Which Venture Capital Model Should I Use?

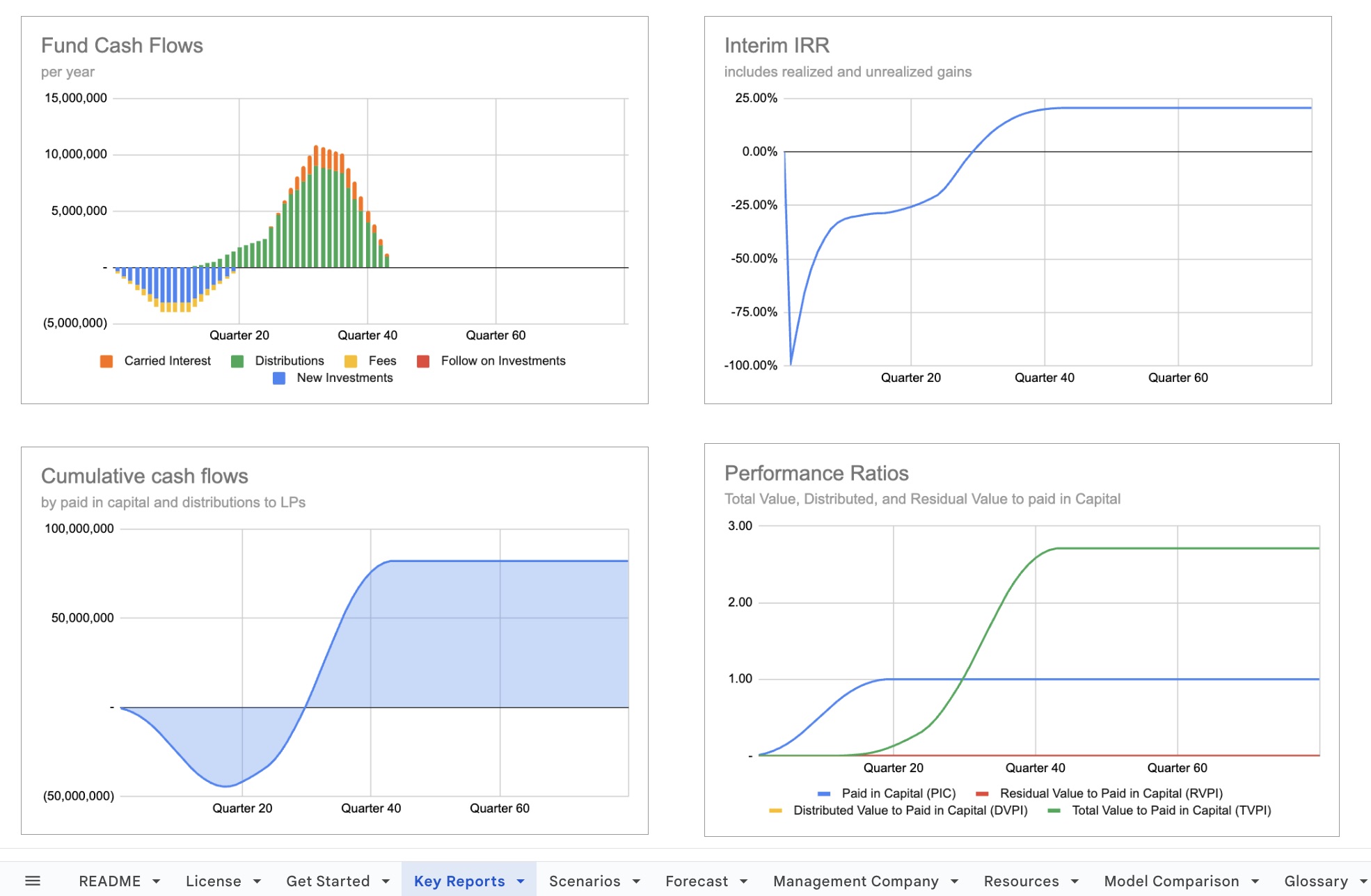

I offer a range of models for venture capital funds. All share the same stucture for reporting cash flows and fund performance metrics, but have a couple key differences, outlined at Portfolio Construction.

