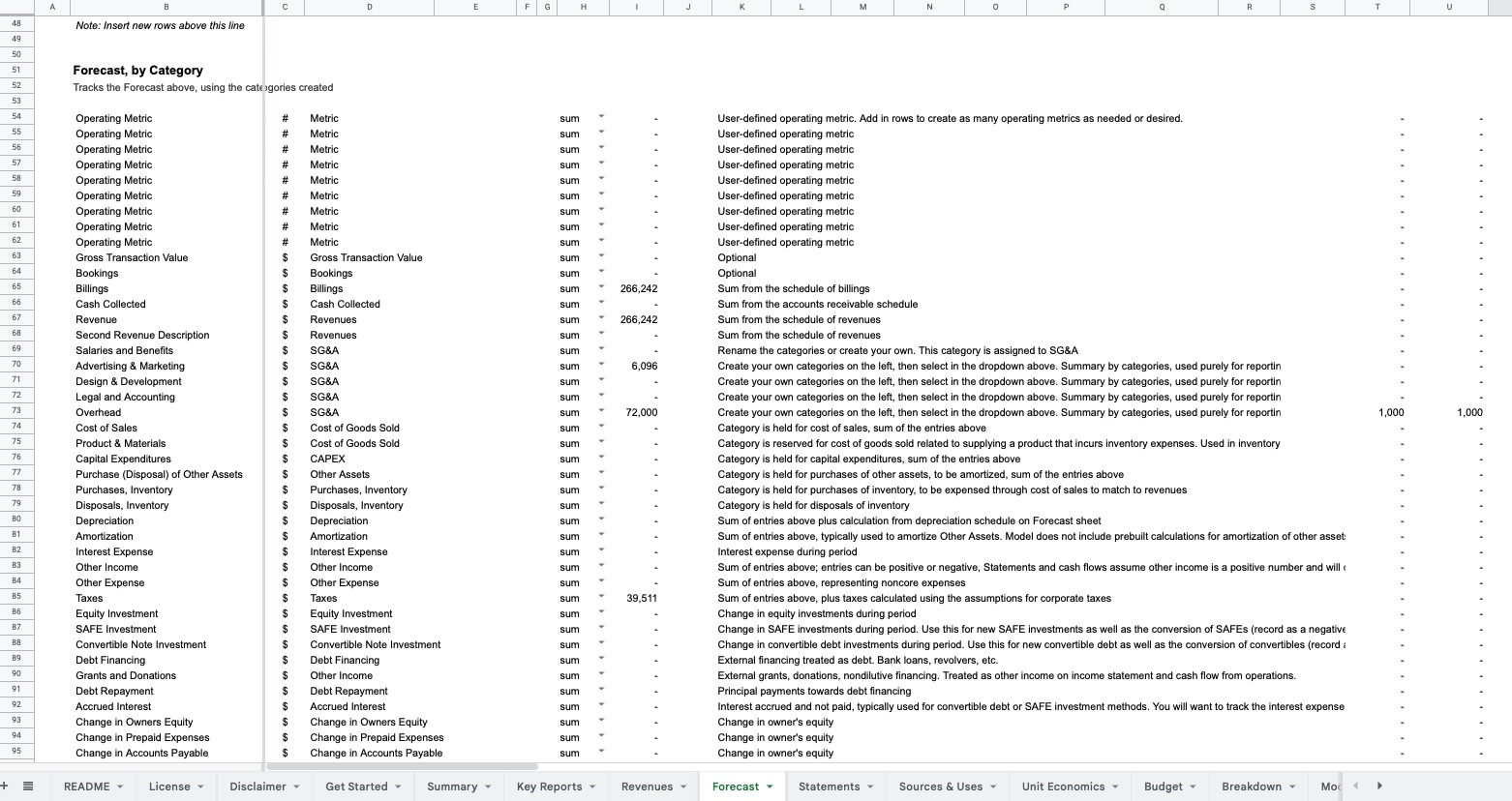

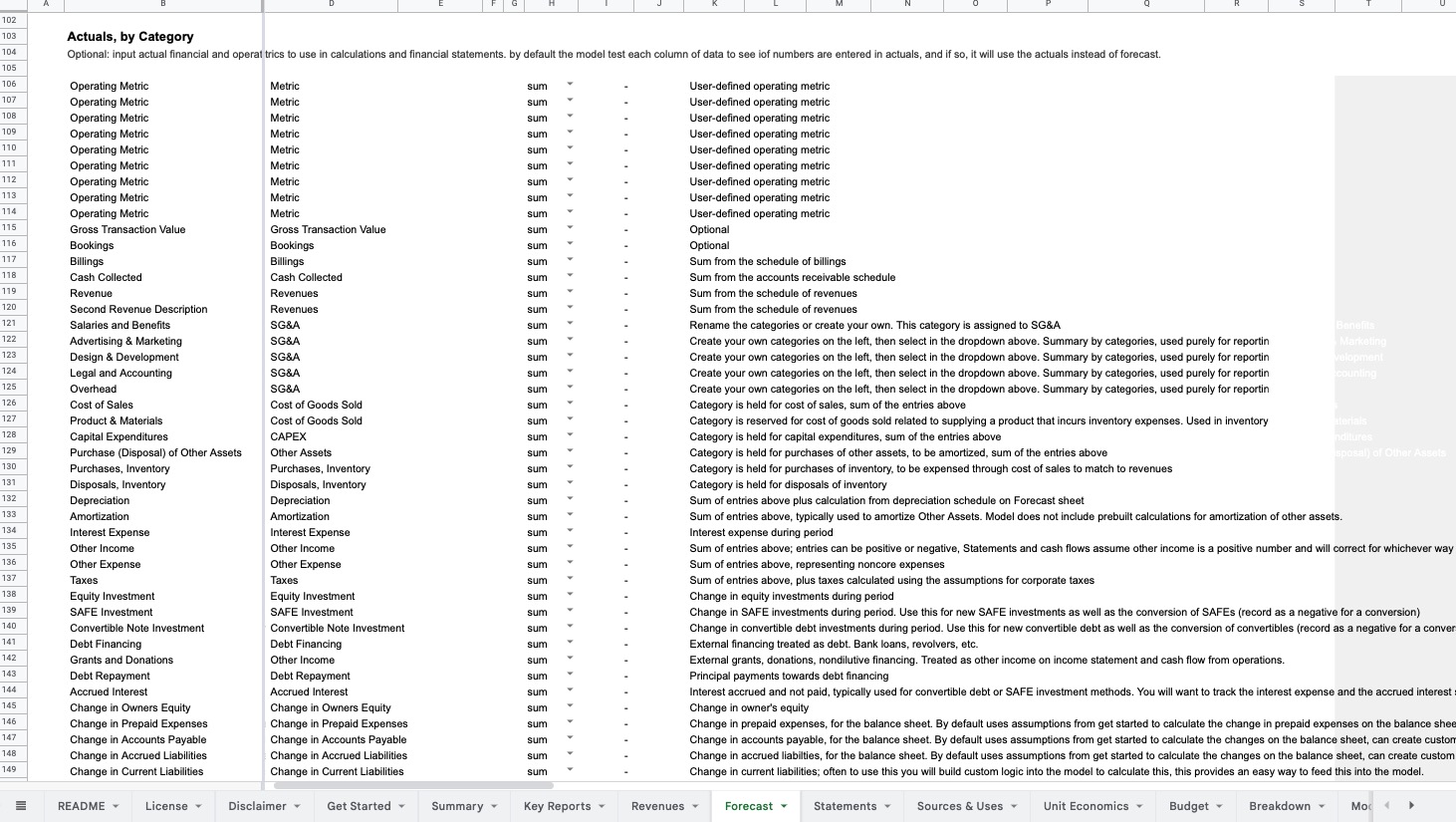

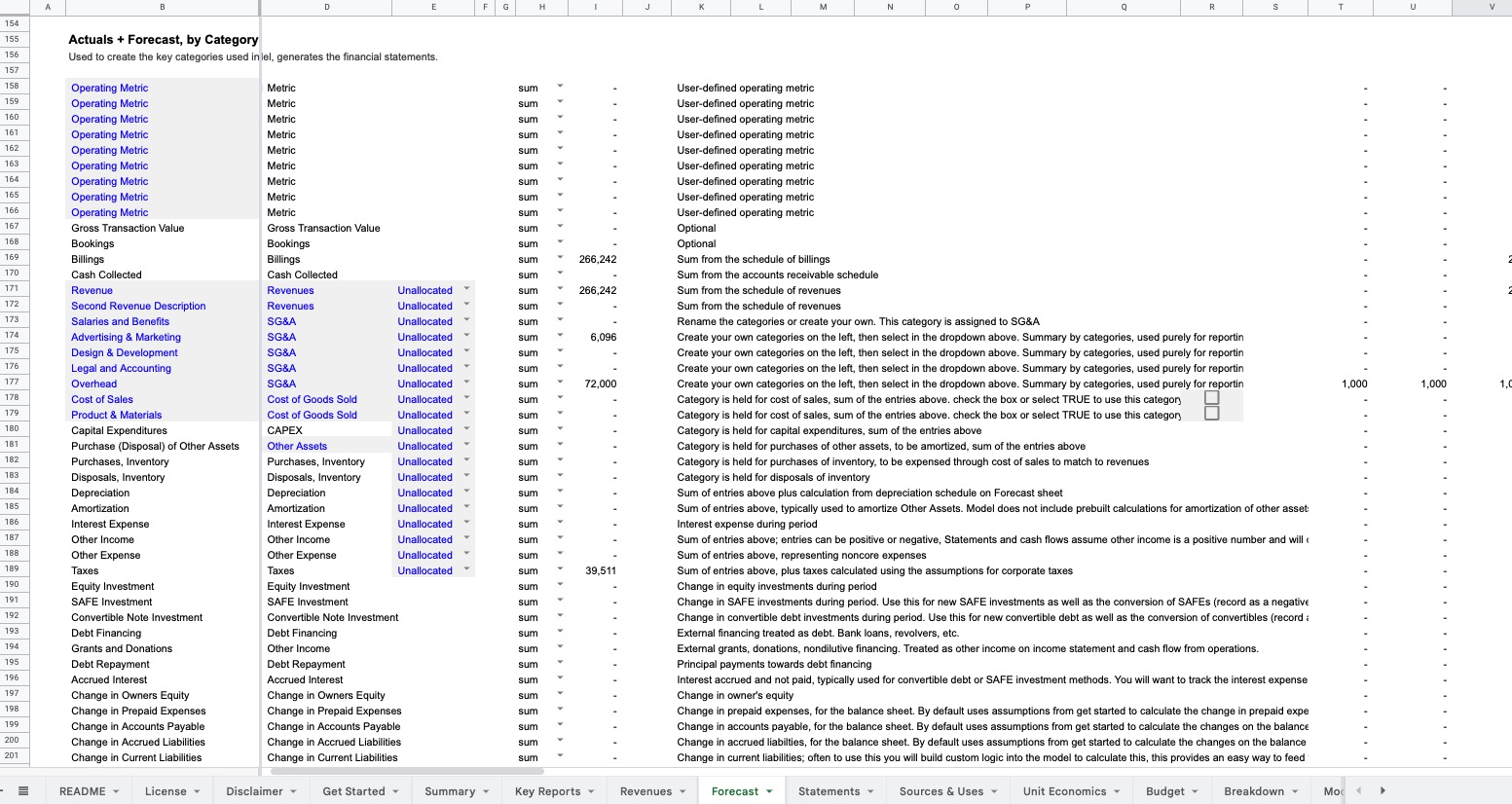

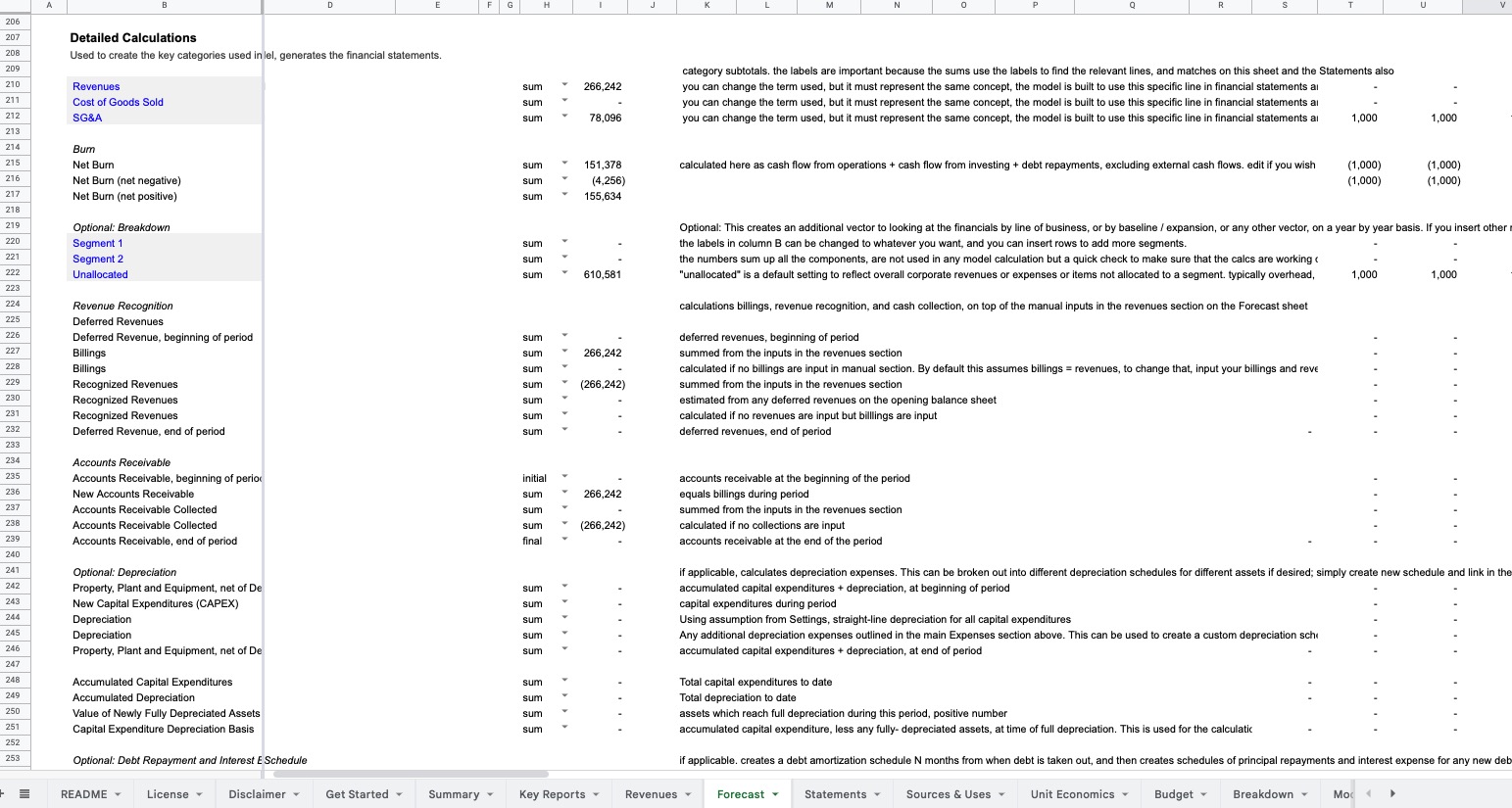

