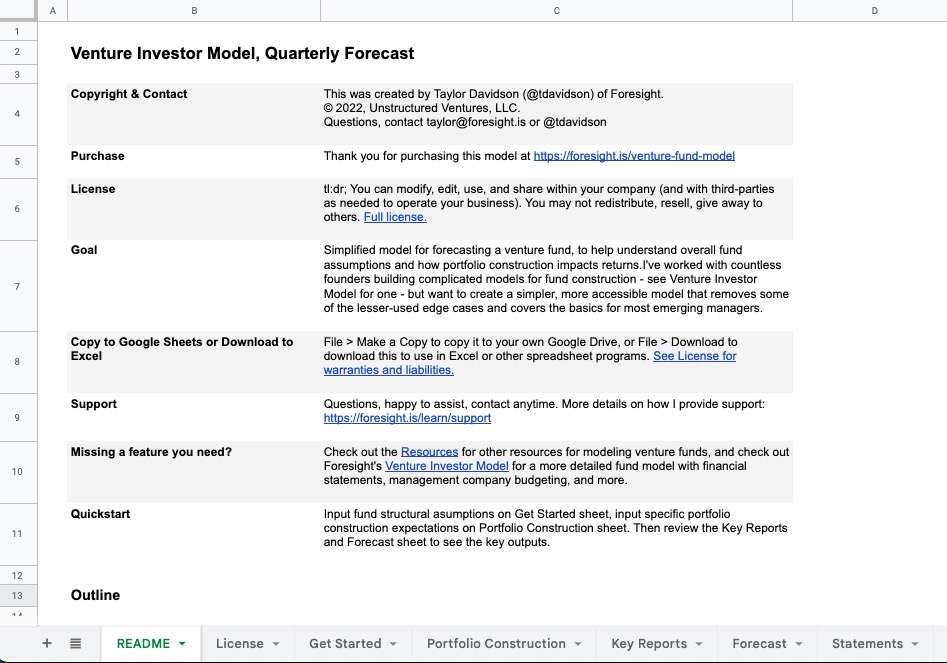

Which Venture Capital Model Should I Use?

I offer a range of models for venture capital funds. All share the same stucture for reporting cash flows and fund performance metrics, but have a couple key differences, outlined below.