Tailored for Rolling Funds

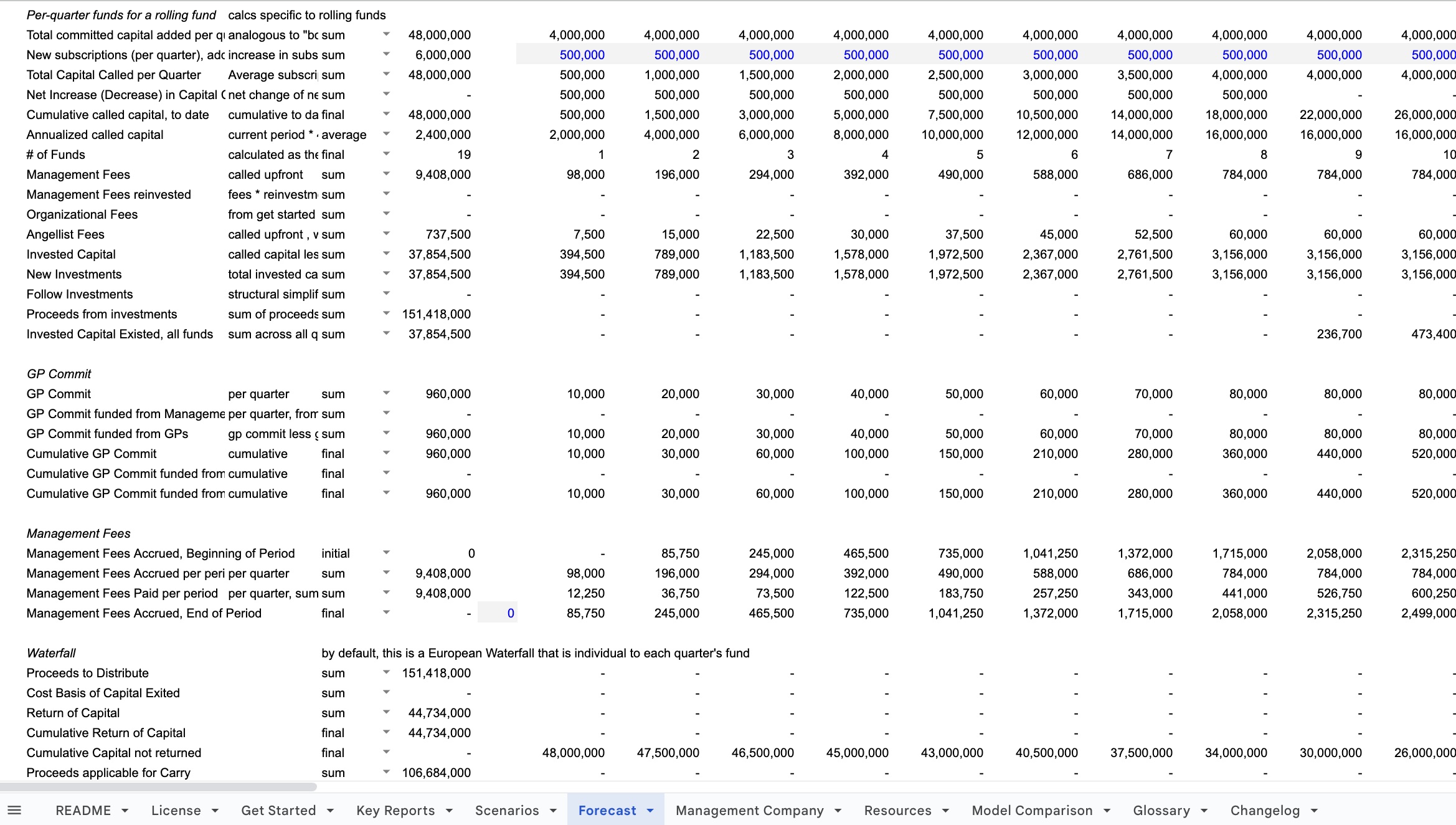

If you are modeling a rolling fund (more about Angellist's Rolling Fund structure), this template is the only Foresight venture capital model that is built for this specific structure. Only this template is built for the specific needs for rolling funds to forecast changes in new committed capital per period, called capital from active subscriptions, the upfront nature of management fees and operating expenses, and a waterfall for a series of quarterly funds.

Caveat on the waterfall

The waterfall is built to handle each quarterly fund separately, rather than a single fund that is invested across multiple quarters, an important distinction for modeling rolling funds. Each quarterly fund is separate, meaning that each fund only has to return capital on itself, and not other quarter's funds.

However, in practice, the waterfall for an individual LP will reflect their investments across multiple quarters, meaning that each LP will in fact have a waterfall that handles a return of capital across multiple quarters, and this model does not currently handle that. Does that matter? If the forecast uses the same returns for each quartererly fund, then this will not change the overall returns, and will only have a minor timing impact on when distributions to LPs happen. It's more of a technical point than a practical one, but one to be aware of.