Input a Price: $25 suggested, but "0" is ok! All donations appreciated.

Download immediately and anytime.

You will have the option to download a Microsoft Excel .xlsx file and copy a Google Sheet file immediately after purchase or submission or your email, and anytime through the link in your email receipt, as well as by logging into my transaction provider at Gumroad and creating an account.

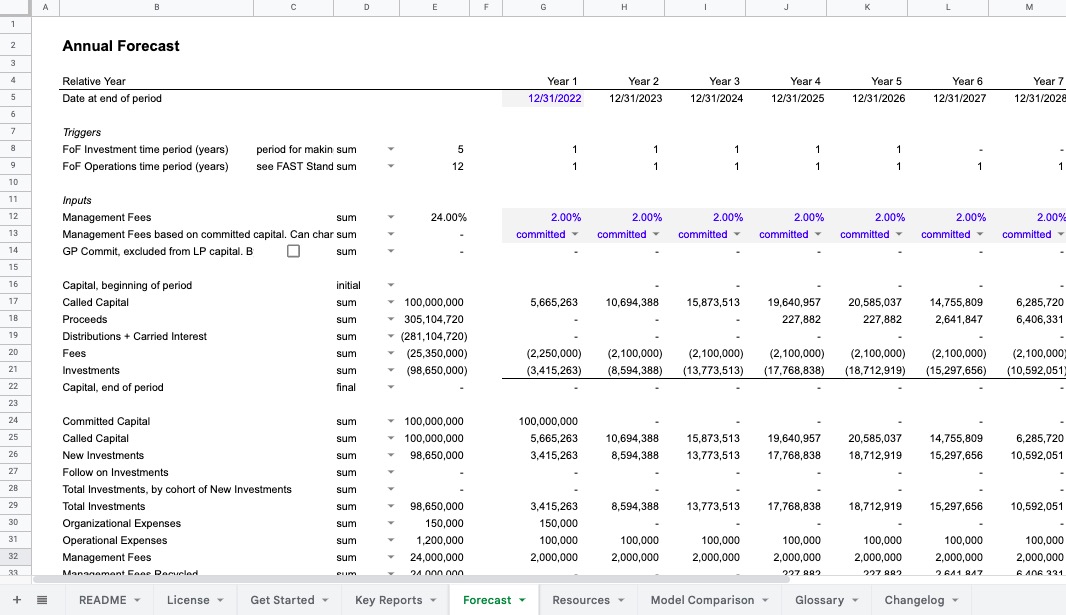

Use in any recommended spreadsheet program.

Foresight's spreadsheet models can be used in both Excel and Google Sheets interchangeably; simply upload the Microsoft Excel model template from Foresight into Google Sheets, or download the Google Sheets to Excel, and everything will structurally work fine.

The models are originally built in Google Sheets, and the formatting is a bit better in Google Sheets; in Excel you may want to adjust the row spacing, fonts, and chart formatting to get the aesthetics you want.

Your payment is secure.

We accept credit cards, debit cards, Apple Pay, and Google Pay. The transmission of your billing information is encrypted using secure socket layer technology (SSL/TLS) and will be processed by Gumroad. Foresight does not have access to your payment details.

You'll get a payment receipt by email immediately after purchase. Note, you will see Gumroad, not Foresight, on your payment statement.

If you're in the EU or UK, you might have to pay VAT.

VAT, if applicable, is additional. Businesses with a valid VAT number can enter their VAT number at time of checkout and not get charged VAT, or can get a VAT refund after purchase..

License and Terms apply on all downloads, purchases, services bookings, and courses.

Get help buying. Call (or text, WhatsApp, et.al.) 1-646-770-0052.