Portfolio Construction

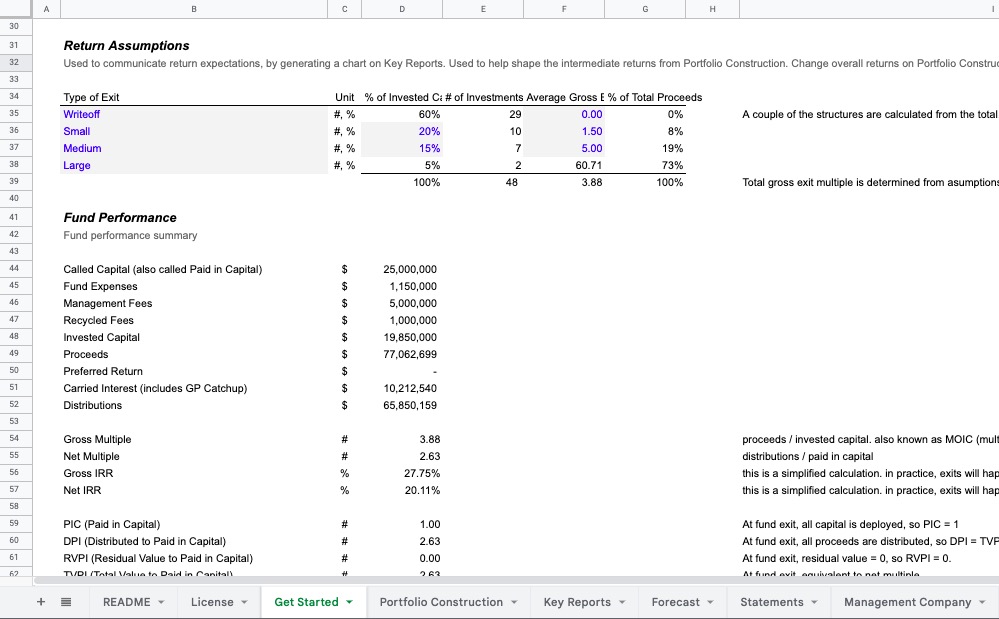

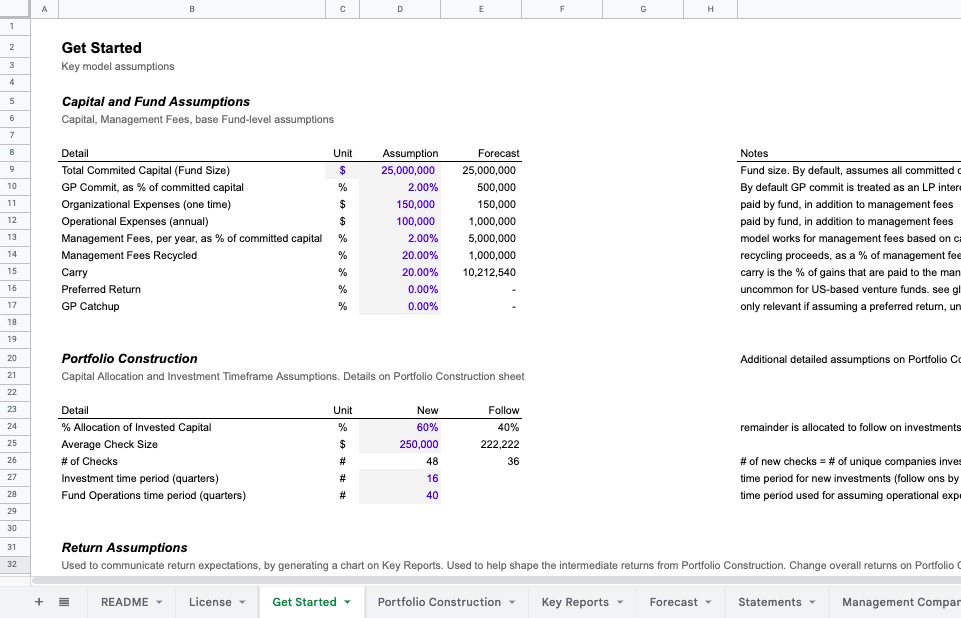

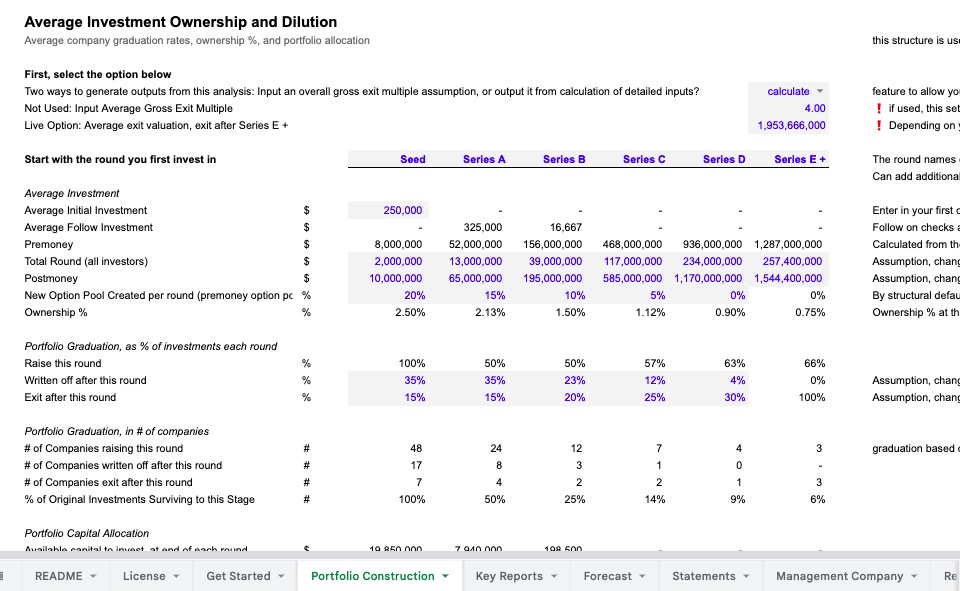

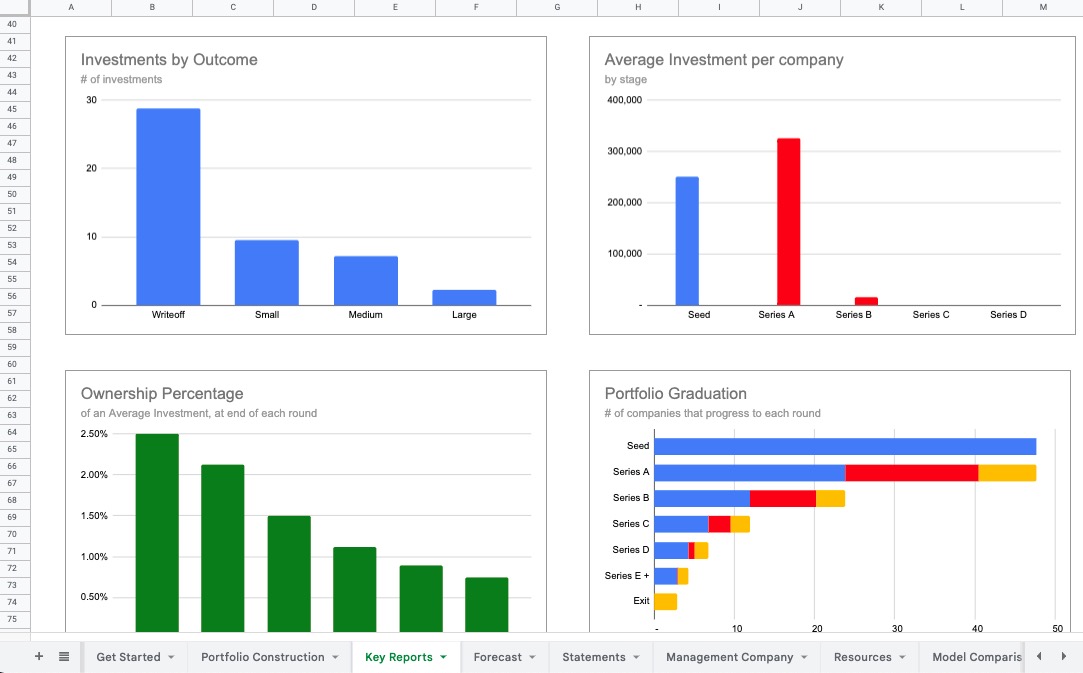

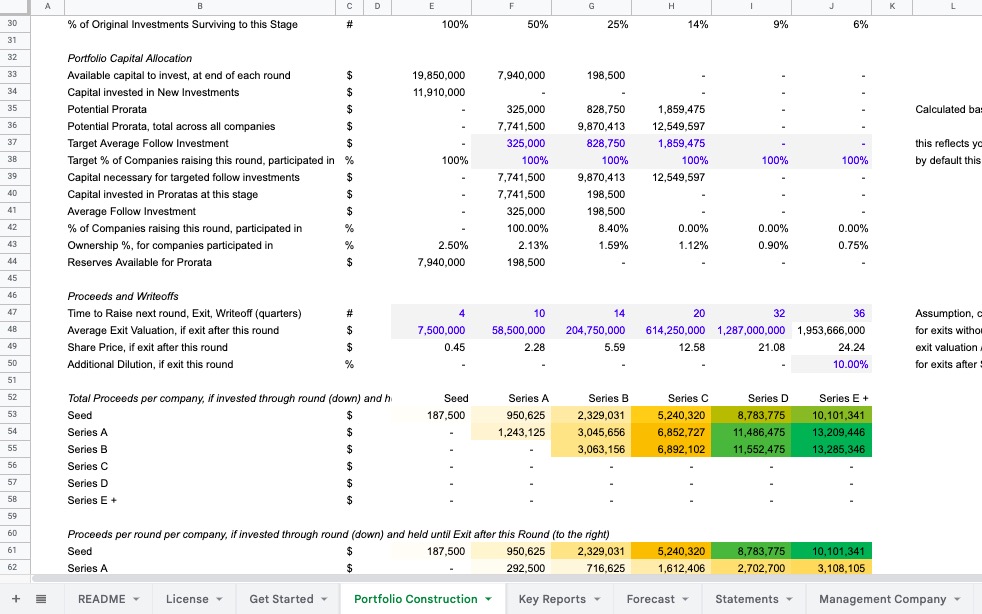

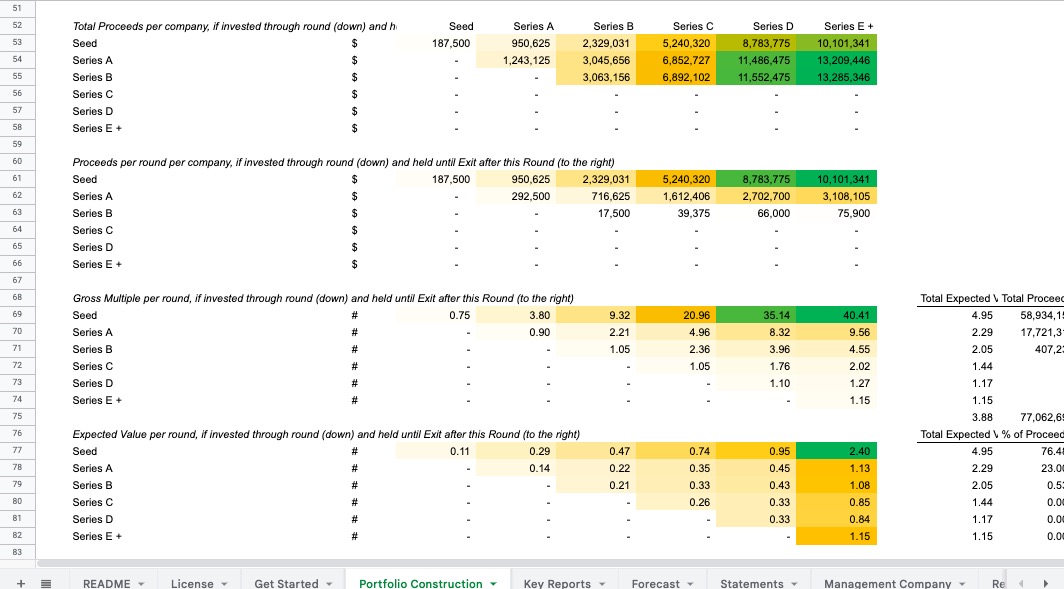

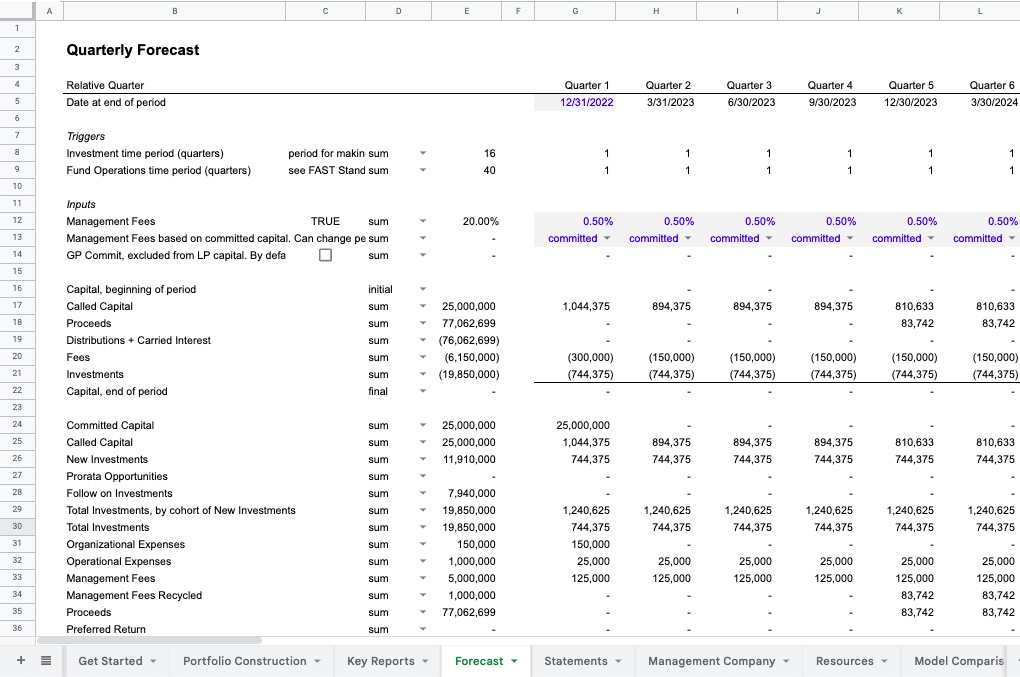

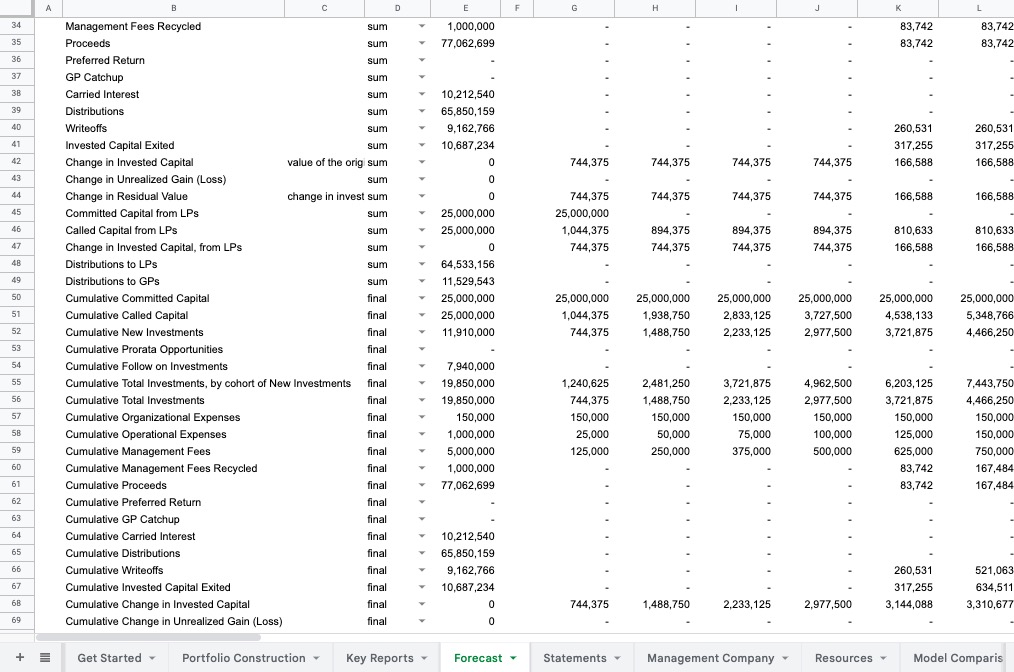

Portfolio construction is the process of creating your portfolio strategy, check sizes, follow on reserves, and expectations around valuations, ownership, and dilution over time. In fund models, portfolio construction drives the logic used to budget for the deployment of capital (e.g. new, follow) and forecast proceeds from investments, both in terms of timing and how much. One of the primary differentiation between the different venture capital models is how the logic for portfolio construction works, and it essentially ranges from simple to more complicated, detailed at Portfolio Construction.

This model expands the timescale to create a quarterly forecast, and expands on the portfolio construction method to model expected graduation rates, follow-ons, proratas, increases in valuations, ownership and dilution, and proceeds per exit and per stage. This creates the detailed logic behind how an investment strategy generates returns, and analyzes the expected value per investment stage based on entry and exit valuations and exit rates per stage.

Background on portfolio construction and how to choose which is best for you at How to Model a Venture Capital Fund

For tracking a portfolio, the Venture Capital Model, Manual Input offers an easy way for investors to track a portfolio as wel as forecast future investments and proceeds.

Timescale

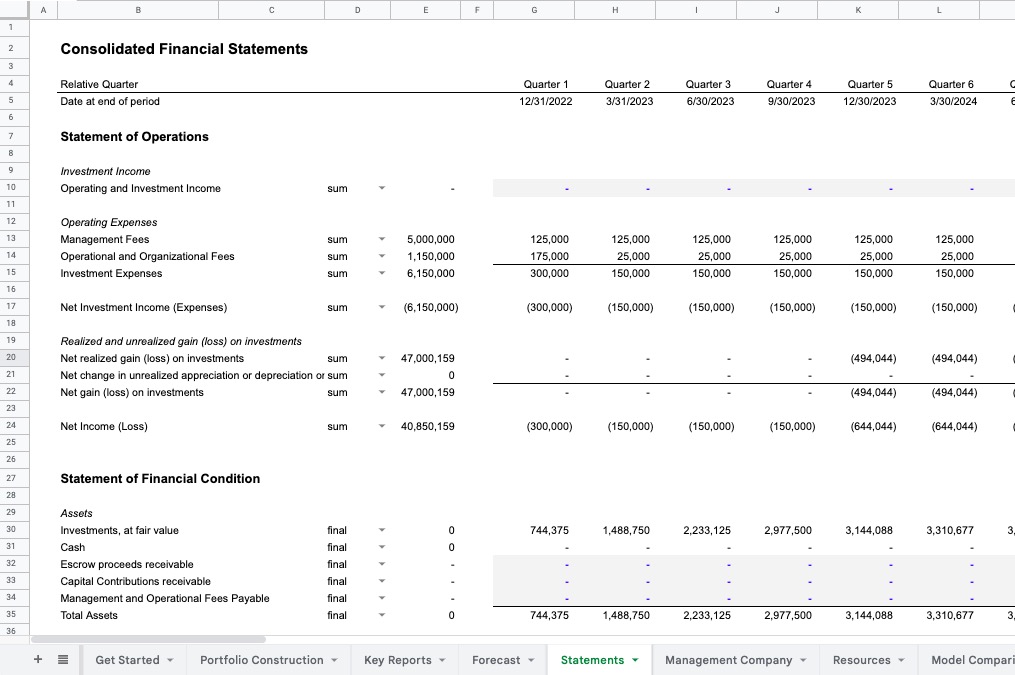

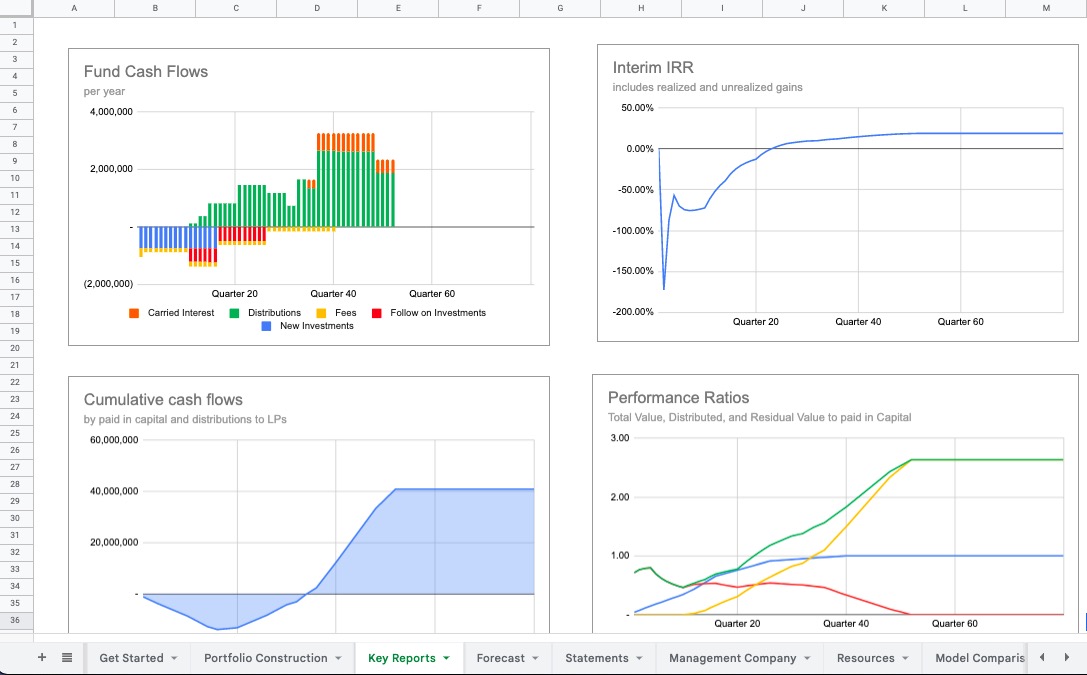

The Venture Capital Model creates quarterly forecasts that are summed into annual forecasts, all free models create annual forecasts, except for the Overall Forecast variants, which do not forecast cash flows over time (only totals).

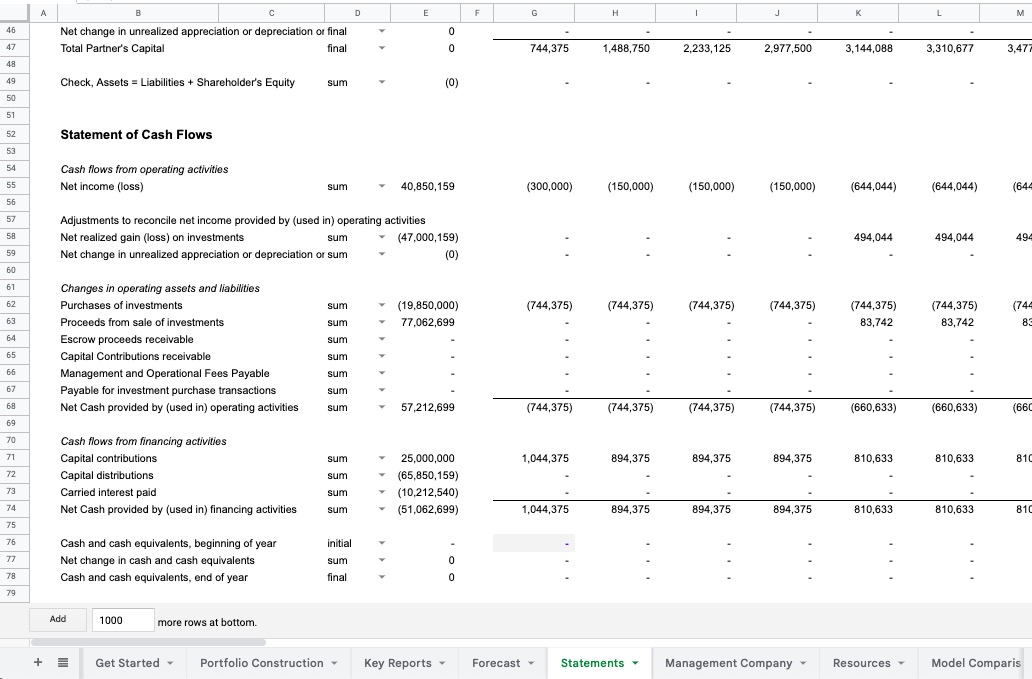

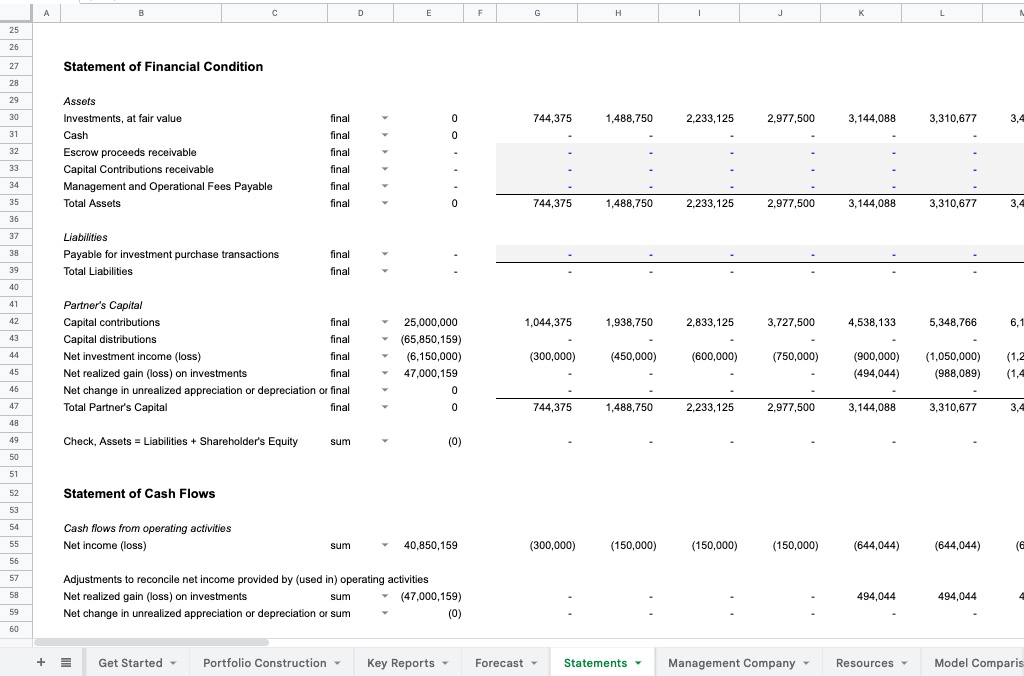

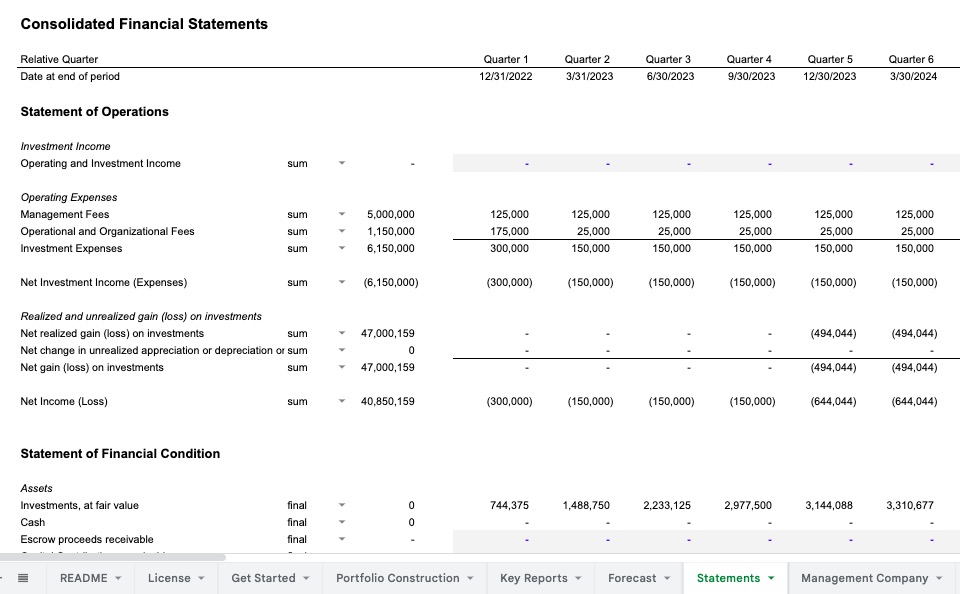

Financial Statements

Financial statements - statement of operations (e.g. income statement), statement of financial condition (e.g. balance sheet), and statement of cash flows are only prebuilt in the Venture Capital Model.

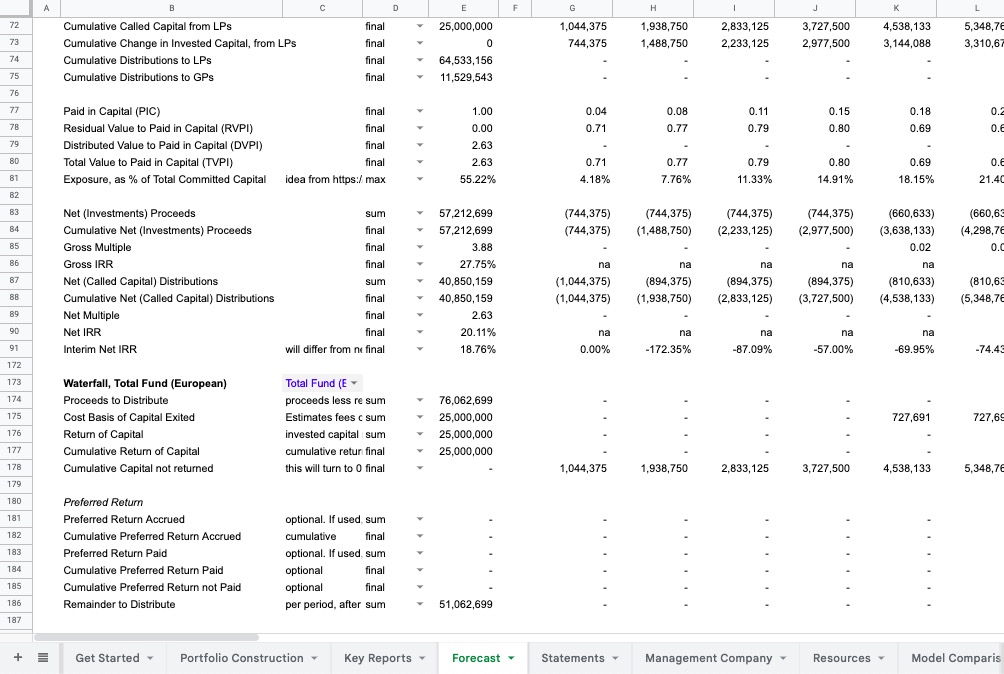

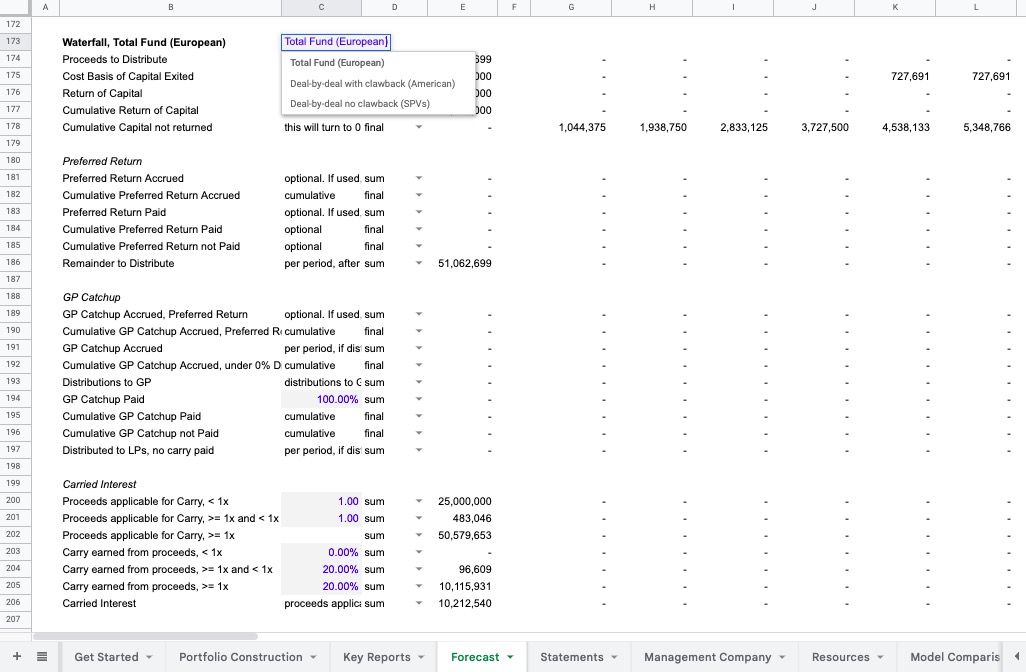

Preferred Return and GP Carry

Preferred return (hurdle rate) and GP carry are only prebuilt in the Venture Capital Model.

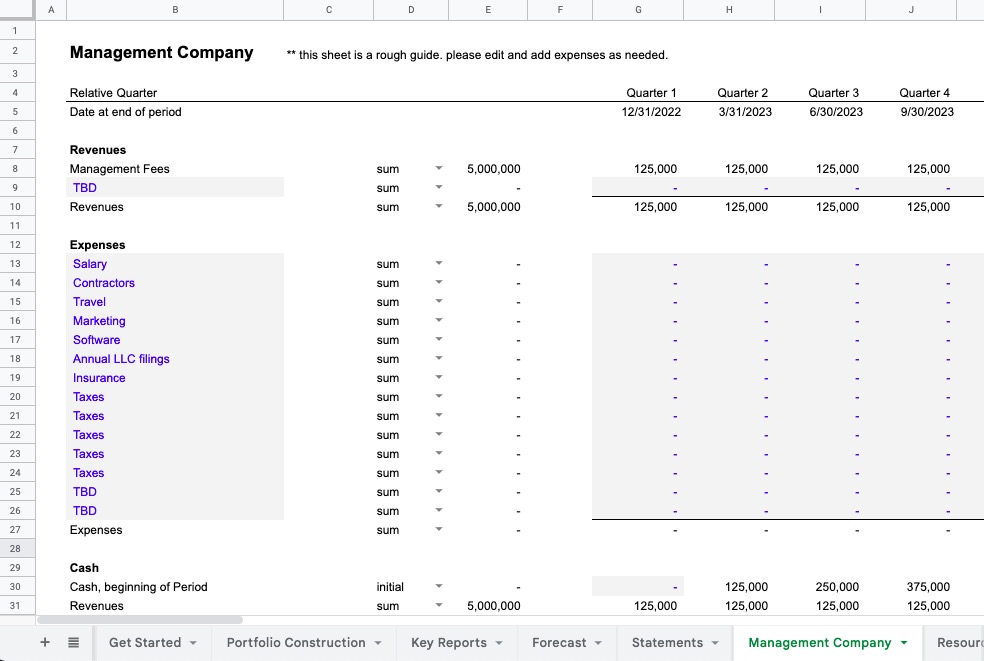

Management Company

The Venture Capital Model and Venture Capital Model, Quarterly Forecast include an additional sheet used to budget the expenses of the management company running the fund. More details at Budgeting the Management Company of a Venture Capital Fund.

Background on those terms at How to Model a Venture Capital Fund