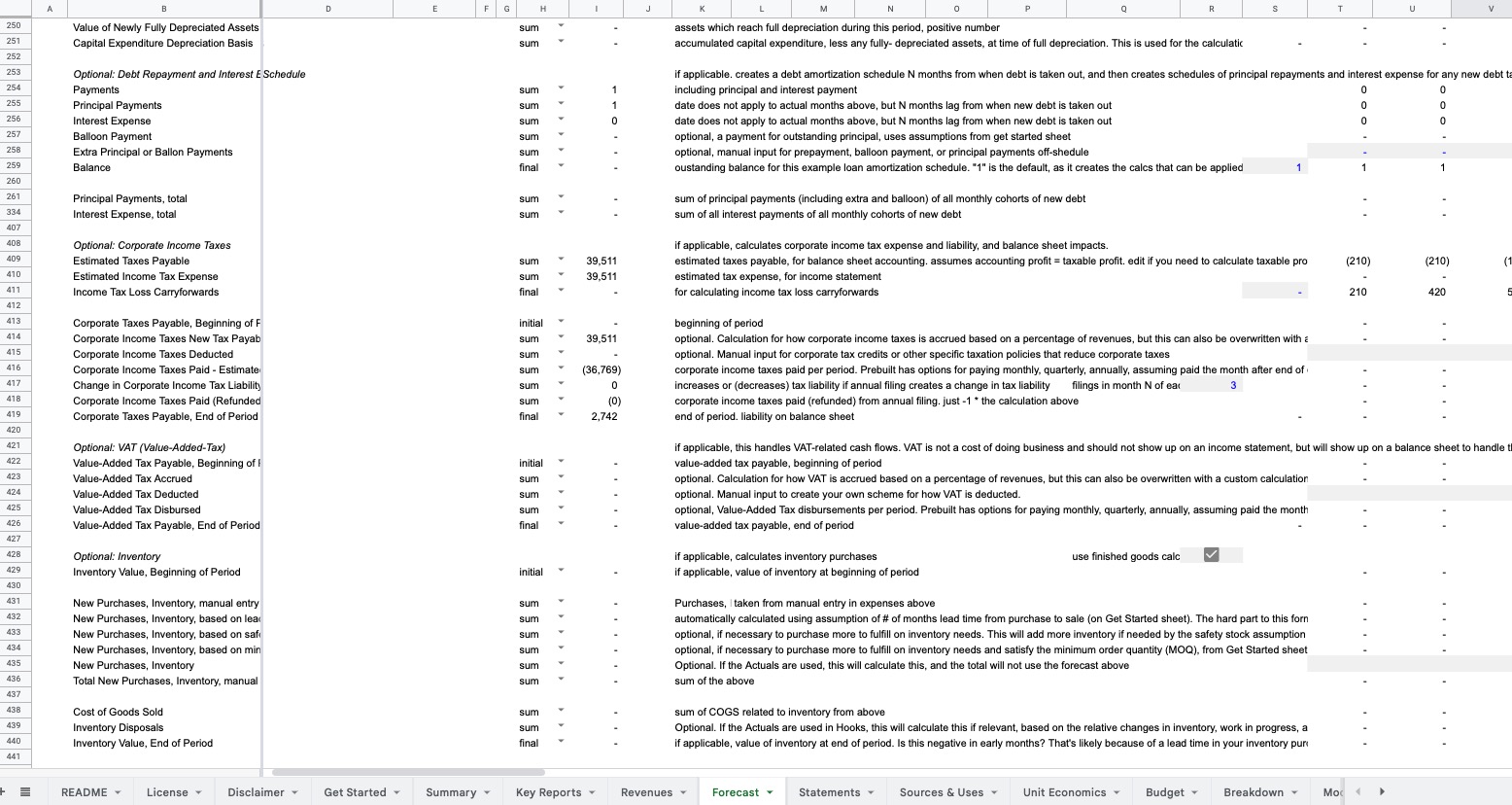

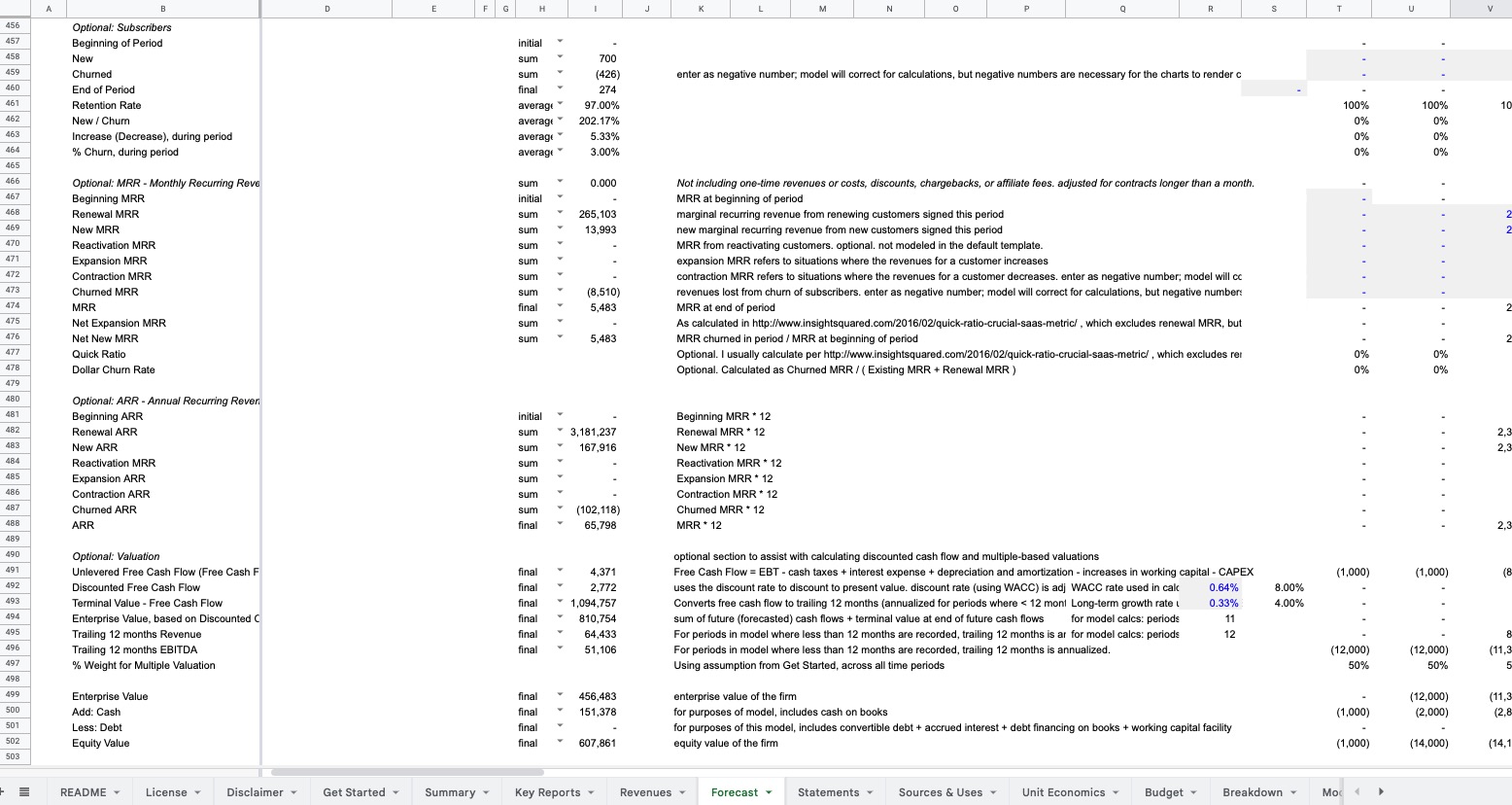

The revenue forecast feeds into the financial core through the Forecast sheet, which exposes the key integration points into the financial core of the model and allows you to feed any revenue forecast into the financial model without having to figure out all the integration points. Any revenue or expense items can be linked into the Revenues and Expenses section on Forecast. Any operational metrics (clients, customers, subscribers, etc.) can also be linked into the Forecast sheet, as well as any actual historical financials you may want to use. This process turns the typically hours-long process of customizing a model into minutes. Read more how to use and extend the model at Bring Your Own Model.

Driver-Based Forecasting

A key component of the model is the driver-based system for revenue and expense forecasting. Below details how that works: