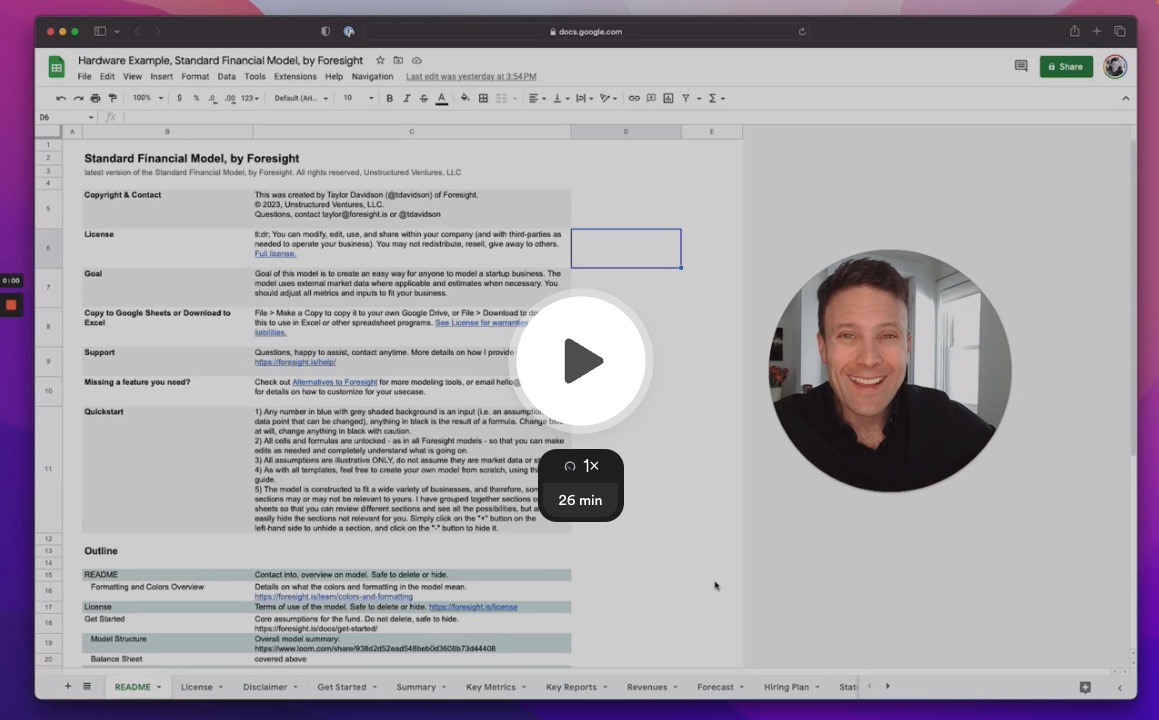

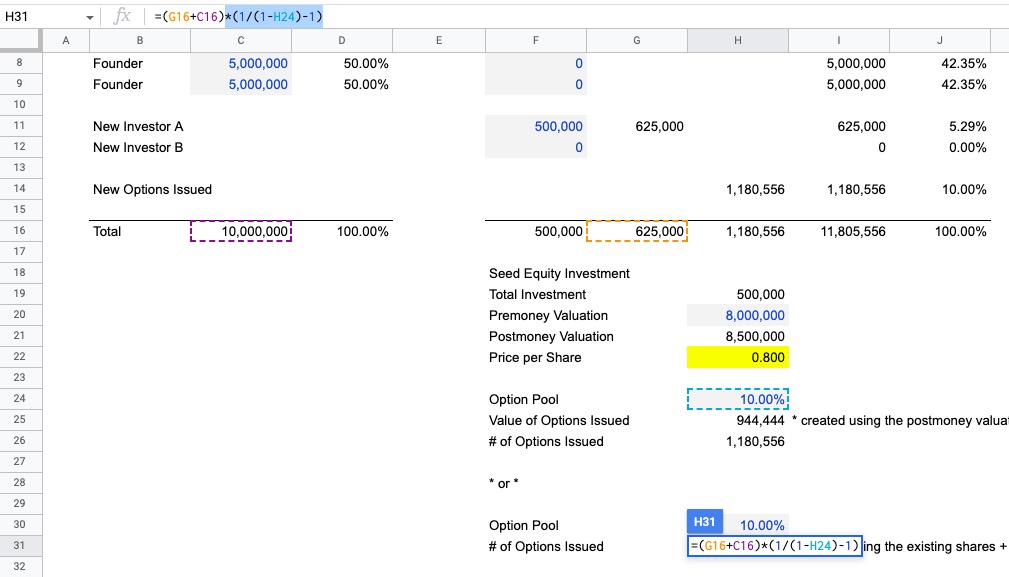

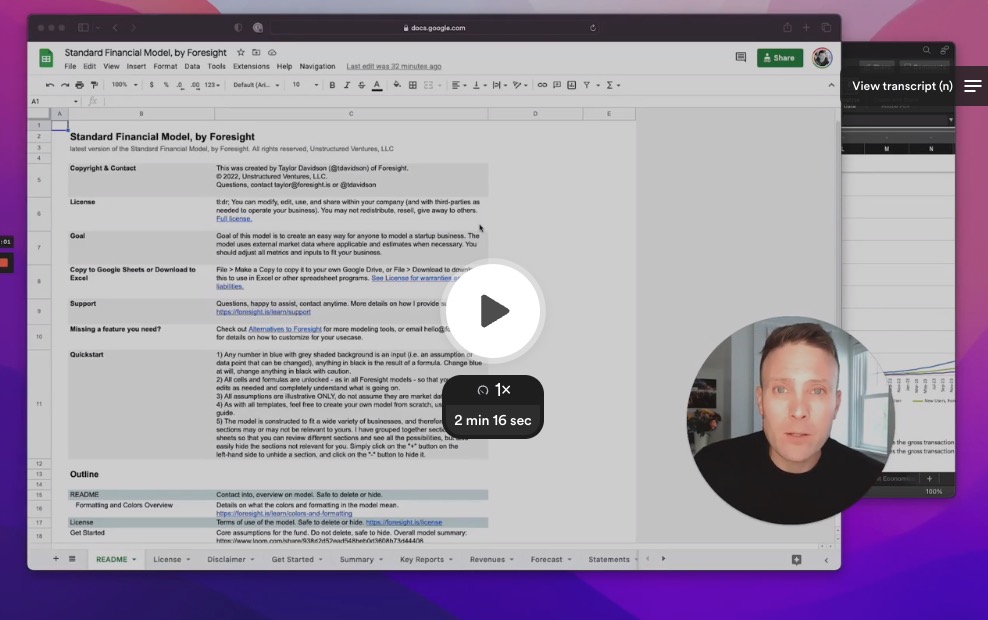

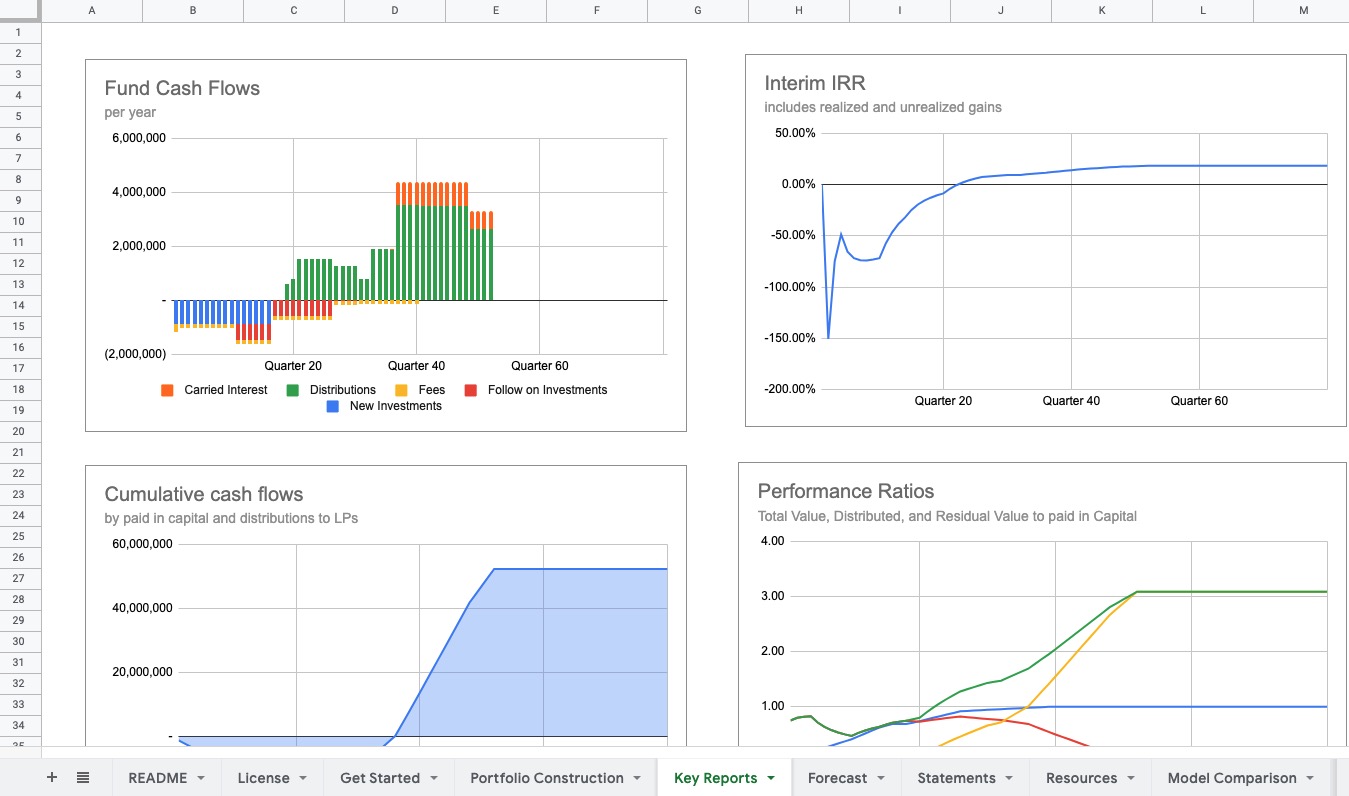

How will we use AI to build spreadsheet forecast models?

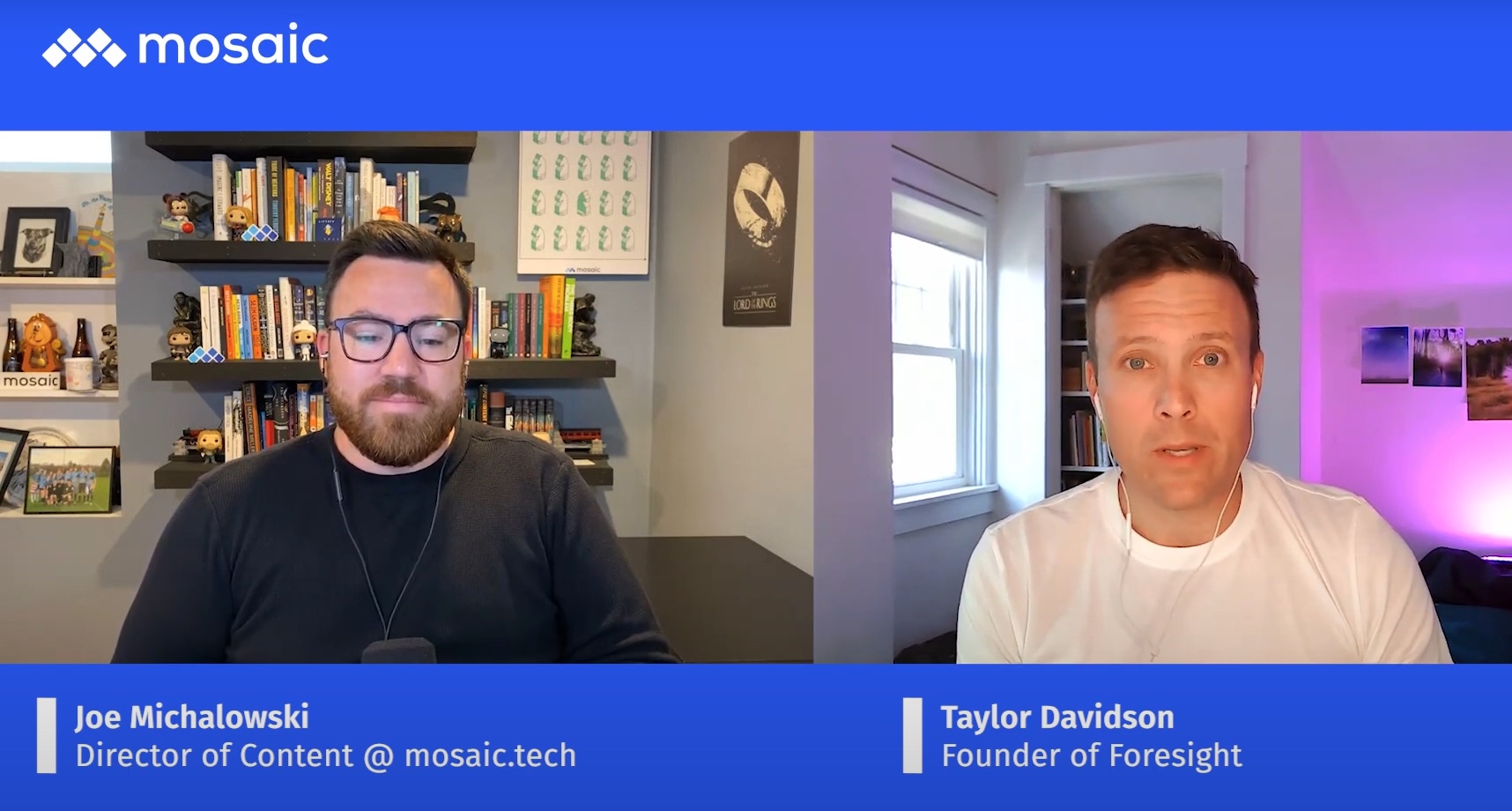

From spreadsheet jockey to prompt CFO, the intersection of artifical intelligence and financial forecasting will bring experimentation to spreadsheets and new opportunities to financial modelers.

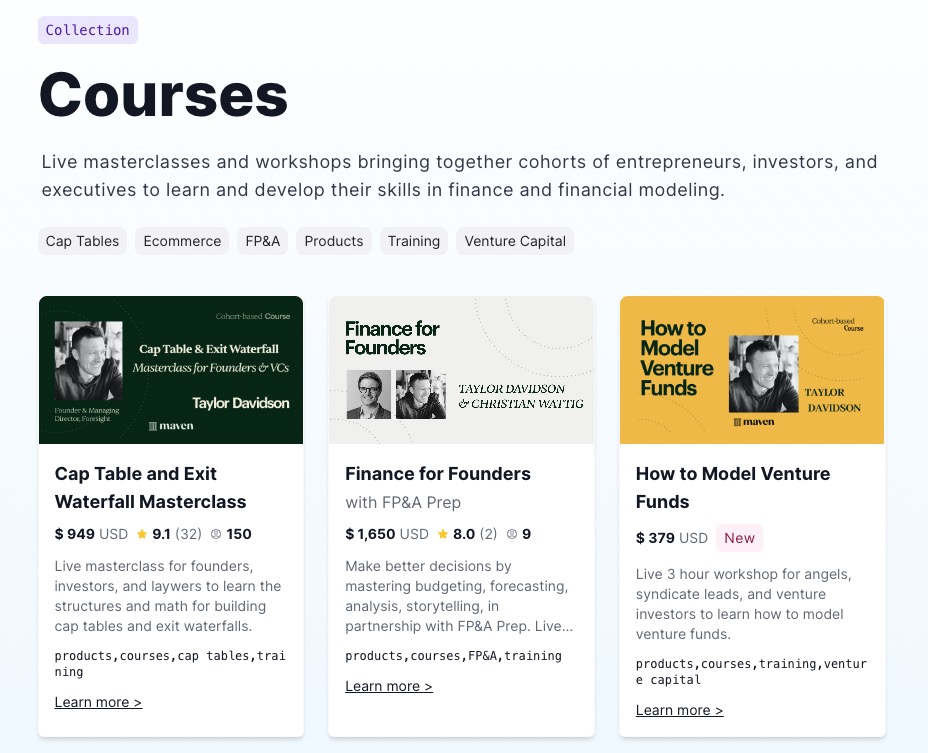

CEO / Founder